EUR/USD Price Analysis: Pair extends gains, rises above 1.0560

- EUR/USD gains 0.30% on Thursday, climbing to 1.0560.

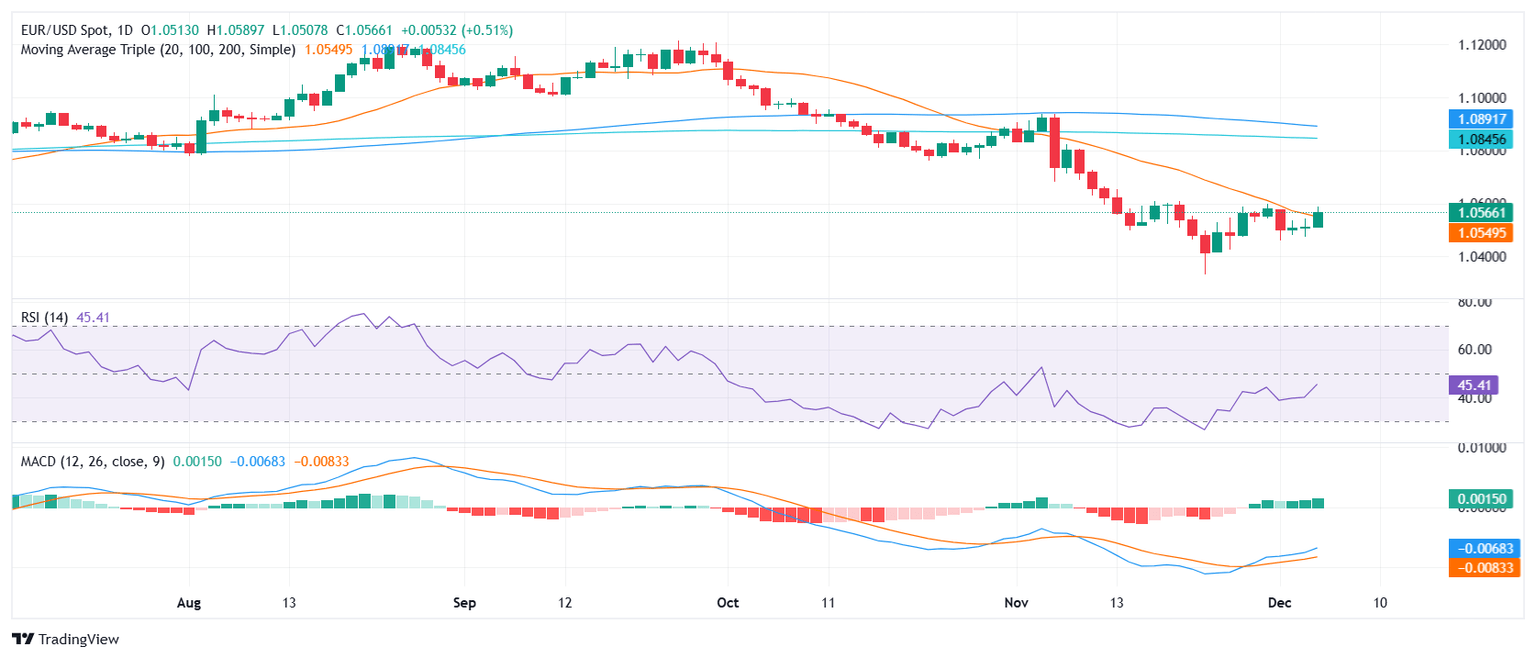

- Pair breaks above the 20-day SMA, improving the short-term outlook.

- Indicators show improving momentum, but lingering risks remain.

The EUR/USD pair extended its rebound on Thursday, rising to 1.0560 and breaking above the key 20-day Simple Moving Average (SMA). This move follows two consecutive days of gains as buyers gained momentum after defending the psychological support at 1.0500 earlier in the week. The pair's break above the SMA marks a significant improvement in the short-term outlook, although risks still linger.

Technical indicators are beginning to show signs of recovery. The Relative Strength Index (RSI) has risen further in negative territory, suggesting improving momentum but still signaling caution. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator shows rising green bars, indicating growing bullish momentum. While these developments are encouraging for the bulls, a sustained recovery is yet to be fully confirmed.

Traders will now watch whether EUR/USD can maintain its position above the 20-day SMA. Immediate resistance lies at 1.0580, followed by the 1.0600 psychological level. On the downside, a failure to hold above 1.0560 could see the pair revisiting support at 1.0530 and potentially retesting the 1.0500 level.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.