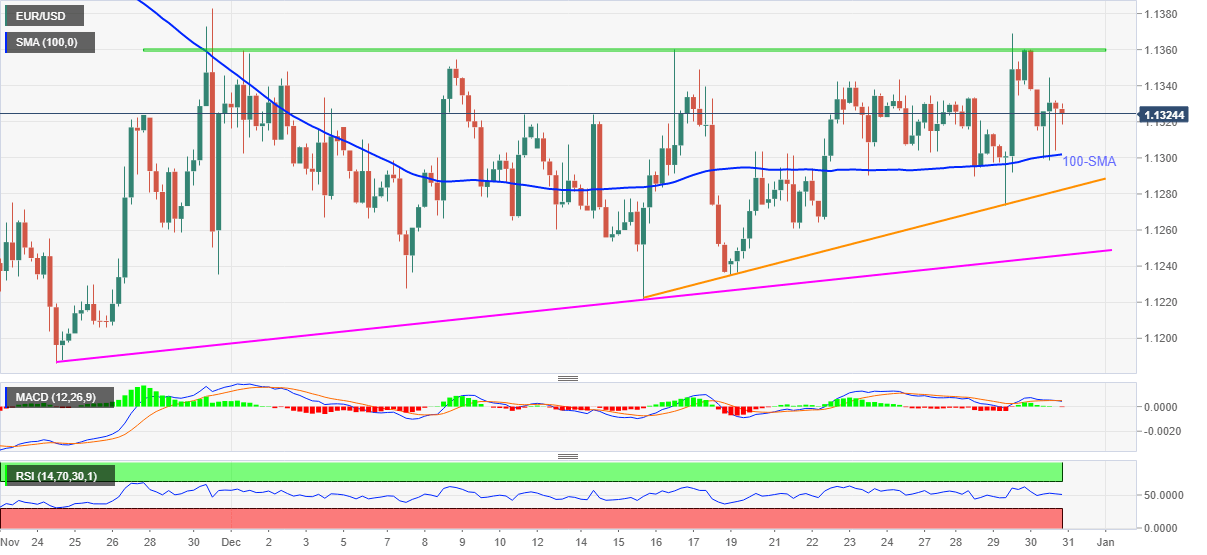

EUR/USD Price Analysis: 100-SMA defends bulls above 1.1300

- EUR/USD fades bounce off 100-SMA, dropped the most in two weeks the previous day.

- Steady RSI, sluggish MACD hints at extended grind between 100-SMA and monthly resistance line.

- Mid-November tops add to the upside filters, five-week-old rising trend line acts as additional support.

EUR/USD consolidates the heaviest daily loss in a fortnight with a choppy range above 1.1300 during Friday’s initial Asian session. That said, the quote seesaws near 1.1325 by the press time.

In doing so, the major currency pair struggles to keep the bounce off 100-SMA after taking a U-turn from the monthly high on Wednesday.

Although EUR/USD buyers keep returning from the 100-SMA, sluggish oscillators, namely the MACD and RSI, hints at another inactive daily performance by the pair as it approaches 2022.

That said, a downside break of the 100-SMA level of 1.1300 will have another support to watch, namely a two-week-old ascending trend line near 1.1280.

Also challenging the EUR/USD bears is an upward sloping support line from November 30, near 1.1245.

Meanwhile, an upside clearance of the monthly horizontal hurdle around 1.1360 will need validation from the November 16 peak of 1.1385 to convince the EUR/USD bulls.

Following that, a run-up toward the tops marked during June and March of 2020, respectively near 1.1425 and 1.1500, can’t be ruled out.

EUR/USD: Four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.