EUR/USD Price Analysis: Rises back to 1.08, potential double bottom on 1H

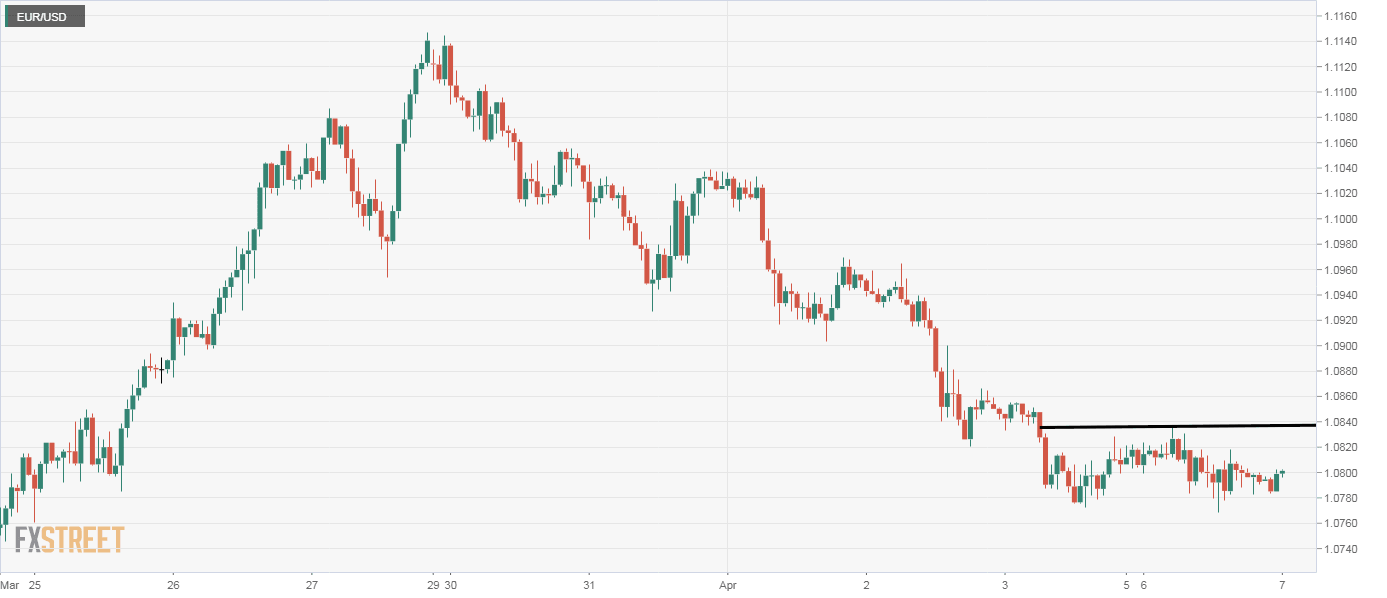

- EUR/USD looks to be creating a double bottom pattern on the hourly chart.

- A break above 1.0836 is needed to confirm a price breakout.

The American dollar is losing ground in Asia amid the uptick in the US stock futures, helping EUR/USD recover early losses.

The pair is currently traded near 1.08, having jumped from 1.0785 to 1.0802 in the 60 minutes to 00:00GMT. The futures tied to the S&P 500 index are up 0.5% at press time and pointing to a continuation of Monday's 7% price rally. The signs of risk reset will likely continue to weigh over the safe-haven US dollar.

Double bottom in Euro

The pair has defended the area around 1.0770 two times since Friday. The hourly chart shows a double bottom pattern with the neckline resistance at 1.0836 is likely in the making.

A break above 1.0836 would confirm a double bottom breakout and open the doors to 1.09 (target as per the measured move method).

Alternatively, acceptance under 1.0770 would invalidate prospects of a double bottom breakout and could yield another leg down toward 1.0750.

Hourly chart

Trend: Bullish above 1.0836

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.