EUR/USD snaps back above 1.1300 as Trump's tariff salvo roils markets

- EUR/USD dips to 1.1296 after Trump announces steep tariffs on EU imports starting June 1.

- The pair rebounds to 1.1350 as US Dollar stays pressured by rising fiscal deficit concerns.

- Euro shrugs off ECB rate cut talk, supported by improving German GDP figures.

EUR/USD recovered during the mid-North American session on Friday after diving below 1.1300 after US President Donald Trump rattled the markets by threatening to impose 50% tariffs on the European Union (EU). At the time of writing, the pair recovered and climbed to around 1.1350

US President Donald Trump posted on his social network early Friday that discussions with the European Union “are going nowhere! Therefore, I am recommending a straight 50% tariff on the European Union, starting on June 1, 2025,” he wrote. The EUR/USD fell to 1.1296 on the remarks before the uptrend resumed.

Following those remarks, US Treasury Secretary Scott Bessent said that “EU proposals have not been of good quality,” adding that “Most countries are negotiating in good faith, except the EU.”

The Greenback remains on the back foot, weighed down by the approval of Trump’s tax bill in the House of Representatives, which is on its way to the Senate. If passed, the proposal would add close to $4 trillion to the US debt ceiling over a decade, according to the Congressional Budget Office (CBO).

It is worth noting that the US Dollar remains unreactive to Federal Reserve (Fed) speakers, who so far have said the US Treasury market is working orderly, adding that uncertainty about supply chains, inventory and inflation keeps business executives unaware of the future.

The US economic docket featured US housing data in May, which was mixed as Building Permits fell, but New Home Sales improved in April.

In the Eurozone, Germany's Gross Domestic Product (GDP) improved yearly, though it remained in contractionary territory.

In the meantime, the Euro shrugged off speculation that the European Central Bank (ECB) is expected to lower interest rates at the upcoming meeting. ECB’s Rehn and Stournaras favor a rate cut in June, with the latter supporting a pause after that meeting.

EUR/USD daily market movers: the Euro favored by “sell America” trend

- The Euro remains favored by overall US Dollar weakness. The US Dollar Index (DXY), which tracks the performance of six currencies against the American Dollar, tumbled 0.79% at 99.10, its lowest level since April 29.

- The “sell America” trend continues with investors selling off bonds, US equities and the US Dollar. It was ignited by US President Donald Trump's “trade war” and Moody’s downgrade of US government debt from AAA to AA1.

- The US schedule featured Building Permits, which fell by 4% MoM in April, declining from 1.481 million to 1.422 million, signaling a slowdown in future construction activity.

- New Home Sales surged 10.9% MoM, rising from 0.67 million to 0.743 million, according to the US Census Bureau. This reflects strong demand in the housing market despite tighter supply conditions.

- Germany’s economy grew in Q1 2025, exceeding estimates due to exports and industry frontloading ahead of US tariffs. The Gross Domestic Product (GDP) improved from 0.2% to 0.4% QoQ.

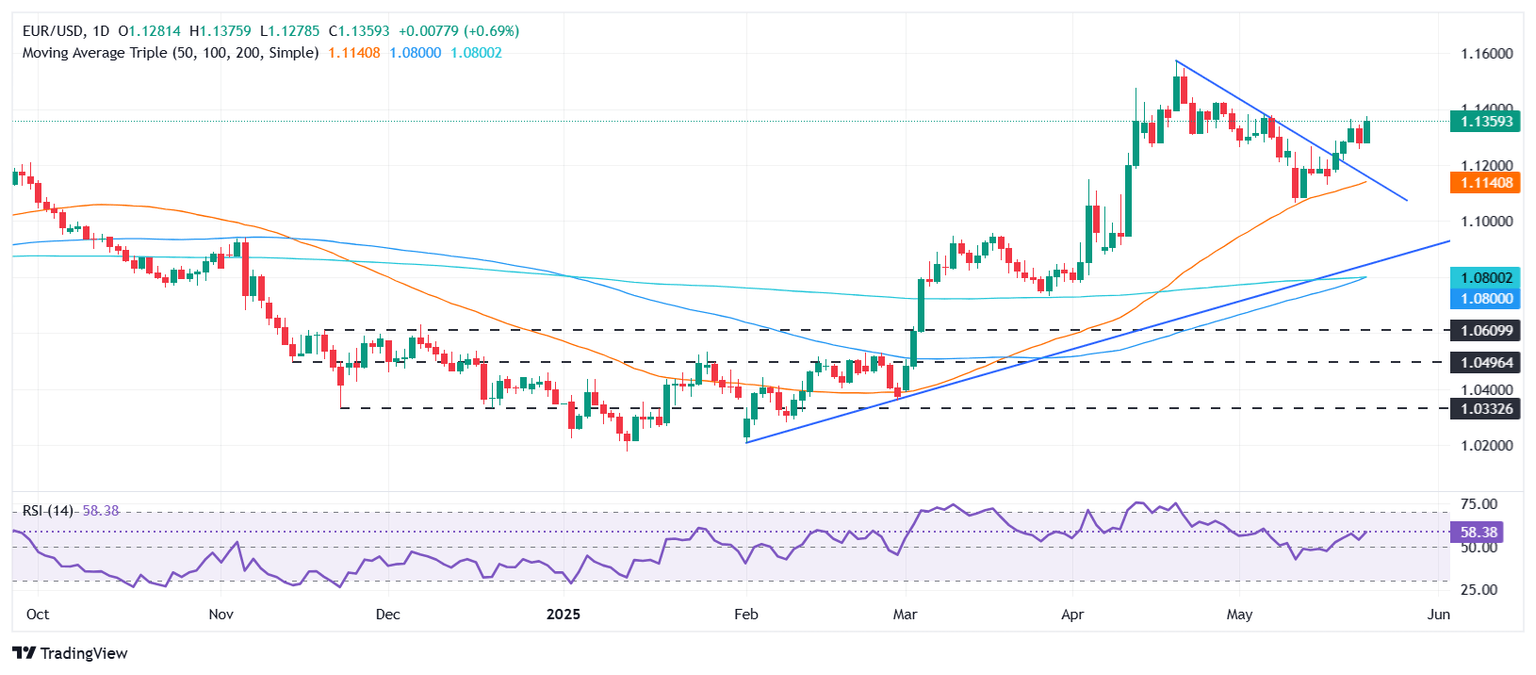

EUR/USD technical outlook: Set to challenge 1.1400 in the near term

The EUR/USD uptrend resumed on Friday, with the pair reaching a two-week high of 1.1375 as traders brace for challenging 1.1400. Buyers are gathering steam as the pair registered the highest high and low during the last five days, and further confirmed by the Relative Strength Index (RSI), which trends up ahead of turning overbought.

If EUR/USD clears 1.1400, it would pave the way for testing key resistance levels, like 1.1450, followed by the 1.1500 mark and the year-to-date (YTD) high at 1.1573.

Conversely, if EUR/USD falls below 1.1300, the pair could test the May 22 low of 1.1255, ahead of 1.1200.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.