EUR/JPY Price Prediction: November bear trend unfolds

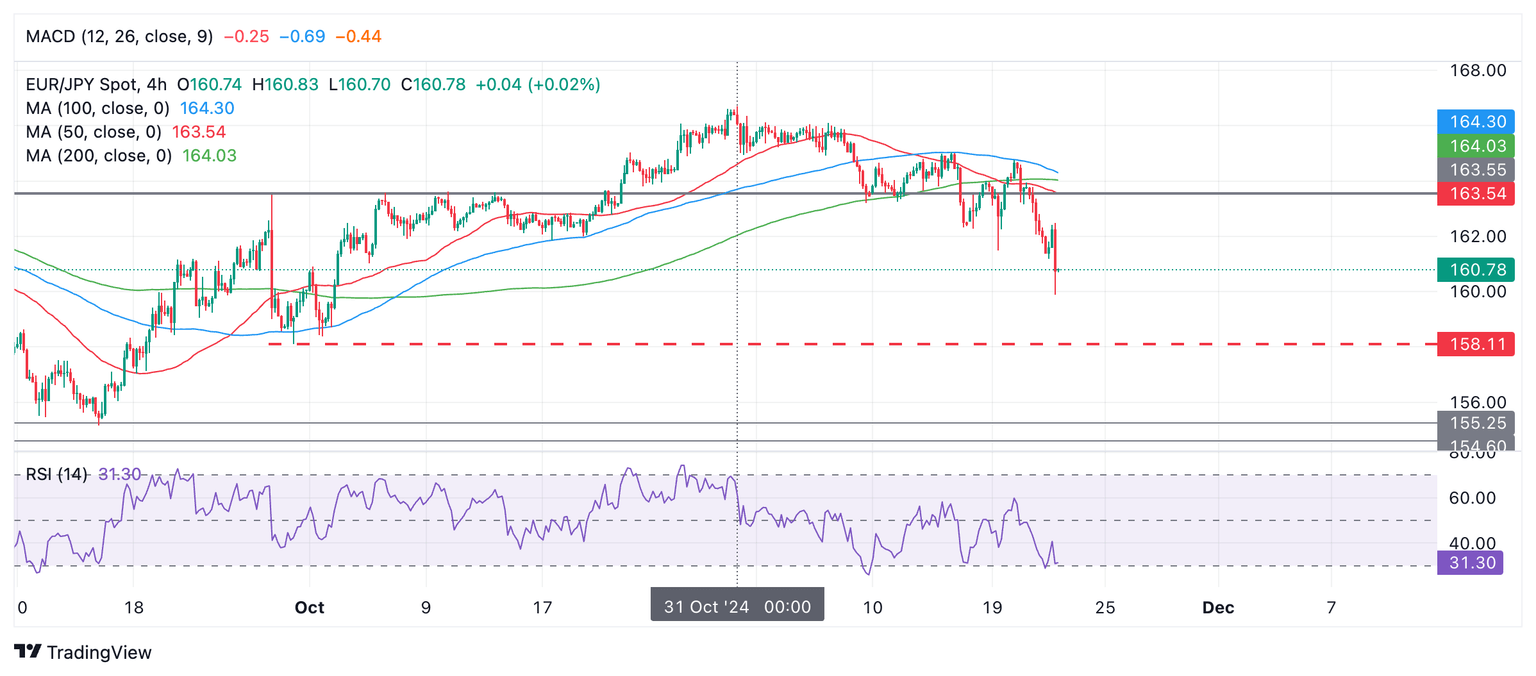

- EUR/JPY is declining in a short-term downtrend which started in November.

- The pair is likely to continue lower given technical analysis theory.

EUR/JPY staircases down from its Halloween peak as it unfolds in a short-term downtrend during November. The odds favor an extension lower given the technical analysis theory that “the trend is your friend”.

EUR/JPY Daily Chart

The next downside target is at the 158.11 September 30 swing low. A break below the 159.90

low of the day would provide confirmation. Alternatively traders might look at a lower timeframe chart such as the 1-hour for a pullback – perhaps a three-wave ABC – to provide a lower risk entry-point.

The Relative Strength Index (RSI) momentum indicator is flirting with the oversold zone below 30. If it closes below 30 the pair will be considered oversold and short holders are advised not to add to their positions.

A deeper sell-off could even take EUR/JPY down to 154.00 – 155.00 August-September lows.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.