EUR/USD edges higher as Fed turmoil and safe-haven flows pressure US Dollar

- EUR/USD climbs 0.43% as traders discount upbeat US GDP and jobless claims, focusing instead on Fed turmoil.

- Trump–Fed clash and safe-haven flows into Euro, Yen and Swiss Franc weigh on the US Dollar momentum.

- French confidence vote looms, threatening Euro stability as ECB minutes and sentiment data highlight fragile outlook.

EUR/USD edges up late in the North American session on Thursday, as the US Dollar (USD) fails to gain traction on upbeat US data, amid the ongoing conflict between US President Donald Trump and Federal Reserve (Fed) Governor Lisa Cook. At the time of writing, the pair trades at 1.1688, up 0.43%.

Traders remained hooked to the battle between the Fed and the White House as the latest Gross Domestic Product (GDP) figures and Initial Jobless Claims in the US showed that the economy is solid. Consequently, the Greenback depreciated for the third consecutive day as traders seeking safety bought the shared currencies, the Swiss Franc (CHF) and the Japanese Yen (JPY).

Despite this, the Euro’s advance might be short-lived, as French Prime Minister Bayrou called for a confidence vote amid an environment in which the country lacks a budget, increasing his chances of being sacked.

The European Union (EU) economic schedule featured the minutes of the European Central Bank (ECB)'s last meeting, the August Economic Sentiment Indicator and Consumer Confidence for the same period.

The US economic schedule will feature on Friday, the release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Traders ignore strong US GDP data, boosting the Euro

- The US economic docket revealed that the economy grew at a faster pace in the second quarter of 2025, with GDP expanding 3.3% quarter-over-quarter, above both the preliminary 3.0% estimate and market expectations of 3.1%.

- Initial Jobless Claims for the week ending August 23 fell to 229K, just below forecasts of 230K and down from 234K the prior week. However, following downward revisions to Nonfarm Payrolls earlier this month, the data showed the labor market has cooled, averaging just 35K job gains per month over the past three months.

- The US Dollar Index (DXY), which tracks the performance of the Dollar against a basket of six currencies, is down 0.33% at 97.85.

- The latest ECB minutes showed that the central bank adopted a wait-and-see mode, with a high bar set for another rate cut. The ECB Governing Council noted that risks to the economy are tilted to the downside, due to an “escalation in global trade tensions.” The ECB is concerned about uncertainty, adding that “There was considerable discussion on the role of uncertainty, which remained very high, related both to trade policy and geopolitics."

- Expectations that the Fed will reduce rates at the September meeting continued to trend higher. The Prime Marketer Terminal interest rate probability tool had priced a 90% chance of the Fed easing policy by 25 basis points (bps) to 4.00%-4.25%. The ECB is likely to keep rates unchanged, with a 94% probability, and only a 6% chance of a 25-bps cut.

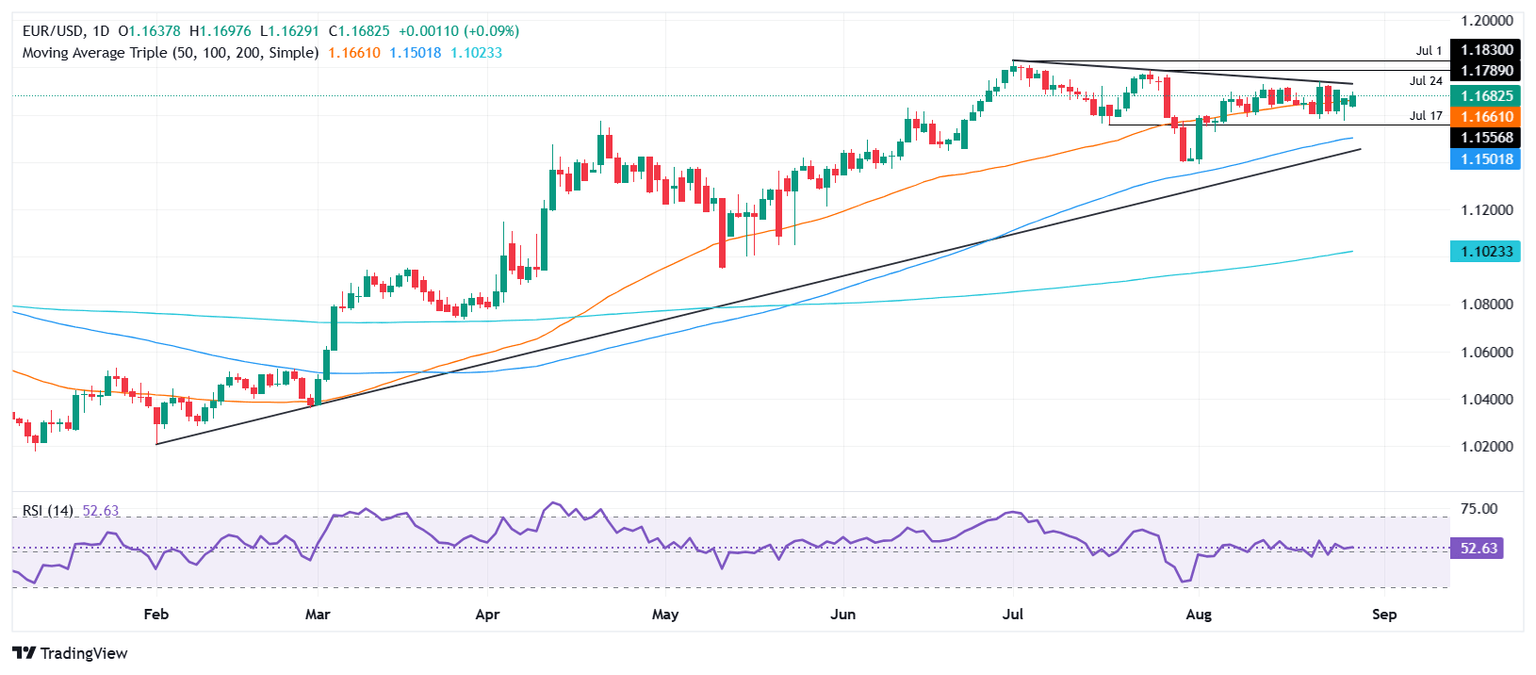

Technical outlook: EUR/USD poised to challenge 1.1700 in the near term

The EUR/USD uptrend remains intact, extending its gains beyond 1.1600 and reaching a three-day high near 1.1700. It is worth noting that the Relative Strength Index (RSI), which had turned bearish, bounced back into bullish territory, indicating that buyers are in control.

A daily close above 1.1700 would solidify the case for testing higher prices. The next area of interest would be 1.1742, the August 22 high, 1.1800, and the year-to-date (YTD) peak of 1.1829.

On the downside, a break below the 50-day SMA of 1.1658 will expose the 20-day SMA at 1.1645, followed by the 100-day SMA near 1.1506.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.