EUR/USD heads into Friday near 1.0550 ahead of EU CPI, US PCE inflation

- The EUR/USD saw gains for Thursday as the DXY recedes.

- Analysts expect further weakness from the Euro moving forward on the end of rate hike cycles.

- Friday to close out the trading week with EU & US key inflation measures.

The EUR/USD tapped into an intraday high of 1.0580 on Thursday before settling to close out the US trading session down near 0.10550. The US Dollar (USD) has gained across the board with the US Dollar Index (DXY) catching a broad-market lift as risk appetite sours on weakening economic data, spiking Treasury yields, and recession concerns.

Investors are gearing up for a full data docket on Friday, with European Consumer Price Index (CPI) figures kicking things off.

European inflation is expected to decline moderately. with the annualized CPI reading for September forecast to tick down from 5.3% to 4.8%.

Market forecasters are expecting a half-percent cut in the rate of price growth for Europe as the continental economy wobbles, with a dovish European Central Bank (ECB) looking entirely set to start looking for rate cuts if the economy continues to sour.

Friday will also see US Personal Consumption Expenditure (PCE) Price Index numbers. US PCE inflation is forecast to hold steady for the month of August at 0.2%, while the annualized figure for the same period is seen ticking lower from 4.2% to 3.9%.

Analysts broadly expect both EU and US inflation readings to step lower, but the weak-side bet goes to Europe as price growth is expected to slump noticeably in the coming months.

Read More:

The Pound and Euro should weaken substantially through early 2024 – Wells Fargo

EUR/USD Price Analysis: A drop to the YTD low appears on the table

Eurozone HICP Preview: Forecasts from five major banks, overall inflation-slowing trend

EUR/USD technical outlook

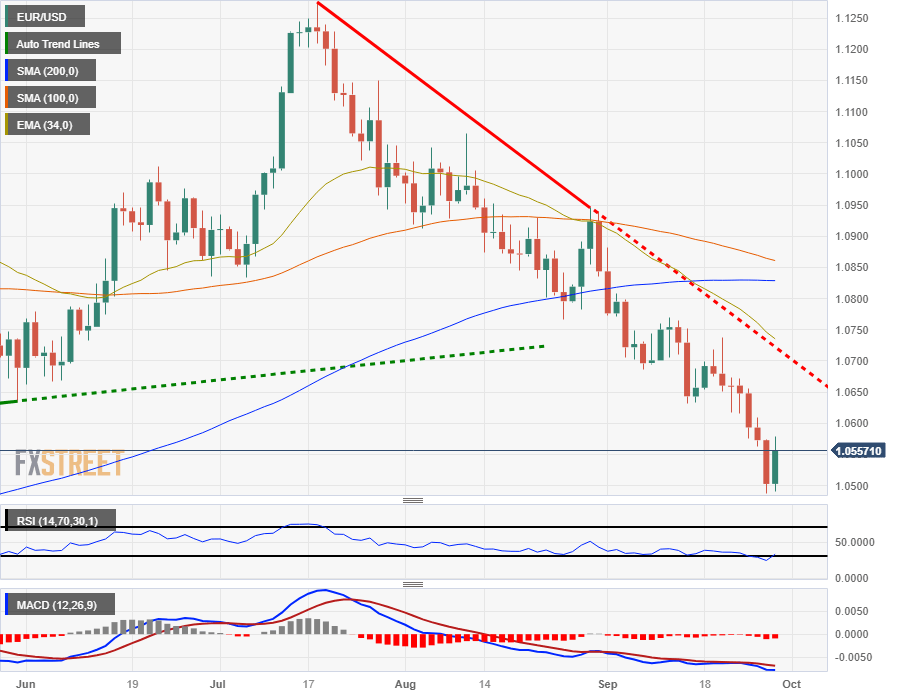

The EUR/USD is testing around 1.0555 after taking a downside rebound from the 100-hour Simple Moving Average (SMA) near 1.0580 in mid-Thursday trading. Hourly candles have broken to the upside of a descending intraday trendline from last week's swing high near 1.0730.

Technical resistance comes from the 200-hour SMA near 1.0620, while near-term price action will see support from the 34-hour Exponential Moving Average (EMA) near 1.0540.

On the daily candlesticks, the EUR/USD is desperate for a green day after closing flat or in the red for the past seven straight trading sessions, and price action still remains firmly bearish with upside momentum capped by a descending trendline from July's peak near 1.1275.

The EUR/USD daily candles have accelerated away from the 200-day SMA, which is turning bearish from just north of the 1.0800 handle.

EUR/USD hourly chart

EUR/USD daily chart

EUR/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.