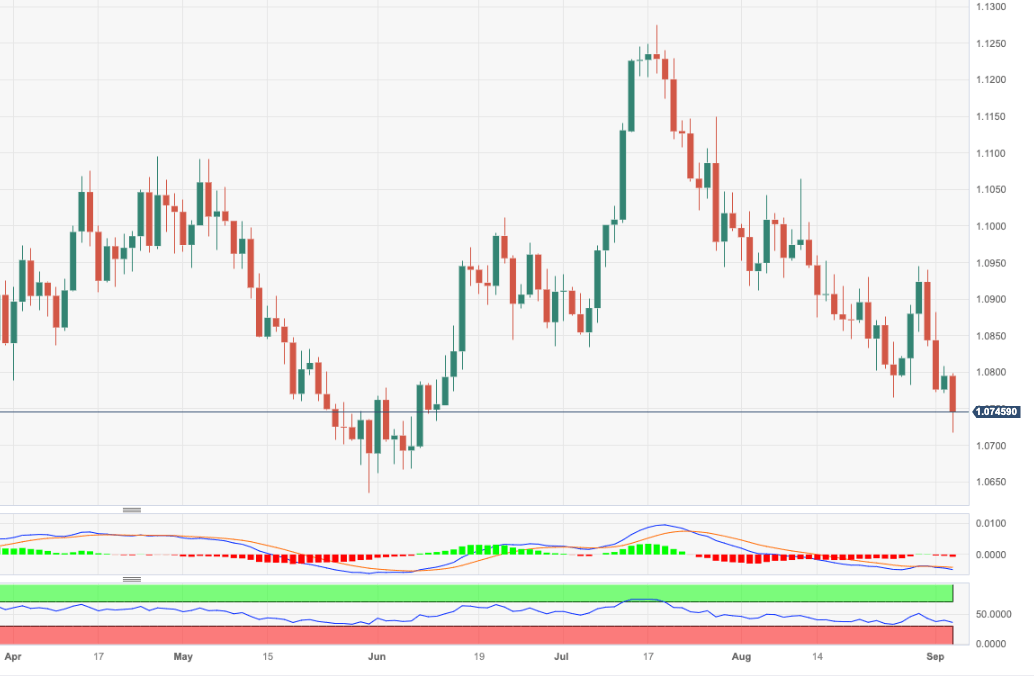

EUR/USD Price Analysis: Next on the downside comes 1.0635

- EUR/USD sees its decline gather pace and test the 1.0715 level.

- Down from here comes the May low in the 1.0630 zone.

EUR/USD sets aside Monday’s decent bounce and resumes the downtrend on Tuesday.

The sharp retracement seen in the latter part of last week seems to have shifted the attention to the downside once again. Against that, the loss of the 1.0700 support is expected to motivate the pair to challenge the May low of 1.0635 (May 31) in the not-so-distant future.

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0819.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.