EUR/USD breaks below 1.13 on strong US data, German GDP in focus

- The Euro was hit by weaker-than-expected EU PMIs, despite cautious optimism from ECB officials.

- US PMIs beat expectations, reinforcing economic resilience and lifting the Greenback.

- Trump’s budget clears House vote, further boosting USD amid fiscal momentum.

EUR/USD tumbled below 1.1300 on Thursday as economic data from the United States (US) fared better than expected compared to Eurozone Flash Purchasing Managers Index (PMI) figures for May. At the time of writing, EUR/USD trades at 1.1271, down by 0.55%.

The US equity markets turned slightly positive as President Donald Trump's “One Big Beautiful Bill” passed the House of Representatives. Next, the Senate will discuss and tweak Trump’s tax and spending cut proposal before passing the bill.

The news boosted the Greenback, which extended its appreciation against the shared currency as US S&P Global Purchasing Managers Indices (PMIs) for May exceeded estimates, reaffirming the economy's solidity.

Other data showed that the number of US citizens applying for unemployment benefits dipped compared to estimates and the previous week's data, a relief for the Federal Reserve (Fed), which has the dual mandate of price stability and maximum employment.

Fed Governor Christopher Waller crossed the news wires and said that if tariffs are close to 10%, the economy would be in good shape for the second half of 2025. He added that in that scenario, the Fed could resume its easing cycle later in the year.

Across the pond, the HCOB preliminary PMIs in France, Germany and the Eurozone unexpectedly contracted in May. At the same time, the German IFO Business Climate survey improved slightly in May.

In the meantime, some European Central Bank (ECB) policymakers crossed the wires. Yannis Stournaras questioned the safety of the US Dollar and created an opportunity for the Euro.

ECB Vice-President Luis De Guindos said inflation could return to the ECB’s 2% target soon while economic growth turns weaker. ECB’s Boris Vujčić noted that inflation could get close to the target by the end of 2025.

This week, the EU’s economic docket will feature GDP data in Germany and ECB speakers. The US schedule will feature housing data and Fed speakers.

EUR/USD daily market movers: Upbeat US economic data weighs on the Euro

- The US House of Representatives has approved the Trump tax bill and is coming to the US Senate. The nonpartisan Congressional Budget Office (CBO) said the budget's approval would add $3.8 trillion to the $36.2 trillion debt over the next decade.

- The S&P Global Flash Manufacturing PMI for May rose to 52.3, up from 50.2 and well above the 50.1 estimate, signaling a stronger rebound in factory activity. The Flash Services PMI also improved, climbing to 52.3 from 50.8, beating forecasts and pointing to continued strength in the services sector.

- US Initial Jobless Claims for the week ending May 17 came in at 227K, slightly below the previous week's 229K and expectations of 230K, reinforcing signs of a resilient labor market.

- The Euro weakened as the Eurozone’s HCOB Flash PMI in May was worse than expected, highlighting the ongoing economic slowdown. The Services PMI fell from 50.1 to 48.9, below estimates of 50.3, and the Manufacturing PMI stood at 49.4, up from 49.0 in April, exceeding forecasts.

- The German HCOB Services PMI dipped from 49.0 to 47.2, below forecasts for a 49.5 increase. The HCOB Manufacturing PMI rose by 48.8, up from April’s 48.4, below forecasts for a 48.9 increase.

- The German IFO Business Climate improved from 86.9 in April to 87.5 in May. Estimates expected a reading of 87.4. The report said that companies are becoming less gloomy about their prospects. “The German economy is slowly regaining its footing," Ifo president Clemens Fuest said.

