EUR/USD Price Analysis: Pair stabilizes below 20-day SMA, sharp weekly decline

- EUR/USD posts mild movements after a volatile week, bouncing slightly after recent sharp losses.

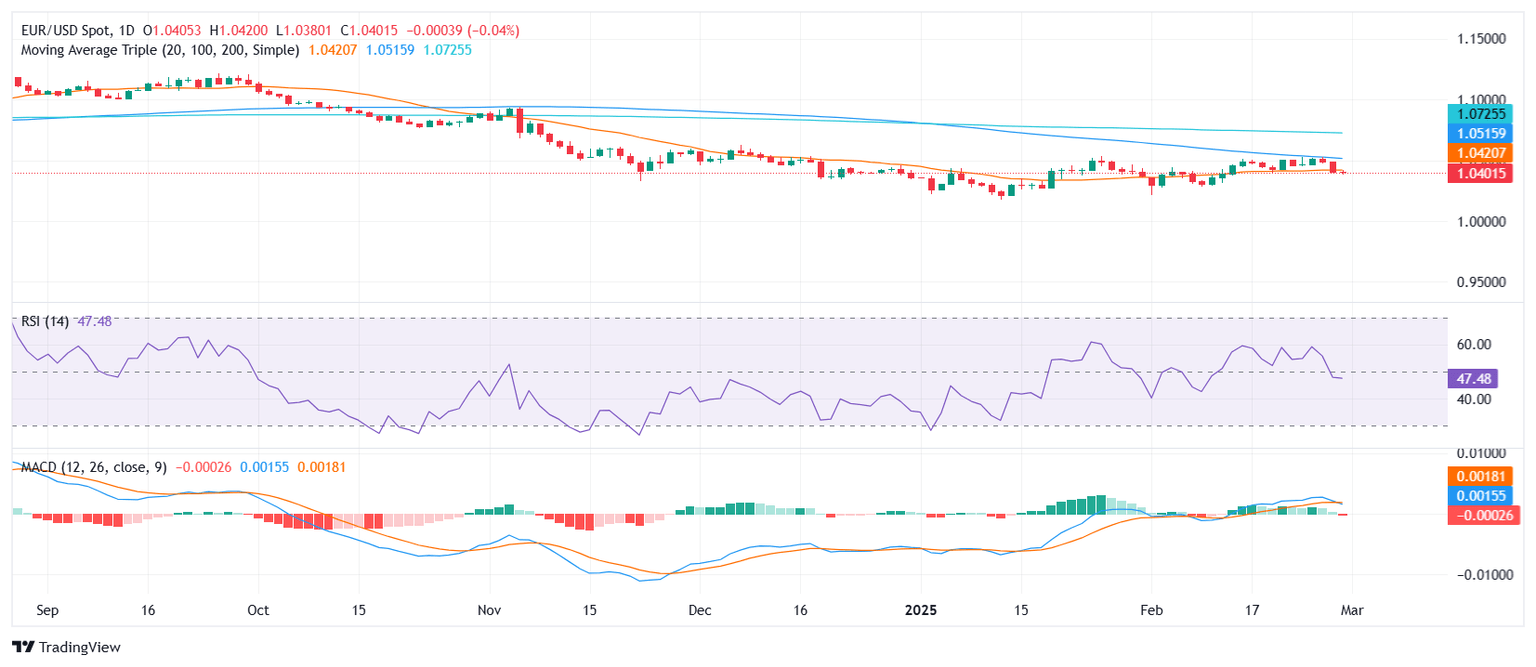

- After facing a third rejection at the 100-day SMA, the pair plummeted to a two-week low, shedding over 0.70% before stabilizing.

- Key resistance stands at the 20-day SMA near 1.0420.

EUR/USD closed the week with a slight recovery but remains in a vulnerable position after failing to sustain gains above the 100-day Simple Moving Average (SMA). The pair faced a decisive rejection at this level, which now appears to be converging with the 20-day SMA, increasing the likelihood of a bearish crossover.

Despite this downside pressure, by the end of the week, the pair stabilized just below the 20-day SMA, limiting further downside momentum. However, technical signals remain cautious, with the Relative Strength Index (RSI) in negative territory but flat, suggesting a temporary pause in the bearish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram showed a fresh red bar, indicating the presence of selling pressure.

Looking ahead, immediate resistance is seen at the 20-day SMA, which needs to be reclaimed for a sustained recovery. A break above this level could expose the 100-day SMA once again. On the downside, support is located at 1.0380, followed by 1.0350, a key level that could determine the next directional move.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.