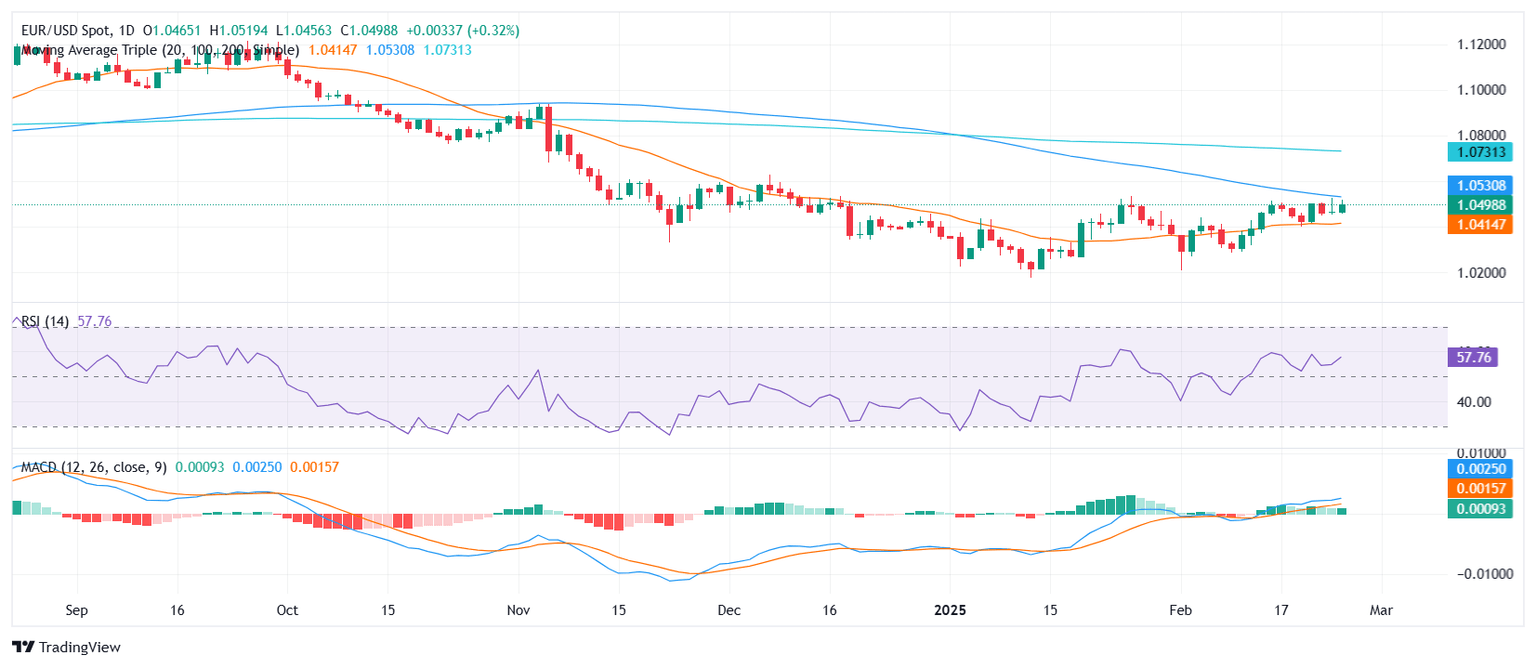

EUR/USD Price Analysis: Bulls approach critical resistance near 100-day SMA

- EUR/USD posts moderate gains, nearing a key resistance zone.

- RSI climbs in positive territory, signaling to strengthen bullish momentum.

- Bulls appear poised for another retest of the 100-day SMA after failing to break through.

The EUR/USD pair extended its upward momentum on Tuesday, inching closer to the crucial 100-day Simple Moving Average (SMA). After a solid advance in recent sessions, the pair now finds itself testing familiar resistance levels. Although buyers haven’t yet conquered this barrier, recent price action suggests that bulls may be gearing up for another attempt.

Technical indicators highlight growing bullish momentum. The Relative Strength Index (RSI) has advanced deeper into positive territory, suggesting that buying interest remains firm. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat green bars, reflecting a pause in momentum but hinting at a potential bullish continuation if resistance breaks.

In the near term, a decisive break above the 100-day SMA could open the door for further gains, with the next resistance potentially around the 1.0550 region. However, if the pair faces another rejection at this level, the bullish narrative may begin to fade, possibly sending the pair back toward support around the 20-day SMA. The next few sessions will be crucial to determine whether buyers can maintain their hold or if the bears will regain control.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.