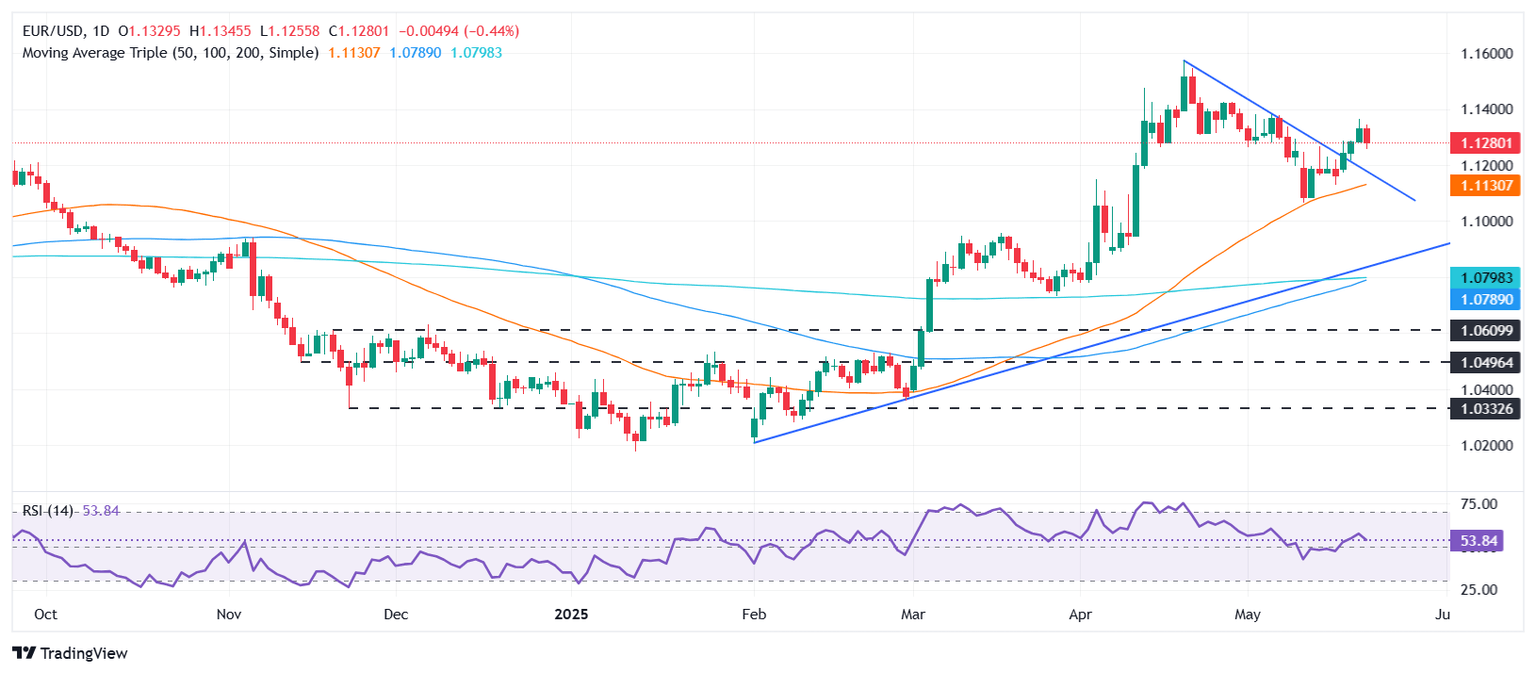

EUR/USD technical outlook: Poised to remain below 1.1300 for the rest of the day

From a technical perspective, EUR/USD is set for a pause in its ongoing rally. A ‘bearish engulfing ‘ chart pattern looms, which could pave the way for further downside as the pair hit a two-day low of 1.1255.

Although momentum remains bullish, as depicted by the Relative Strength Index (RSI), the RSI is edging towards the 50-neutral line, indicating buyers are losing momentum.

If EUR/USD prints a daily close below 1.1300, this could pave the way to test 1.1255. Once surpassed, the next floor level would be the 1.1200 mark, ahead of the 50-day Simple Moving Average (SMA) at 1.1138.

On the flip side, if EUR/USD climbs past 1.13, further gains are seen, with the first resistance being the latest cycle high at 1.1362, the May 21 daily peak.

Economic Indicator

Gross Domestic Product (QoQ)

The Gross Domestic Product released by the Statistisches Bundesamt Deutschland is a measure of the total value of all goods and services produced by Germany. The GDP is considered as a broad measure of the German economic activity and health. A high reading or a better than expected number has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).

Read more.Next release: Fri May 23, 2025 06:00

Frequency: Quarterly

Consensus: 0.2%

Previous: 0.2%

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.