EUR/JPY trades in tight range as psychological resistance firms at 170.00

- EUR/JPY trades in a narrow range below the key psychological resistance level at 170.00.

- Trade talks and tariff uncertainty with the US continue to influence the Euro and the Yen.

- The RSI falls from overbought territory, suggesting that EUR/JPY bulls may be losing steam.

The Japanese Yen (JPY) is steadying against the Euro (EUR) on Wednesday as markets continue to monitor trade developments with the United States.

At the time of writing, EUR/JPY is trading above 169.00 with the 10-day Simple Moving Average (SMA) providing support at 168.90.

After reaching a YTD high of 169.86 on Monday, failure to reclaim the 170.00 psychological level pushed the pair into a narrow range.

With a July 9 tariff deadline fast approaching, the US is focusing on smaller, step-by-step trade deals rather than sweeping agreements, aiming to avoid triggering new tariffs.

Trade talks with the European Union (EU) are showing positive signs of progress. The EU has shown openness to a blanket 10% tariff but is pushing for exceptions in sensitive sectors such as semiconductors and pharmaceuticals.

However, tensions between the United States and Japan have increased over recent days. After a dispute arose over Japan’s reluctance to increase its imports of rice from the US, President Trump has threatened to increase tariffs on Japanese goods above 30%.

On Wednesday, Bloomberg reported on the recent developments in the US-Japan trade saga. Trump said that Japan would receive a letter stating, "Thank you very much...we know you can't do the kind of things that we need, and therefore you pay a 30 percent, 35 percent or whatever the number is that we determine."

If higher tariffs are imposed on Japan and the EU manages to secure a deal with the US, EUR/JPY could continue to climb.

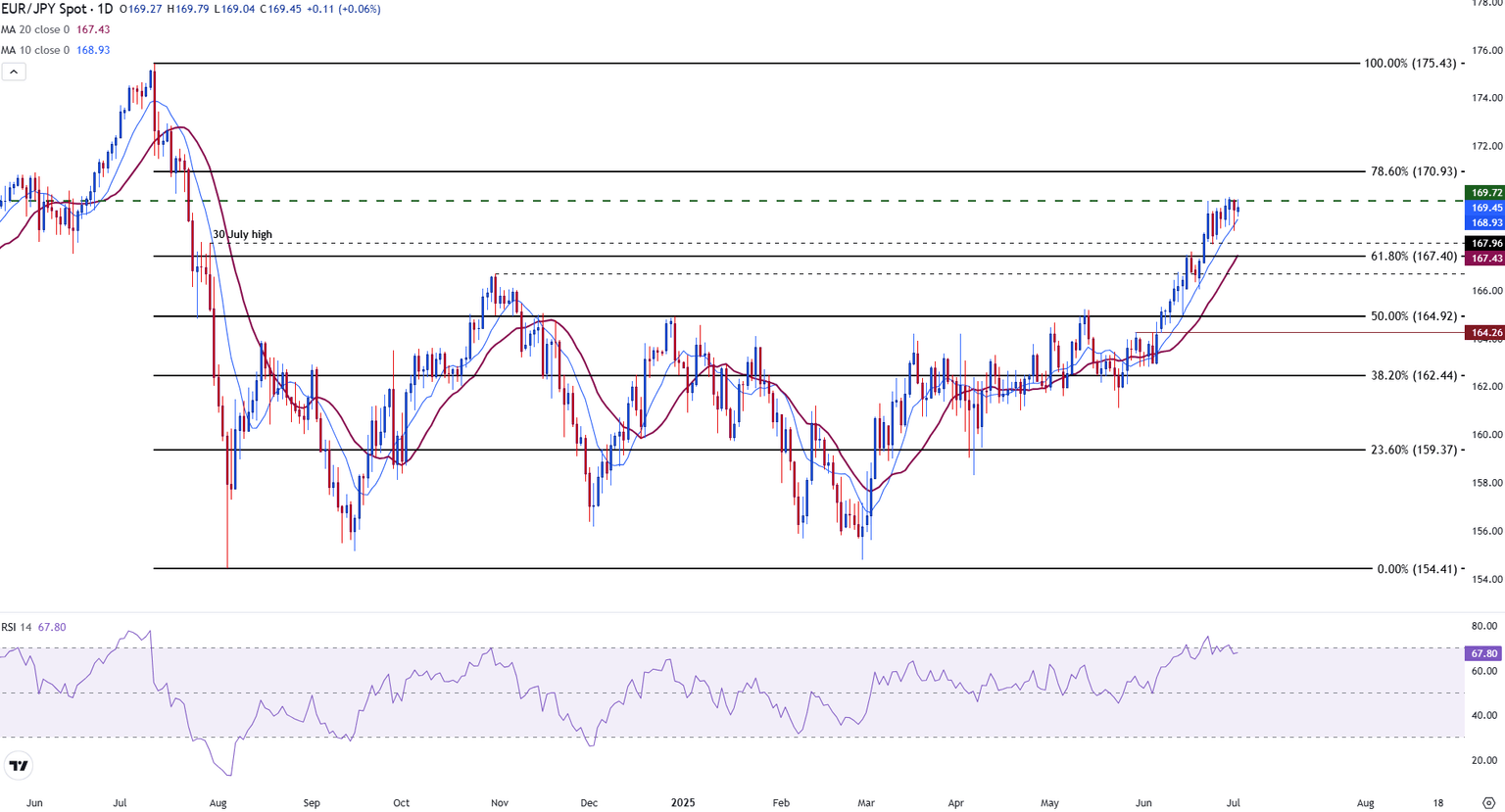

EUR/JPY remains capped by psychological resistance at 170.00

From a technical standpoint, the psychological resistance level of 170.00 currently remains intact. This round number has been holding bulls at bay over the past four days.

After rising to a new YTD of 169.86, bullish momentum eased before finding temporary support above the 10-day Simple Moving Average (SMA) at 168.90.

The Relative Strength Index (RSI) is at 66 and is pointing lower. With the RSI easing back after testing overbought conditions last week, the downside move reflects fading bullish momentum.

EUR/JPY daily chart

Both fundamental and technical factors influence the near-term trajectory of EUR/JPY. If bulls manage to break above 170, the 78.6% Fibonacci retracement level of the July-August 2024 decline may come into play as resistance at 170.93, just below the round number of 171.00.

However, if bearish momentum increases and EUR/JPY falls below the 10-day SMA, the 61.8% Fibo level at 167.40, which aligns with the 20-day SMA, could serve as additional support for price action.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.