EUR/USD Price Analysis: Breaks below 1.17, head-and-shoulders breakdown confirmed

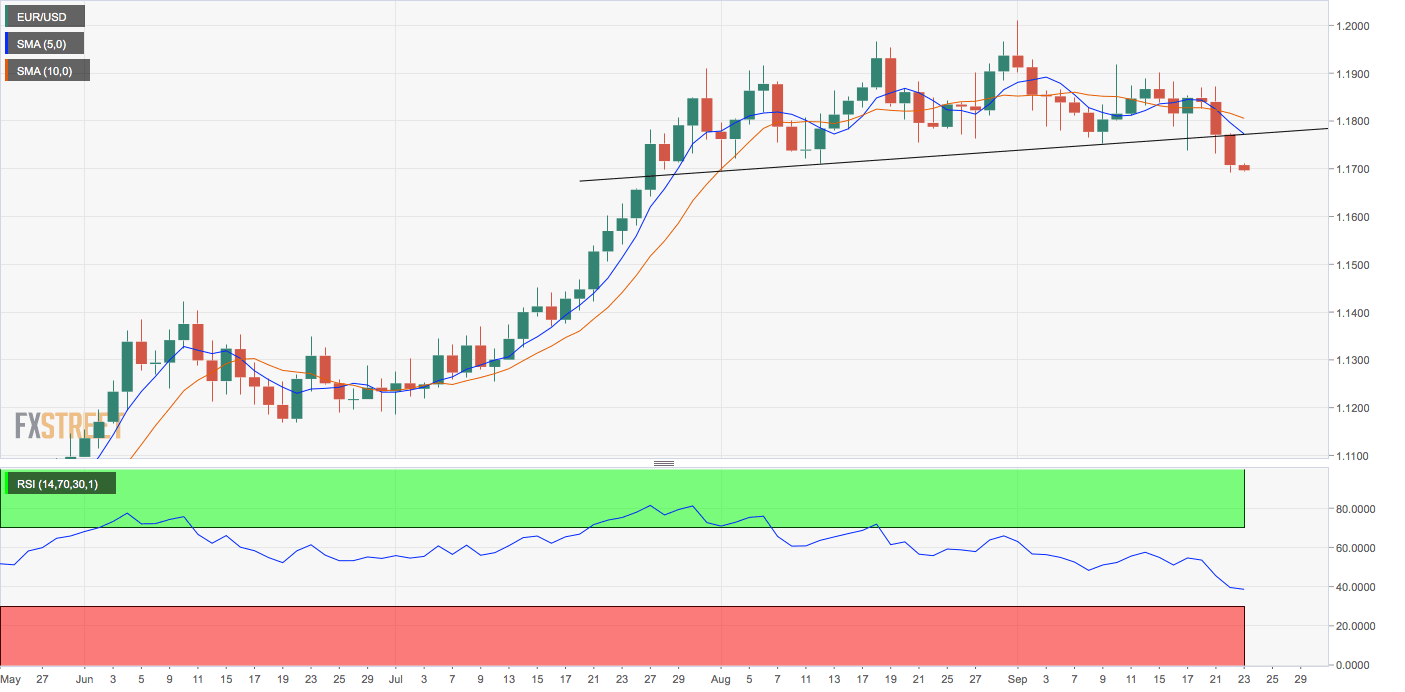

- EUR/USD's daily chart shows a head-and-shoulders bearish reversal pattern.

- Key indicators support the case for deeper declines.

EUR/USD is currently trading below 1.17, having declined from 1.1773 to 1.1690 on Tuesday.

Notably, the pair closed well below 1.1770 on Tuesday, confirming a head-and-shoulders breakdown on the daily chart.

The bearish reversal pattern has created room for a continued decline to 1.1530 (target as per the measured move method).

The breakdown is backed by descending 5- and 10-day simple moving averages (SMAs) and a below-50 or bearish reading on the 14-day relative strength index.

The bearish bias will be neutralized if the pair finds acceptance above the former support-turned-resistance of 1.1770.

EUR/USD's bearish reversal indicates the dollar has bottomed out and heading higher against most currencies.

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.