EUR/NOK extends its consolidation below 10.0000

- EUR/NOK trades in a choppy fashion so far this week.

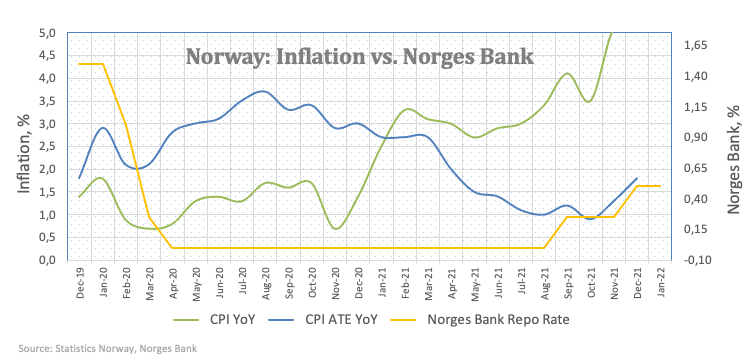

- The Norges Bank left the repo rate unchanged at 0.50%.

- The central bank signalled an interest rate hike in March.

EUR/NOK alternates gains with losses so far this week in the area just below the psychological 10.0000 mark.

EUR/NOK muted on NB decision, looks to oil

EUR/USD resumes its upside following Wednesday’s decline after the Norges Bank left the policy rate unchanged at 0.50% at its meeting on Thursday.

The Scandinavian central bank matched estimates on Thursday although it reiterated its intention to hike the key rate at the March event. The Norges Bank justified the decision on the solid performance of Norwegian fundamentals and noted that the elevated underlying inflation is now approaching the bank’s target.

The bank also noted that there is still uncertainty surrounding the progress of the Omicron pandemic, while the Committee expressed its concerns over the potential increase in prices and wages stemming from the supply disruptions and price pressures overseas.

Despite prices for a barrel of the European benchmark Brent crude rising sharply since mid-December, NOK failed to appreciate in an equally (or even close) pace during the same period.

EUR/NOK significant levels

As of writing the cross is gaining 0.18% at 9.9777 and faces the next resistance at 10.0443 (55-day SMA) followed by 10.0782 (2022 high Jan.6) and then 10.1181 (200-day SMA). On the other hand, a breach of 9.9018 (2022 low Jan.13) would open the door to 9.8383 (low Nov.17 2021) and finally 9.8166 (low Nov.1 2021).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.