EUR/USD Price Analysis: Bulls regain ground but momentum shows signs of exhaustion

- EUR/USD was seen trading around the 1.0910 zone after the European session, recovering after recent corrections.

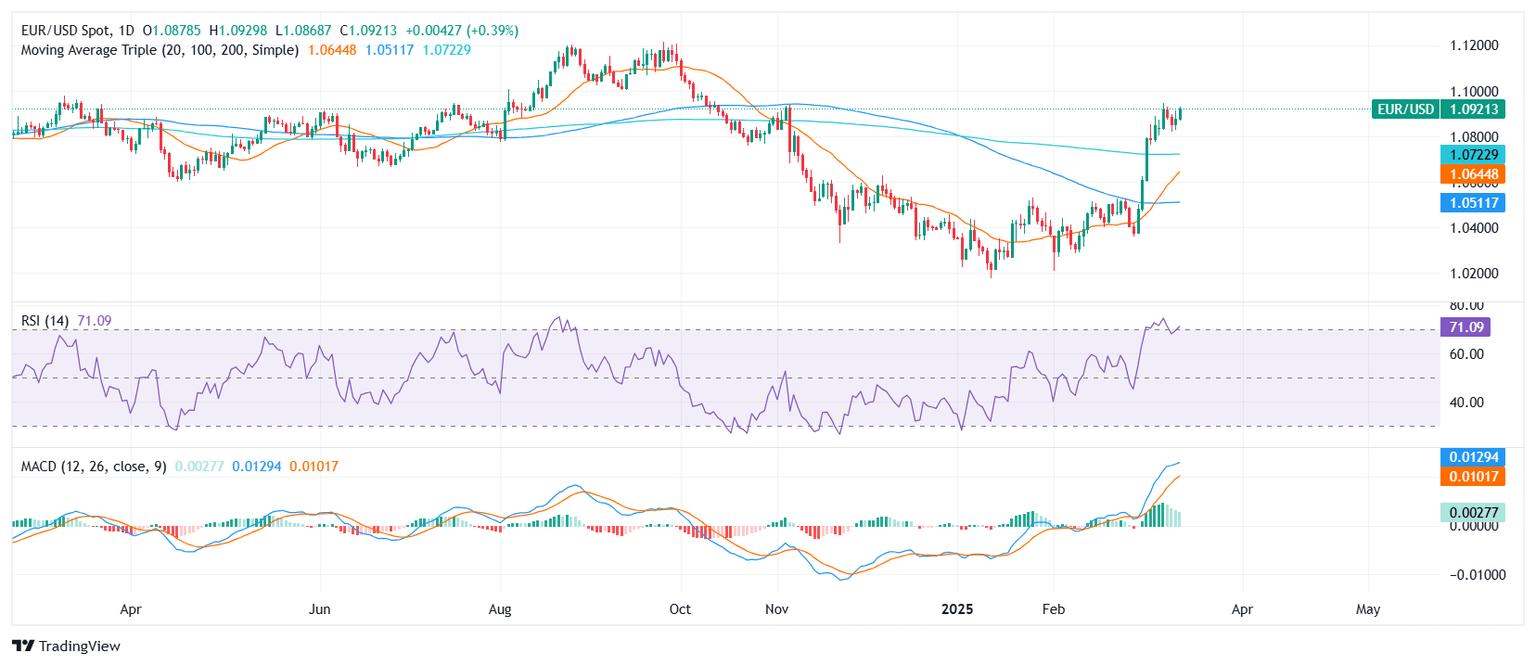

- Despite the bounce, momentum indicators suggest uncertainty, with the RSI returning to overbought territory but the MACD showing weaker green bars.

EUR/USD extended gains on Monday after the European session, climbing toward the 1.0910 area as bulls made a comeback following a brief corrective phase. The pair recovered moderately, but signs of fading momentum persist, making the short-term outlook uncertain.

The Relative Strength Index (RSI) has returned to overbought levels, signaling strong buying interest, yet the Moving Average Convergence Divergence (MACD) is printing weaker green bars, suggesting that bullish momentum could be fading. This mixed picture leaves room for either sideways trading or a potential pullback if buyers fail to sustain the upward push.

On the technical front, immediate resistance is found near 1.0930, and a breakout above this level could open the door for further gains toward 1.0950. On the downside, initial support lies at 1.0880, followed by a stronger floor around 1.0850. If sellers gain traction, the pair could see a deeper retracement in the sessions ahead.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.