EUR/USD extends losses with markets cautious amid high trade uncertainty

- The Euro retraced previous gains, with investors wary of taking excessive risks amid high trade uncertainty.

- The US Dollar is picking up after a mild reversal following dovish FOMC minutes.

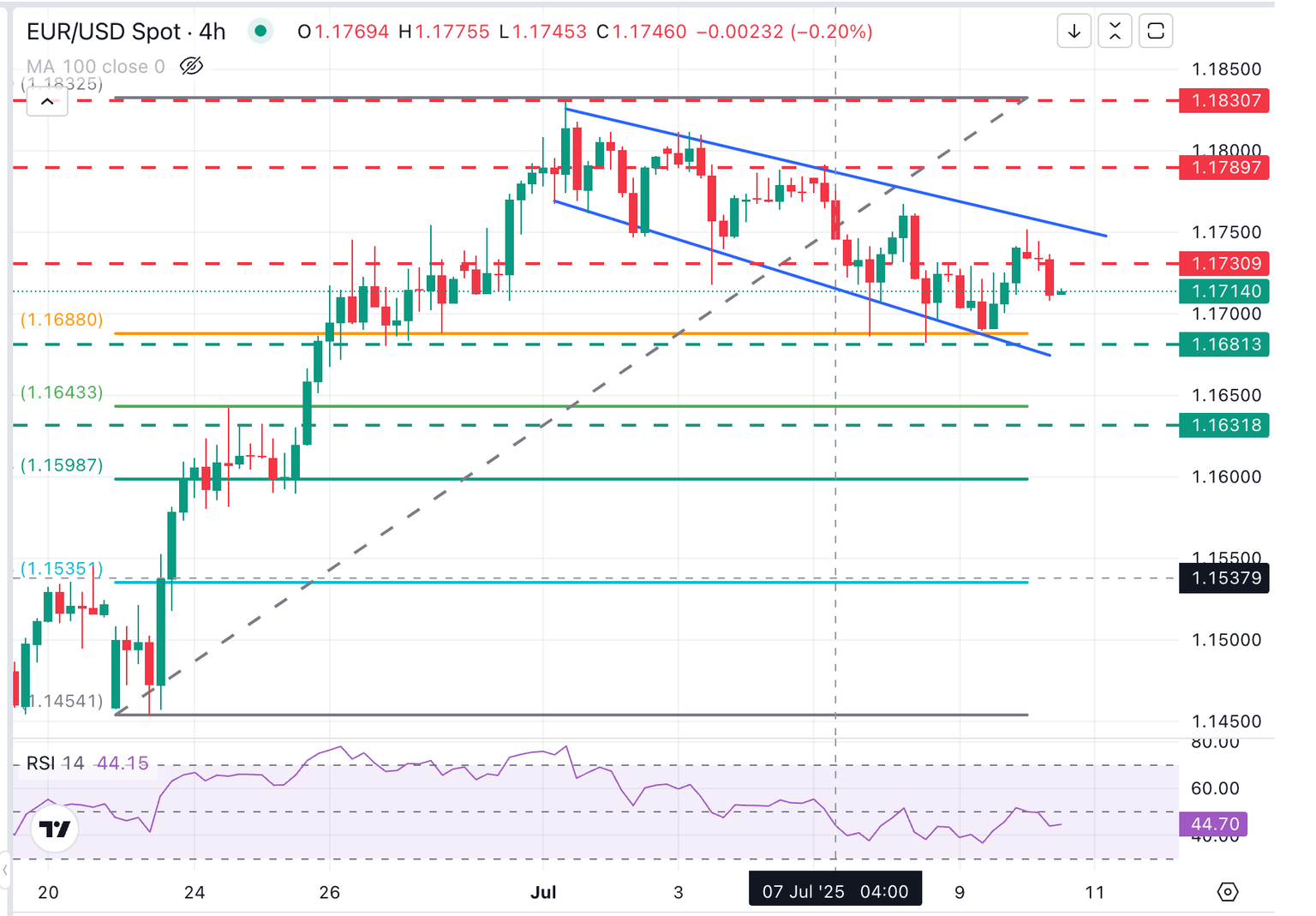

- EUR/USD remains trapped within a bearish channel, below the 1.1750 trendline resistance.

