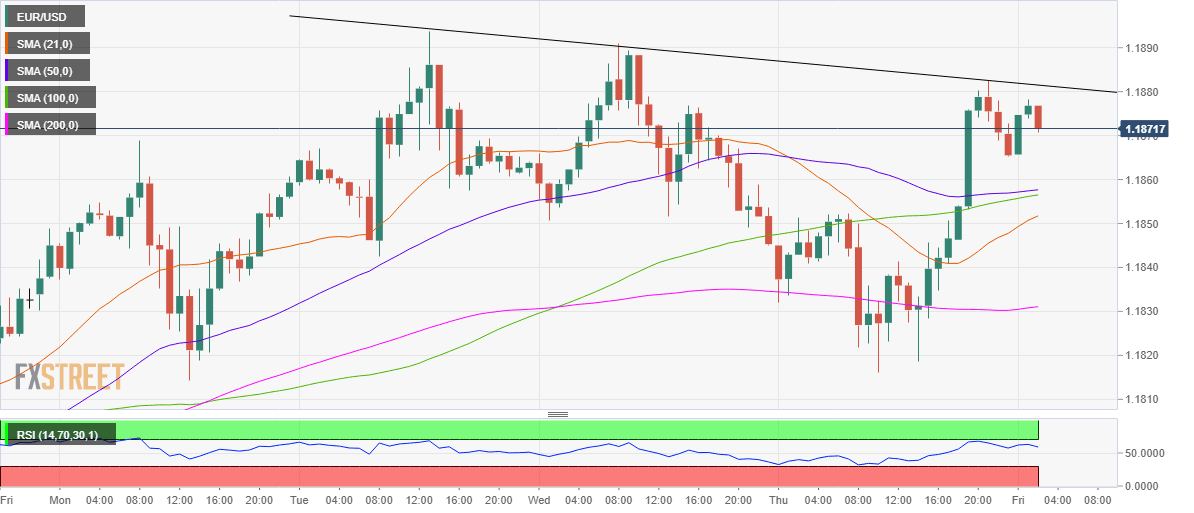

EUR/USD Price Analysis: Descending trendline resistance near 1.1880 limits immediate upside

- EUR/USD’s upside attempts face rejection at the trendline hurdle.

- The spot trades above all the major HMAs.

- Hourly RSI keeps points south but stays in the bullish zone.

EUR/USD extends its consolidative mode into Asia, following a solid comeback seen in the US last session.

The overnight rally in the spot prompted the bulls to regain ground above all the major hourly moving averages (HMA).

Although the descending trendline resistance at 1.1881 remains a tough nut to crack for the buyers so far this Friday.

The downward turn in the hourly Relative Strength Index (RSI), currently at 58.47, suggests that the bulls are likely to face a tough time surpassing the foresaid hurdle.

Acceptance above that level could see a test of the 1.1900 level.

Alternatively, the major could find strong support at 1.1857, the confluence of the 50 and 100-HMA.

Meanwhile, the bullish 21-HMA at 1.1851 could be tested if the follow-through selling interest picks up pace.

Further south, the horizontal 200-HMA at 1.1831 is the level to beat for the bears.

EUR/USD: Hourly chart

EUR/USD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.