EUR/JPY turns lower and returns below 147.00

- The euro fails at 147.80 and retreats below 147.00.

- A sourer market mood underpins a mild JPY recovery.

- EUR/JPY is trapped on a bullish triangle pattern.

The euro was capped at 147.80 and pulled down against the Japanese yen on Monday, retracing Friday’s gains to hit session lows at 146.70. The sourer market mood at the start of the week has underpinned the safe-haven Japanese yen, weighing on the common currency.

The yen appreciates on risk aversion

Earlier on the day, the downbeat Chinese manufacturing and services activity figures reactivated investors’ concerns that the impact of the country’s strict COVID-19 restrictions, over the world's second-largest economy might dampen global growth, which has hammered risk appetite.

Beyond that, the market remains cautious ahead of the US Federal Reserve’s monetary policy meeting, due on Wednesday, which has weighed the euro against a stronger US dollar.

On the macroeconomic front, preliminary data showed that the eurozone inflation accelerated beyond expectations in October, showing a 10.7% annual rise against the 1.2% market consensus and following a 9.9% increase in the previous month.

These figures combined with the deceleration of the Gross Domestic Product; 0.2% in the Q3 against 0.8% in the previous quarter are posing a problem to the ECB and have increased bearish pressure on the euro.

EUR/JPY trapped within a bullish triangle pattern

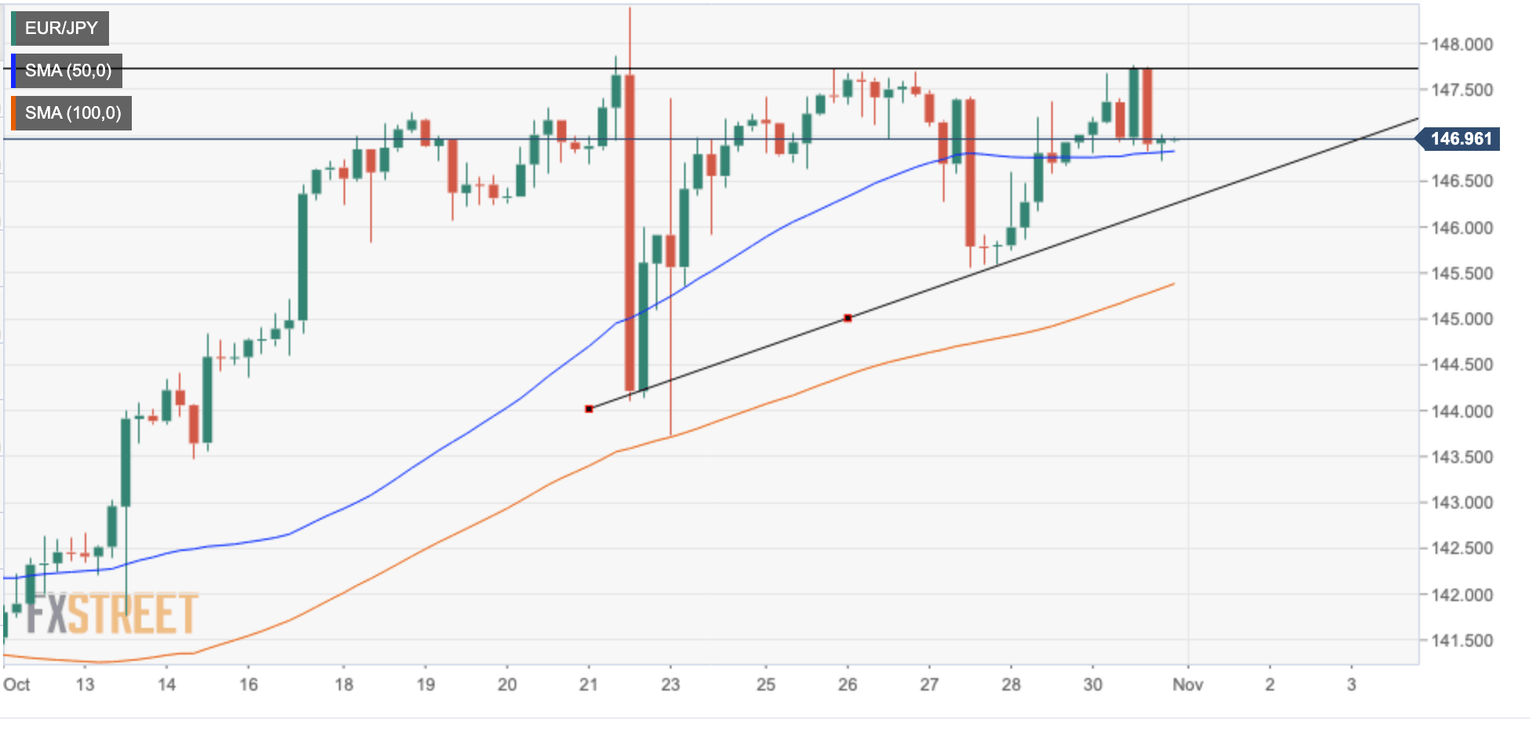

From a technical perspective, the 4-hour chart shows the pair pulling back from the upper limit of a bullish triangle pattern (in the image below).

The pair’s reversal from the mentioned 147.80 area seems to have found buyers at the 50-period SMA, now around 146.80, which closes the path toward the lower limit of the triangle, at 146.20

On the upside, a successful move above 147.80 would increase bullish traction, which could push the pair towards the October 17 high at 148.40 ahead of the 150.00 psychological level.

EUR/JPY 4-hour chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.