EUR/USD Price Analysis: Pair attempts mild rebound but outlook remains negative

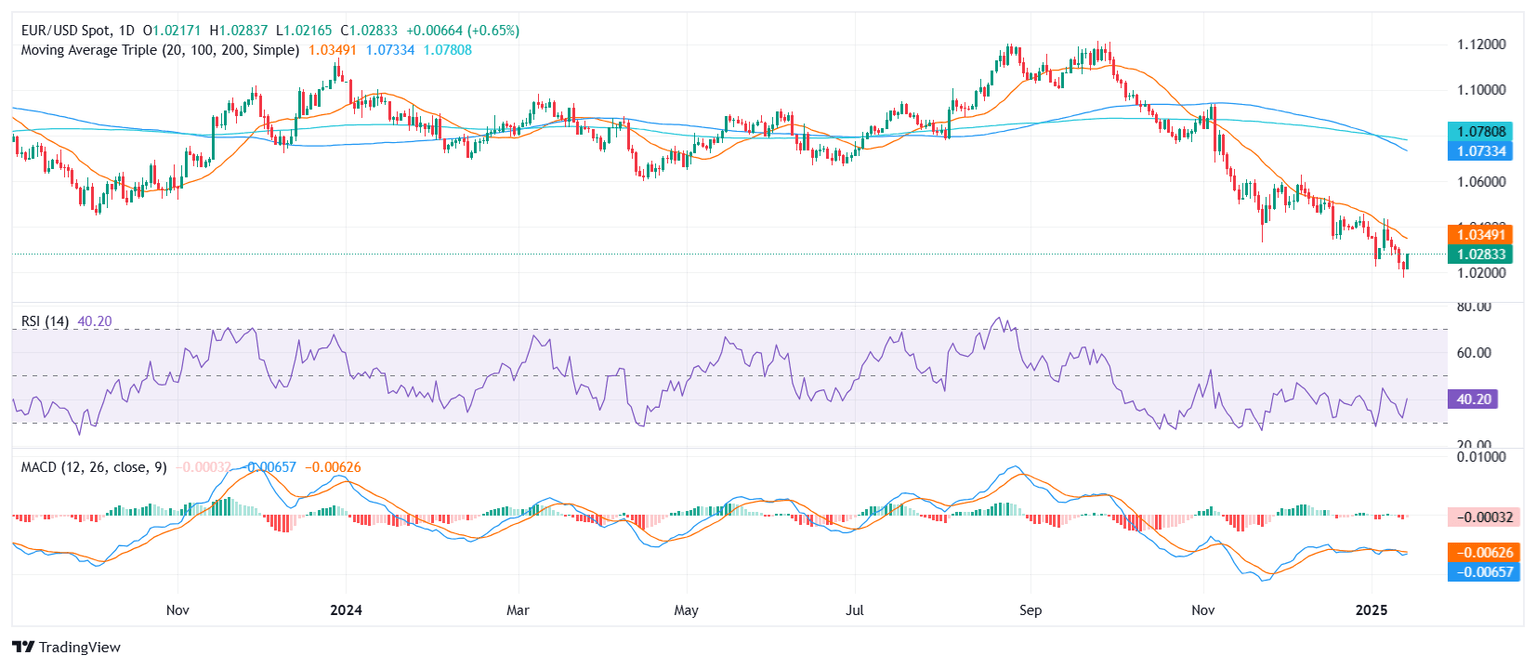

- EUR/USD slips marginally to 1.0270 on Tuesday, ending a five-day losing streak.

- RSI currently at 37, moving sharply higher despite remaining in negative territory.

The EUR/USD pair managed to eke out a modest recovery on Tuesday, edging down to 1.0270 yet avoiding a sixth consecutive day in the red. Despite this fragile bounce, the pair remains under pressure, underscoring the persistent headwinds that have characterized its performance over the past week.

Technical indicators offer a mixed perspective. While the Relative Strength Index (RSI) has ticked up to 37 and shows signs of life, it continues to reside in negative territory. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat red bars, suggesting that the recent reprieve may lack the follow-through needed to spark a robust bullish reversal.

Looking ahead, immediate support stands near the 1.0250 handle, with any drop below that level potentially exposing the 1.0220 region. On the upside, overcoming resistance around 1.0300 would be essential to bolster the pair’s recovery attempt, opening the door for a possible retest of the 1.0350 zone if bullish momentum takes hold.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.