EUR/USD weakens as Eurozone PMI sinks into contraction

- EUR/USD falls sharply to near 1.1100 on weak Eurozone preliminary Purchasing Managers’ Index data of September.

- ECB policymakers appear to be increasingly concerned about inflation remaining persistent.

- Markets expect the Fed to deliver a second consecutive 50 bps interest-rate cut in November.

EUR/USD faces sharp selling pressure and falls to near the crucial support of 1.1100 in Monday’s North American session. The major currency pair weakens on multiple headwinds: poor Eurozone Purchasing Managers’ Index (PMI) data for September and a sharp recovery in the US Dollar (USD).

The Eurozone Composite PMI surprisingly contracted to 49.0. Economists expected that activities in the overall economy to have grown at a slower pace to 50.6 from 51.0 in August. A sharp contraction in the overall economic activity was majorly driven by weakness in the manufacturing sector and a slower expansion in the service sector activity.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said, “The eurozone is heading towards stagnation. After the Olympic effect had temporarily boosted France, the eurozone heavyweight economy, the Composite PMI fell in September to the largest extent in 15 months. The index has now dipped below the expansionary threshold. Considering the rapid decline in new orders and the order backlog, it doesn't take much imagination to foresee a further weakening of the economy.

Signs of further weakness would increase market speculation for a third interest rate cut by the European Central Bank (ECB) in October. Meanwhile, the latest comments from ECB policymakers have indicated that they are more concerned about price pressures remaining persistent. ECB policymakers have emphasized the need for more data pointing to a further slowdown in inflation. On Friday, ECB Vice President Luis de Guindos said that he wants to see more good inflation data before slicing interest rates further. "We will have more information in December than in October," Guindos said.

Daily digest market movers: EUR/USD weakens as downbeat Eurozone PMI weighs on Euro

- EUR/USD drops sharply as the US Dollar (USD) gains ground despite growing speculation that the Federal Reserve (Fed) will continue to opt for a larger-than-usual 50 basis points (bps) interest rate cut in the November meeting, as it delivered last Wednesday, amid growing concerns over job growth. According to the CME FedWatch tool, the likelihood of the Fed reducing interest rates by 50 bps to 4.25%-4.50% in November has increased to 51.7% from 29.3% a week ago.

- On the contrary, the latest Reuters poll to economists shows that the central bank will cut the federal fund rates by 25 bps in each of the monetary policy meetings to be held in November and December.

- Meanwhile, Fed Governor Michelle Bowman issued a statement on Friday explaining why she was against the decision to begin the policy-easing cycle with a 50-bps rate cut. Bowman, which voted to kick off the rate-cut process with a 25 bps cut, said a larger reduction could stoke overall demand given that inflationary pressures have yet not returned to the bank’s target of 2%.

- On the United States (US) economic data front, the preliminary S&P Global Composite Purchasing Managers’ Index (PMI) data for September, came in lower at 54.4 than their prior release of 54.6. The report showed that further weakness in the Manufacturing PMI was offset by slightly higher-than-expected service sector activity.

- Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said, "The sustained robust expansion of output signaled by the PMI in September is consistent with a healthy annualized rate of GDP growth of 2.2% in the third quarter. But there are some warning lights flashing, notably in terms of the dependence on the service sector for growth, as manufacturing remained in decline, and the worrying drop in business confidence."

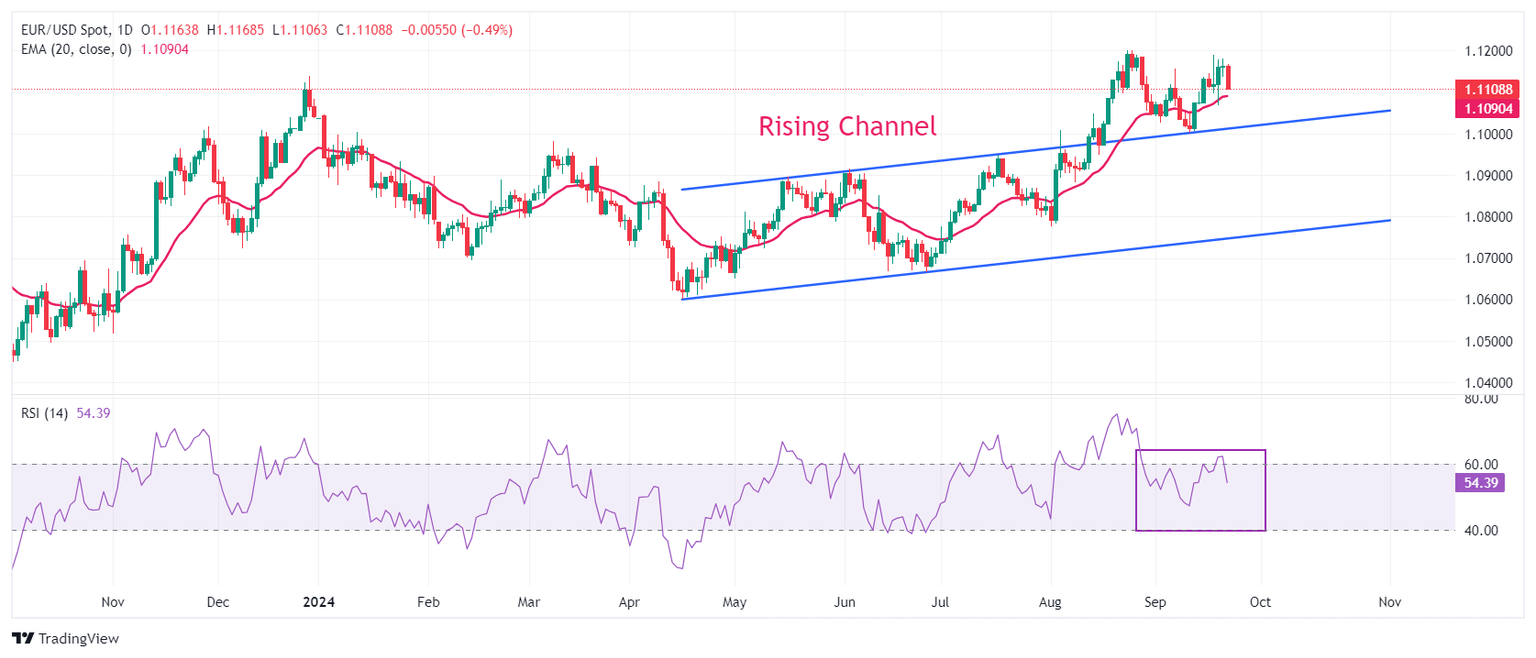

Technical Analysis: EUR/USD falls to near 1.1100

EUR/USD dips below 1.1100 in European trading hours. The near-term outlook of the currency pair is expected to find interim support near the 20-day Exponential Moving Average (EMA) near 1.1090.

The outlook of the major currency pair would remain firm till it hold the breakout of the Rising Channel chart pattern formed on a daily time frame near the psychological support of 1.1000.

The 14-day Relative Strength Index (RSI) moves lower to 55, suggesting momentum is weakening

Looking up, the round-level resistance of 1.1200 will act as a major barricade for the Euro bulls. A decisive break above the same would drive the asset toward July 2023 high of 1.1276. On the downside, the psychological level of 1.1000 and the July 17 high near 1.0950 will be major support zones.

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Mon Sep 23, 2024 13:45 (Prel)

Frequency: Monthly

Actual: 54.4

Consensus: -

Previous: 54.6

Source: S&P Global

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.