EUR/USD Price Analysis: Pair plunges after third rejection at 100-day SMA

- EUR/USD extends its decline, hitting its lowest level in two weeks.

- RSI continues to weaken in negative territory, reflecting intensifying bearish momentum.

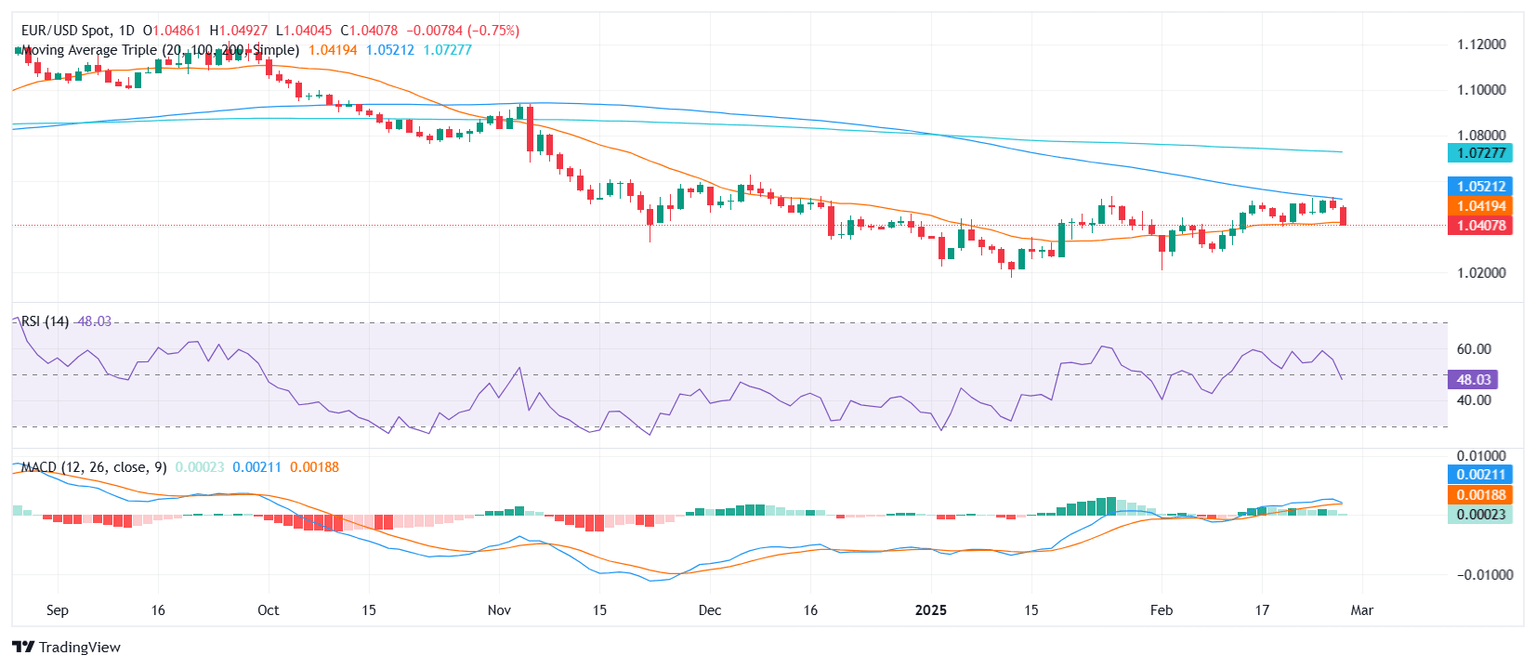

The EUR/USD pair suffered a sharp decline on Thursday, sinking to its lowest level in two weeks as sellers took control following yet another failure at the 100-day Simple Moving Average (SMA). This marks the third consecutive rejection at this resistance level, reinforcing its significance as a major hurdle for bulls. The latest drop also saw the pair shedding over 0.70% from recent highs, putting additional pressure on its near-term outlook.

From a technical standpoint, indicators are tilting further into bearish territory. The Relative Strength Index (RSI) continues to decline within negative territory, reflecting growing downside momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows decreasing green bars, highlighting the gradual erosion of bullish pressure.

For now, the pair has lost grip of the 20-day SMA, increasing the risk of deeper losses. Conversely, a rebound from this area could open the door for another attempt to reclaim the 100-day SMA at around 1.0520.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.