The EUR/USD pair has been unable to hold gains and trades with minor losses ahead of the US session opening. Investors' concerns about the uncertain outlook for international trade are weighing on risk appetite and providing support to the safe-haven US Dollar.

The Euro (EUR) saw some recovery during the Asian and Early European sessions, but bulls were capped at the 1.1750 area, and the pair retreated to levels right above 1.1700 at the time of writing. From a wider perspective, Thursday's price action confirmed that the bearish structure from the July 1 highs remains in play.

News reports about the trade negotiations between the European Union (EU) and the US are positive, and markets remain hopeful that the bloc might skip the 10% baseline tariff. US President Donald Trump noted the EU's constructive attitude, and the European trade chief, Maros Sefcovic, affirmed that a trade deal might be announced in the coming days.

In the US, the minutes of the last Fed meeting revealed that most committee members see it appropriate to lower interest rates in the coming months. This, and a strong US 10-year bond auction on Wednesday, contributed to pulling treasury yields down, easing the US Dollar's (USD) bullish momentum.

Earlier on Thursday, German Consumer Price Index (CPI) data confirmed that monthly inflation remained flat in June. In the US, the main attraction on Thursday will be the Weekly Jobless Claims release, which will provide further insight into the health of the US labour market.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | 0.00% | -0.06% | -0.01% | -0.28% | -0.21% | 0.16% | |

| EUR | -0.06% | -0.06% | -0.14% | -0.05% | -0.32% | -0.27% | 0.08% | |

| GBP | -0.01% | 0.06% | -0.10% | 0.01% | -0.24% | -0.20% | 0.14% | |

| JPY | 0.06% | 0.14% | 0.10% | 0.05% | -0.20% | -0.08% | 0.12% | |

| CAD | 0.00% | 0.05% | -0.01% | -0.05% | -0.24% | -0.23% | 0.13% | |

| AUD | 0.28% | 0.32% | 0.24% | 0.20% | 0.24% | 0.02% | 0.40% | |

| NZD | 0.21% | 0.27% | 0.20% | 0.08% | 0.23% | -0.02% | 0.36% | |

| CHF | -0.16% | -0.08% | -0.14% | -0.12% | -0.13% | -0.40% | -0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Dollar bounces up on trade uncertainty

- The Euro has given away gains, with risk appetite fading through the European session. Concerns about the uncertain global trade outlook have weighed more than the hopes of lower interest rates in the US, which is providing some support to the safe-haven US Dollar.

- On Wednesday, the FOMC minutes revealed diverging views among the committee, with most policymakers anticipating at least one rate cut this year, as they believe the tariffs' impact on inflation will likely be temporary, while the labour market is showing signs of cooling.

- The Fed minutes heightened hopes of an interest rate cut in September. The CME Group's Fed Watch Tool shows a 72% chance of at least 25 bps cuts after the summer, up from less than 65% before the minutes were released. Chances of a July cut remain practically unchanged at 6%.

- US Treasury yields pulled back on Wednesday, with the benchmark 10-year yield easing about 10 basis points from Tuesday's highs following an auction for $39 billion worth of US bonds, which saw a stronger-than-expected demand.

- In the Eurozone, German CPI data confirmed that inflation stalled in June compared with the previous month and the yearly rate eased to the ECBs 2% target. The data had a slightly negative impact on the Euro.

EUR/USD remains trapped within a descending channel

EUR/USD's upside attempts remain capped below the descending trendline resistance from July 1 highs, now at the 1.1760 area. This keeps the price action trapped within a broadening wedge pattern, a figure that reflects an emotional market and that often appears at major tops.

Above here, the high from July 4 and 7 at 1.1790 is likely to challenge bulls ahead of the multi-year high of 1.1830.

The Relative Strength Index (RSI) on the 4-hour chart is fluctuating around the 50 level, suggesting that the pair keeps looking for direction, while the 1.1680 area – where the 38.2% Fibonacci retracement level of the June 24 - July 1 rally meets the July 7 and 8 lows – provides significant support.

A bearish reaction below here would increase pressure towards the 1.1630-1.1645 area, where previous highs meet the 50% Fibonacci retracement level of the mentioned late June rally.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Next release: Thu Jul 10, 2025 12:30

Frequency: Weekly

Consensus: 235K

Previous: 233K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.