EUR/USD Price Analysis: Extended losing streak tests bullish recovery

- EUR/USD slips, settling near 1.0305 and marking three consecutive days of losses.

- RSI remains flat at 40 in negative territory, suggesting momentum has stalled.

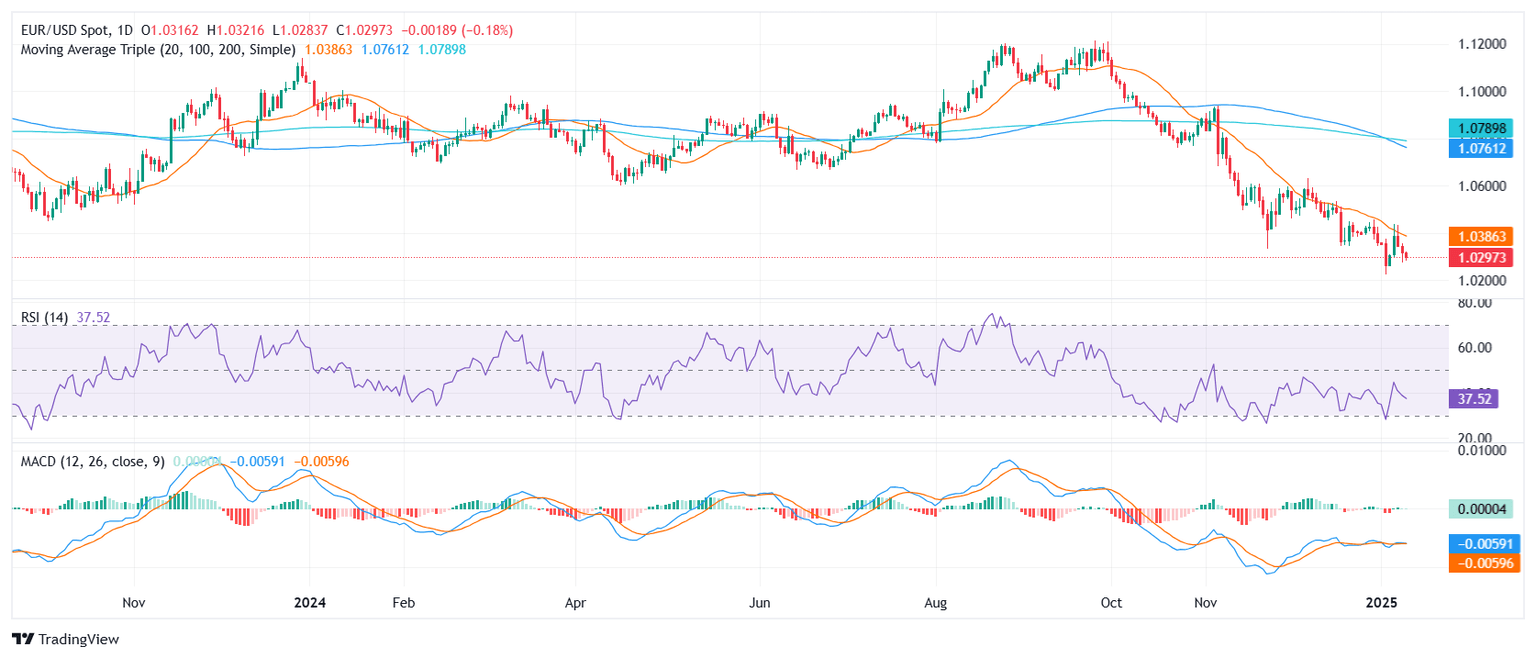

The EUR/USD pair continued its downtrend on Thursday, edging 0.18% lower to trade around 1.0305. This decline not only extends the losing streak to a third session but also underscores the pair’s struggle to establish a more robust recovery. Despite a brief bounce earlier in the month, the 20-day Simple Moving Average (SMA) remains out of reach, signaling that bullish momentum has yet to build meaningful traction.

Technical readings reflect a market grappling with waning upward impulses. The Relative Strength Index (RSI) rests at 40, indicating only minimal buying interest, while the Moving Average Convergence Divergence (MACD) histogram is printing fewer green bars, highlighting the gradual erosion of bullish momentum. If the pair fails to rebound above the 20-day SMA in the coming sessions, sellers may maintain the upper hand.

Looking ahead, EUR/USD could find immediate support around the 1.0280 region, with a deeper pullback potentially targeting 1.0250. On the upside, recapturing the 20-day SMA near 1.0350 would be critical for a more convincing recovery, exposing the 1.0400 threshold as the next key resistance.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.