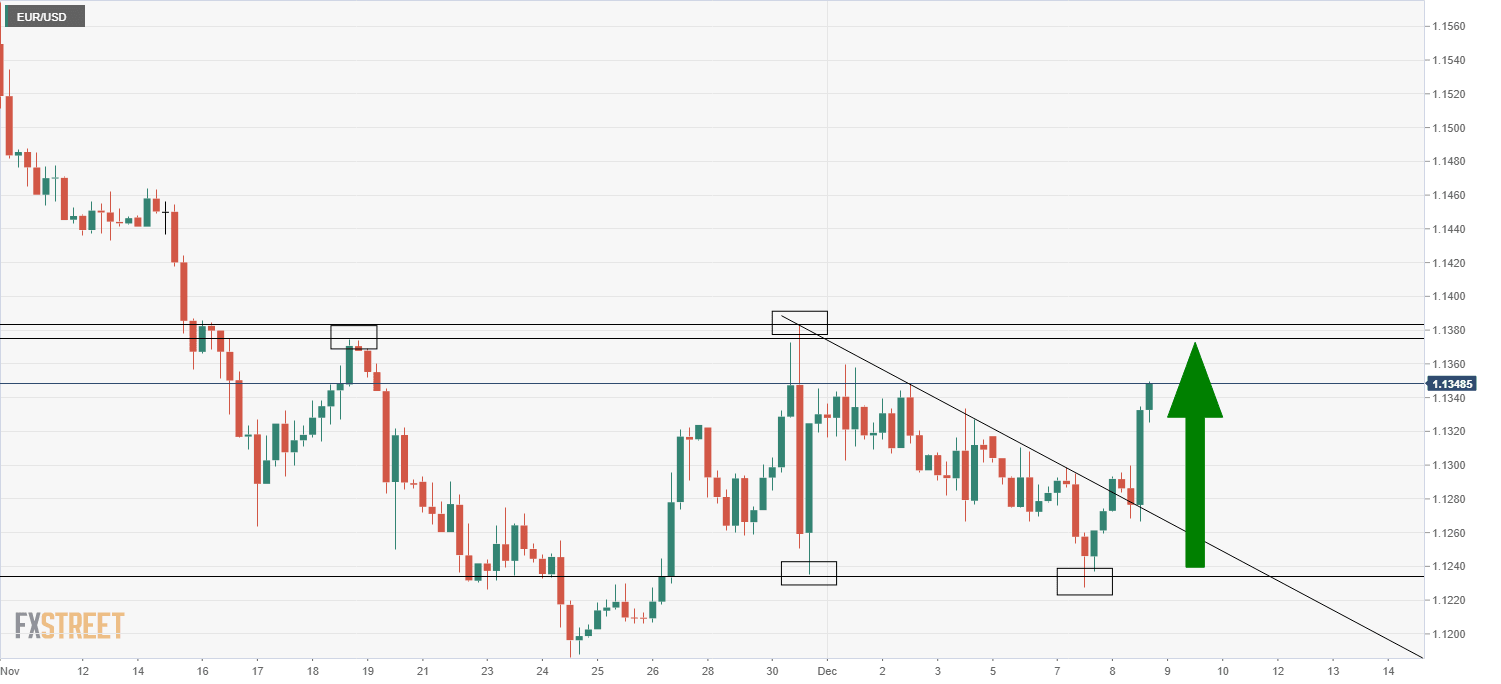

EUR/USD rallies to 1.1350 on technical buying, rally halted for now as pair runs into key downtrend

- Technical buying has buyed EUR/USD on Wednesday, sending it back towards 1.1350.

- EUR/Usd has run into strong resistance, however, in the form of a key long-term downtrend.

EUR/USD was boosted primarily by technical buying on Wednesday, as the pair broke above a week-long downtrend to pop above the 1.1300 level again and surpassed its 21-day moving average at 1.1327 before stabilising around 1.1350. At current levels, the pair is up an impressive 0.75% on the day.

Risk appetite was a little weaker on the session, with US and European equities slipping amid mixed headlines about the efficacy of existing vaccines versus the new, fast spreading Omicron variant of Covid-19. This weighed ever so slightly on USD Short-Term Interest Rate (STIR) market pricing of Fed rate hikes in 2022 (the implied yield on the December 2022 three-month eurodollar future fell about 2bps but remained close to recent highs). This seems to be weighing a tad on the buck, aiding EUR/USD.

EUR/USD has now run into resistance in the form of a descending trend line that had acted as support for EUR/USD throughout the summer months and into October. The pair broke below this trendline in November and it now appears to be acting as resistance in the 1.1350 area. A break above this trendline would likely see EUR/USD extend its gains towards last week’s highs in the 1.13828 area.

Elevated volatility expected

FX market volatility has been elevated in recent weeks amid heightened uncertainty regarding Omicron. As more and more reports emerged of its apparent mildness, the rally in equity markets this week may have some thinking that “concerns about Omicron are now over”. But it remains to early to say whether this is the case. Even if the infection is mild, if enough people are infected at the same time, only a small hospitailisation percentage would be enough to overwhelm healthcare systems in some countries. That means lockdown risk remains on the table, as was seen on Wednesday with the UK.

That means FX market volatility may remain elevated in the next few days and EUR/USD could continue to see unusually high levels of choppiness, even if it would normally be expected for FX markets to be more rangebound ahead of key US inflation data. The fact that the Fed, BoE and ECB all decide on policy next week is another reason why FX market volatility is likely to remain high in the coming weeks. The Deutsche Bank Currency Volatility Index remains above 7.0, well above its 5.7-6.5ish range throughout Q2 and Q3 this year, though it has pulled back a tad from recent highs at 7.40.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset

-637745833301055930.png&w=1536&q=95)