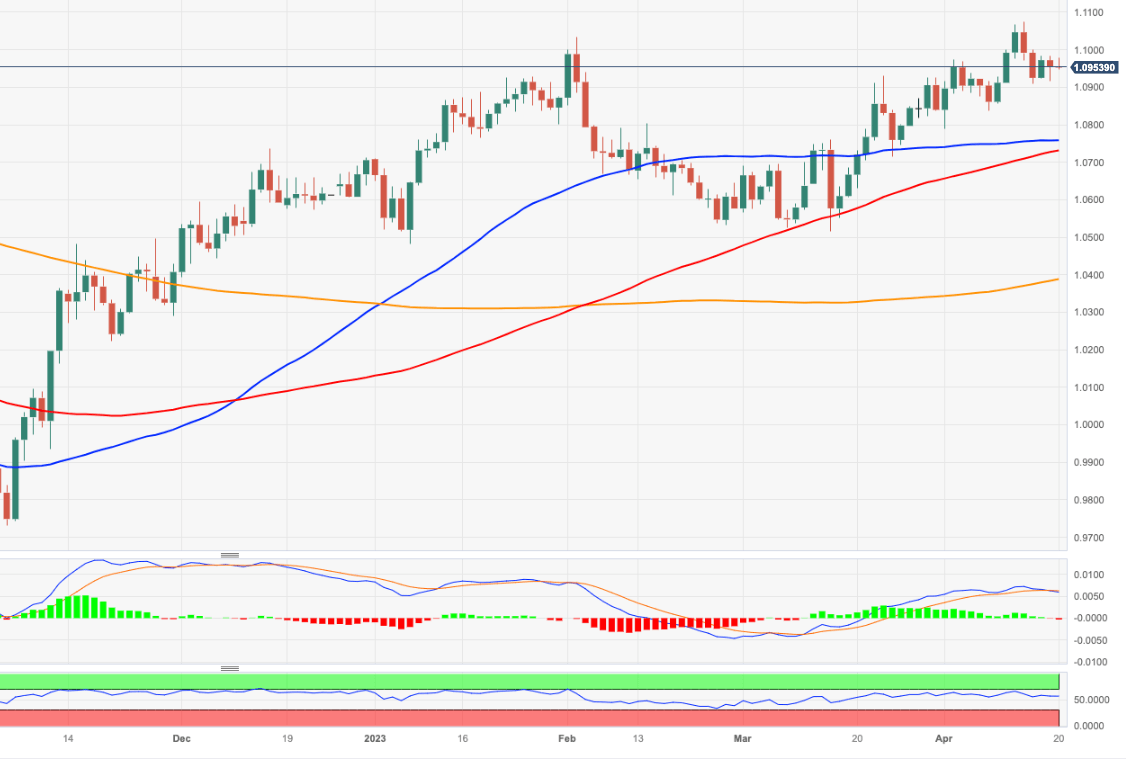

EUR/USD Price Analysis: The 2023 high emerges as the big magnet for bulls

- EUR/USD struggles to advance further north of 1.0980 on Thursday.

- The next resistance level of note comes at the YTD peak near 1.1070 .

EUR/USD’s initial bullish attempt runs out of steam near 1.0980 on Thursday.

Further consolidation should not be ruled out for the time being. The breakout of this theme exposes a probable move to 1.1000 ahead of the 2023 high at 1.1075 (April 14). On the downside, the 1.0900 zone emerges as quite a decent contention so far.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0387.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.