EUR/USD Price Analysis: A drop below 1.0760 exposes further losses

- EUR/USD picks up further downside traction near 1.0750.

- Losses could accelerate below the 3-month line near 1.0760.

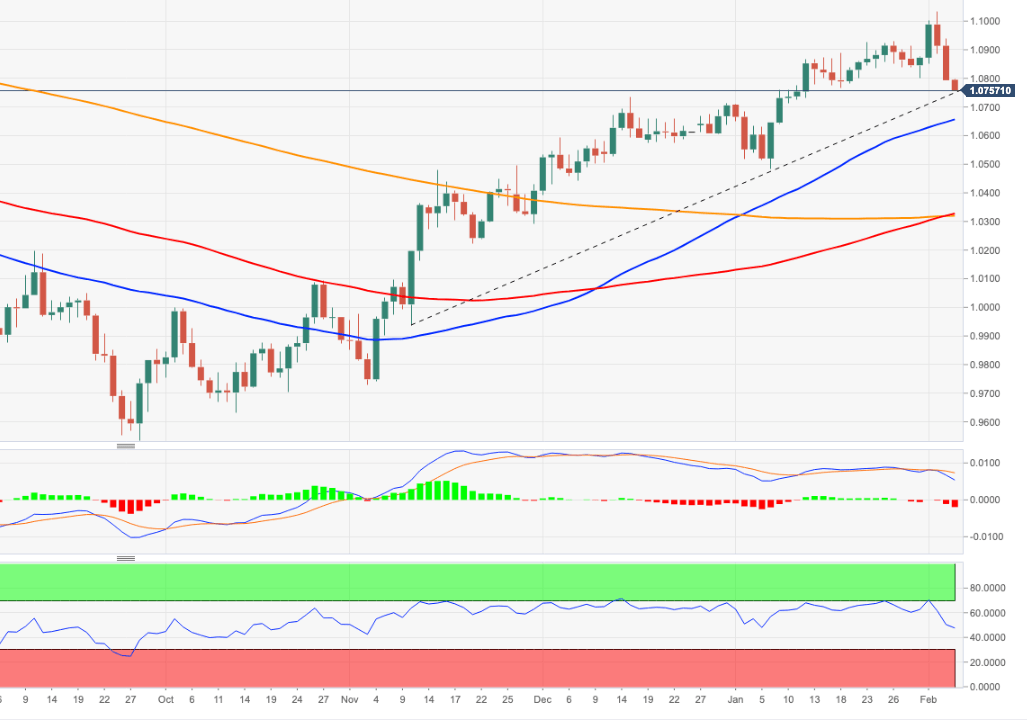

EUR/USD extends the corrective decline for the third consecutive session and flirts with the 1.0750 region at the beginning of the week.

A convincing breakdown of the 3-month support line around 1.0760 could open the door to extra weakness in the short-term horizon. Against that, there is an interim support at the 55-day SMA at 1.0655 prior to the 2023 low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0318.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.