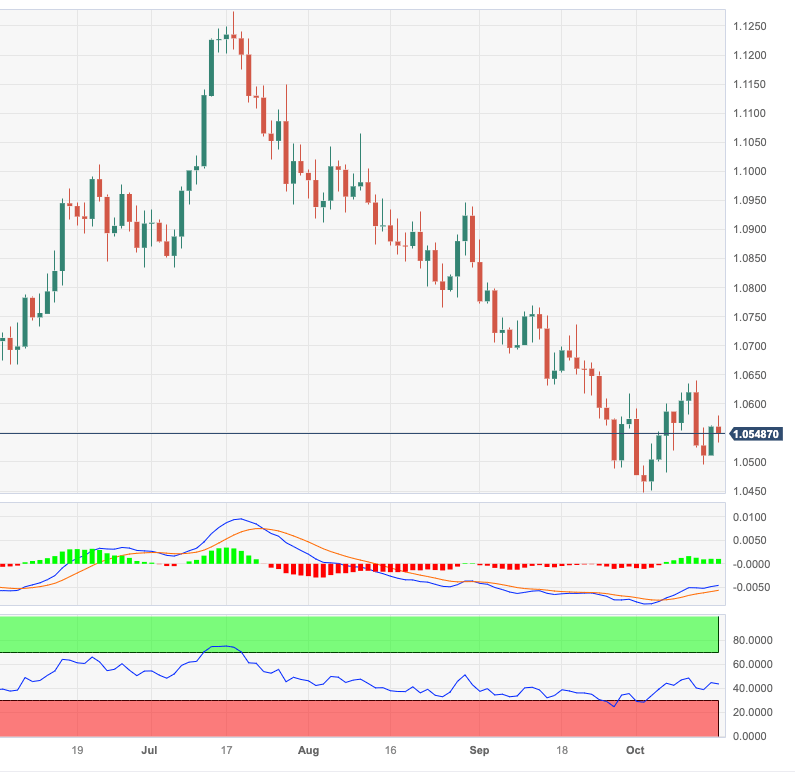

EUR/USD Price Analysis: Some consolidation appears on the table

- EUR/USD partially reverses Monday’s marked gains.

- The pair could trade in a range bound theme in the short term.

EUR/USD fades the earlier bullish attempt to the 1.0580 region on Tuesday.

In case bulls regain the upper hand, the pair should surpass the monthly peak of 1.0639 (October 12) to allow for extra gains to, initially, the interim 55-day SMA at 1.0735 ahead of the weekly top of 1.0767 (September 12).

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.