EUR/USD Price Analysis: Euro snaps 6-day losing trend

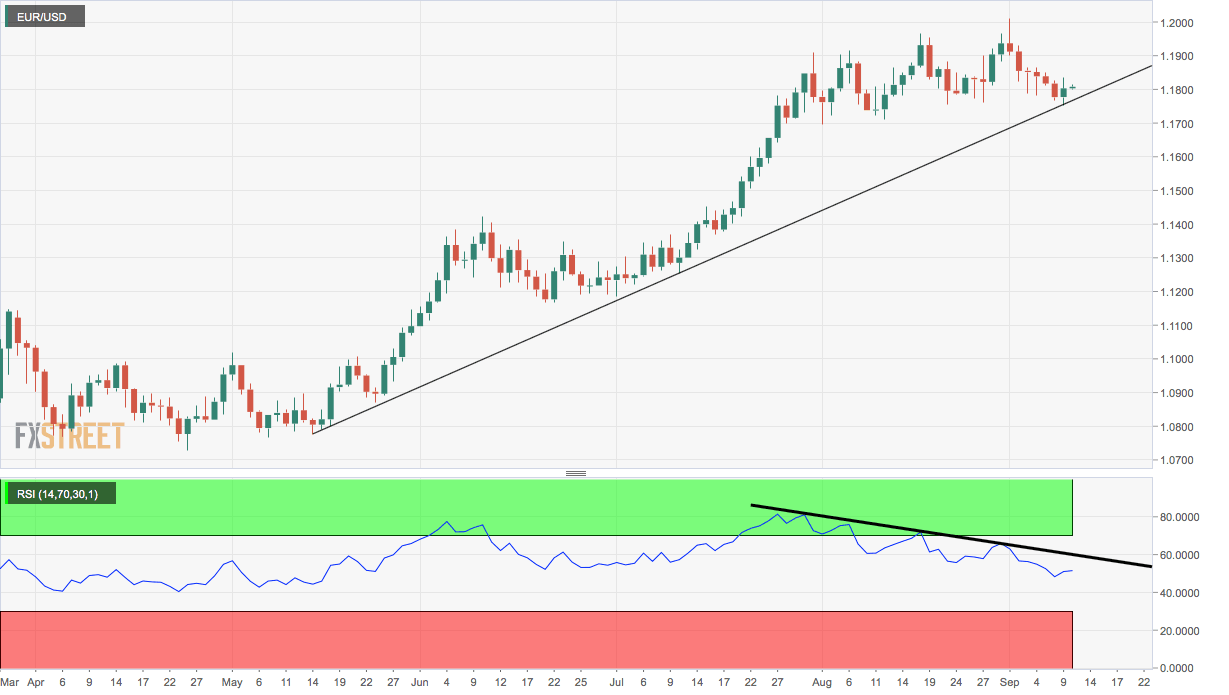

- EUR/USD has reversed higher from a multi-month ascending trendline.

- Wednesday's high is now the level to beat for the bulls.

EUR/USD jumped 0.24% on Monday, ending a six-day losing streak and defending the trendline rising from May 14 and July 10 lows.

The bounce from the ascending trendline has neutralized the immediate bearish view. That said, a reversal higher would be confirmed if the pair finds acceptance above the overnight high of 1.1834 on Thursday.

More substantial evidence of bullish revival would be the relative strength index's violation of the downtrend line.

However, the trend change would remain elusive if the European Central Bank (ECB) offers a more dovish forward guidance than expected. EXpectations for supportive comments have been built up in the market due to rising euro and falling inflation expectations.

Key support levels are located at 1.1753 (Wednesday's low) and 1.1696 (Aug. 3 low). Meanwhile, resistances are located at 1.17855 (200-hour SMA) and 1.19 (psychological hurdle).

Daily chart

Trend: Neutral

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.