EUR/USD Price Analysis: Bears await US CPI and Fed decision before placing fresh bets

- EUR/USD struggles to lure buyers and is undermined by a combination of factors.

- Reduced Fed rate cut bets continue to lend support to the USD and cap the upside.

- Political uncertainty in Europe weighs on the Euro ahead of the US CPI and Fed.

The EUR/USD pair oscillates in a narrow range during the Asian session on Wednesday and consolidates its losses registered over the past three days, to the 1.0720 area, or the lowest level since early May touched the previous day. Spot prices currently trade just below mid-1.0700s, nearly unchanged for the day, as traders await the release of the US consumer inflation figures and the crucial FOMC decision before placing fresh directional bets.

Heading into the key data/event risks, diminishing odds for an imminent rate cut by the Federal Reserve (Fed) in September assist the US Dollar (USD) to stand tall near a one-month peak touched on Tuesday. The shared currency, on the other hand, is undermined by the fact that Eurosceptic nationalists registered the biggest gains in European Parliament elections in the Sunday vote. Adding to this, French President Emmanuel Macron's decision to call snap elections later this month increases political uncertainty in the Eurozone's second-largest economy and contributes to capping the EUR/USD pair.

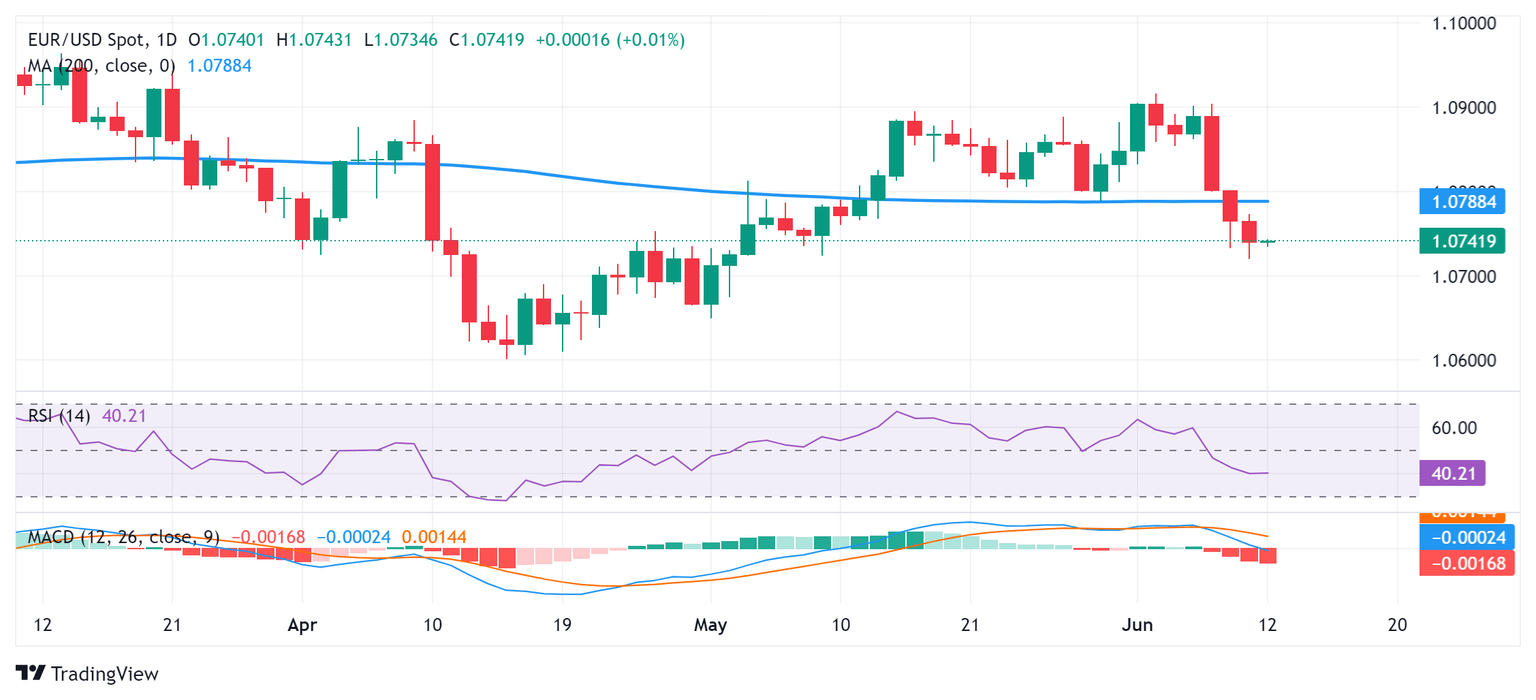

From a technical perspective, this week's sustained break and acceptance below the very important 200-day Simple Moving Average (SMA) near the 1.0800 mark was seen as a fresh trigger for bearish traders. Furthermore, oscillators on the daily chart are holding in the negative territory, suggesting that the path of least resistance for the EUR/USD pair is to the downside. Hence, any attempted recovery could attract fresh sellers near the 200-day SMA. This should act as a key pivotal point, which if cleared might prompt a short-covering rally to the 1.0865-1.0870 supply zone en route to the 1.0900 mark.

On the flip side, bearish traders might now wait for some follow-through selling below the 1.0700 mark before placing fresh bets. The EUR/USD pair might then accelerate the downward trajectory towards the next relevant support near the 1.0650-1.0640 region before eventually dropping to the 1.0600 mark, or the YTD low touched in April. A convincing break below the latter should pave the way for an extension of the recent downtrend witnessed over the past week or so, from levels just above the 1.0900 round figure.

EUR/USD daily chart

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.