EUR/USD Price Analysis: Range breakout seen on D1 favors move above 1.11

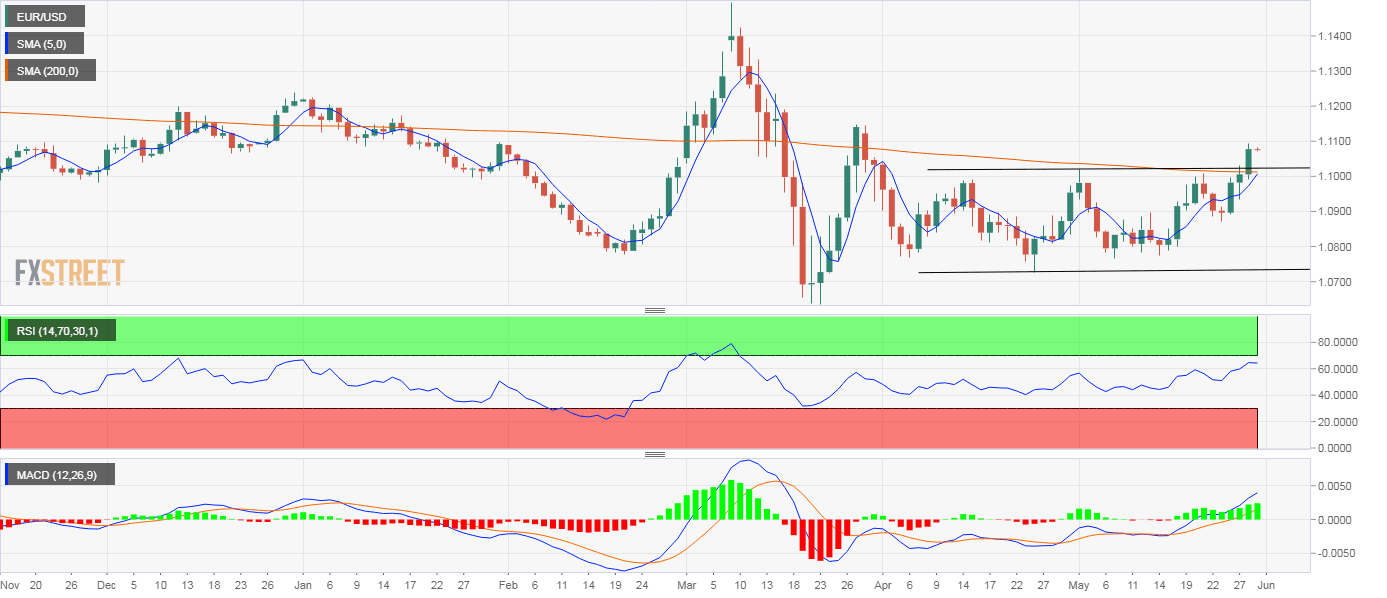

- EUR/USD jumped 0.67% on Thursday, confirming a range breakout on the daily chart.

- Momentum indicators are biased bullish and suggest scope for a move above 1.11.

EUR/USD closed well above 1.1019 on Thursday, confirming an upside breakout of the multi-week trading range of 1.0727 to 1.1019.

The breakout is backed by an above-50 or bullish reading on the 14-day relative strength index (RSI). The daily chart MACD histogram is printing higher bars above the zero line, a sign of the strengthening of the bullish momentum.

What's more, the ascending 5-day simple moving average (SMA) looks set to cross above the 200-day SMA. All in all, the odds appear stacked in favor of a convincing move above 1.11. At press time, the pair is trading at 1.1080, having hit a high of 1.1094 on Thursday.

The 4-hour chart RSI is reporting overbought conditions. So, a minor pullback may be seen before stronger gains.

With resistance at 1.1065 breached, the focus has now is on 1.1145/66 – the late March high and 61.8% retracement of the March collapse.

A close below 1.1019 is needed to invalidate the bullish setup.

Daily chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.