EUR/USD Price Analysis: Pair edges above 1.0500 but still struggles below 20-day SMA

- EUR/USD sees a slight uptick on Monday, hovering near 1.0500.

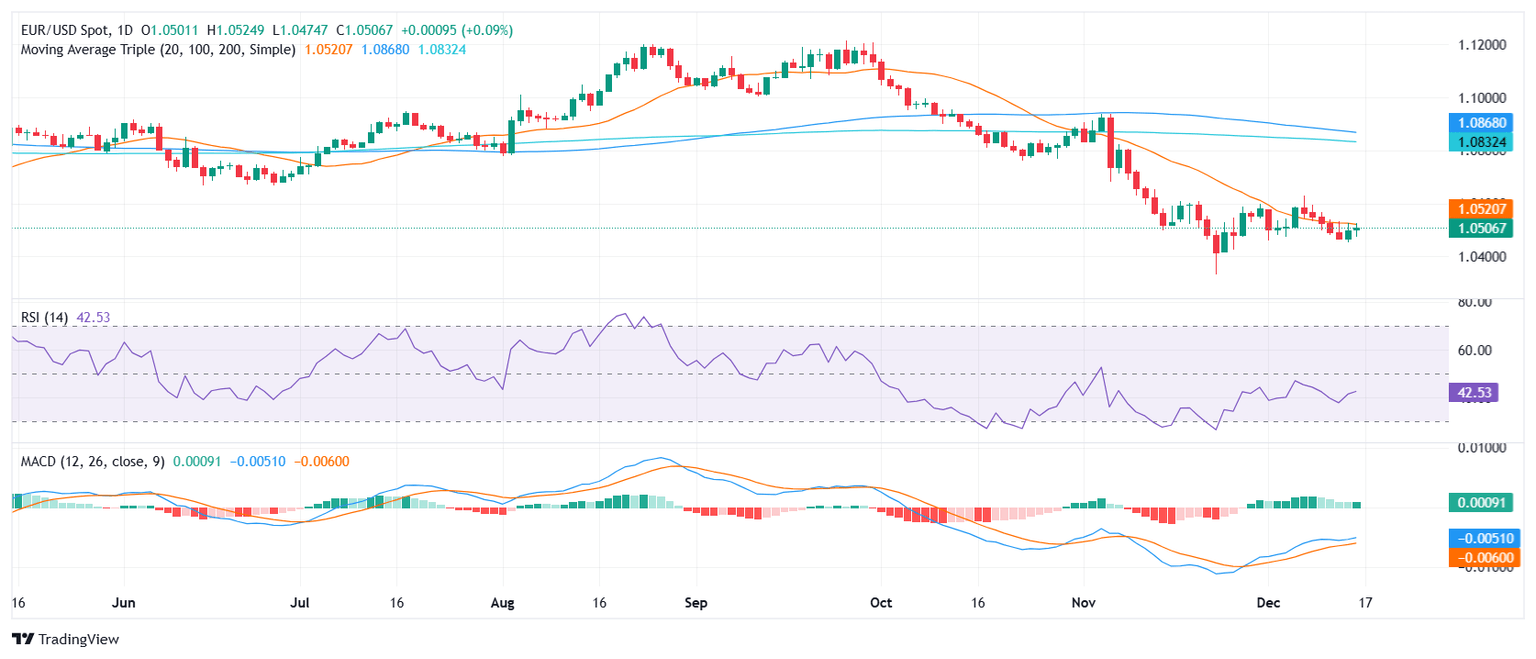

- RSI rises modestly to 43 but remains in negative territory, signaling a fragile recovery.

- MACD histogram shows rising green bars, yet the pair lacks the momentum to break above the 20-day SMA.

The EUR/USD pair managed another mild recovery on Monday, drifting slightly above the 1.0500 mark after bouncing from recent lows. Although the pair approached the 20-day Simple Moving Average (SMA) near 1.0520, it once again failed to breach this key resistance level, maintaining a cautious outlook.

Technical indicators reflect a tentative improvement but remain skewed to the downside. The Relative Strength Index (RSI) has ticked higher to 43, indicating a mild gain in buying interest, but it still resides in negative territory. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is now printing rising green bars, suggesting early signs of stabilizing momentum. However, the pair’s inability to overcome the 20-day SMA undermines the sustainability of any bullish attempt.

For a meaningful shift in sentiment, EUR/USD would need a decisive break above the 20-day SMA at around 1.0520. Until that occurs, the bias remains tilted to the downside, with initial support seen at the psychological 1.0500 level, followed by the 1.0480 area. A failure to hold above these levels could open the door to further losses, reinforcing the overall bearish perspective.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.