EUR/JPY Price Forecast: Climbs beyond mid-162.00s, bulls have the upper hand while above 200-day SMA

- EUR/JPY kicks off the new week on a stronger note in reaction to the latest trade optimism.

- The technical setup warrants some caution for bulls amid the divergent BoJ-ECB expectations.

- A convincing break below the 200-day SMA would shift the bias in favor of bearish traders.

The EUR/JPY cross gains strong positive traction at the start of a new week and snaps a three-day losing streak to the 161.00 neighborhood, or a nearly one-month low set on Friday. US President Donald Trump's decision to delay the implementation of tariffs on the European Union (EU) boosts the shared currency and lifts spot prices to the 162.70-162.75 region during the Asian session.

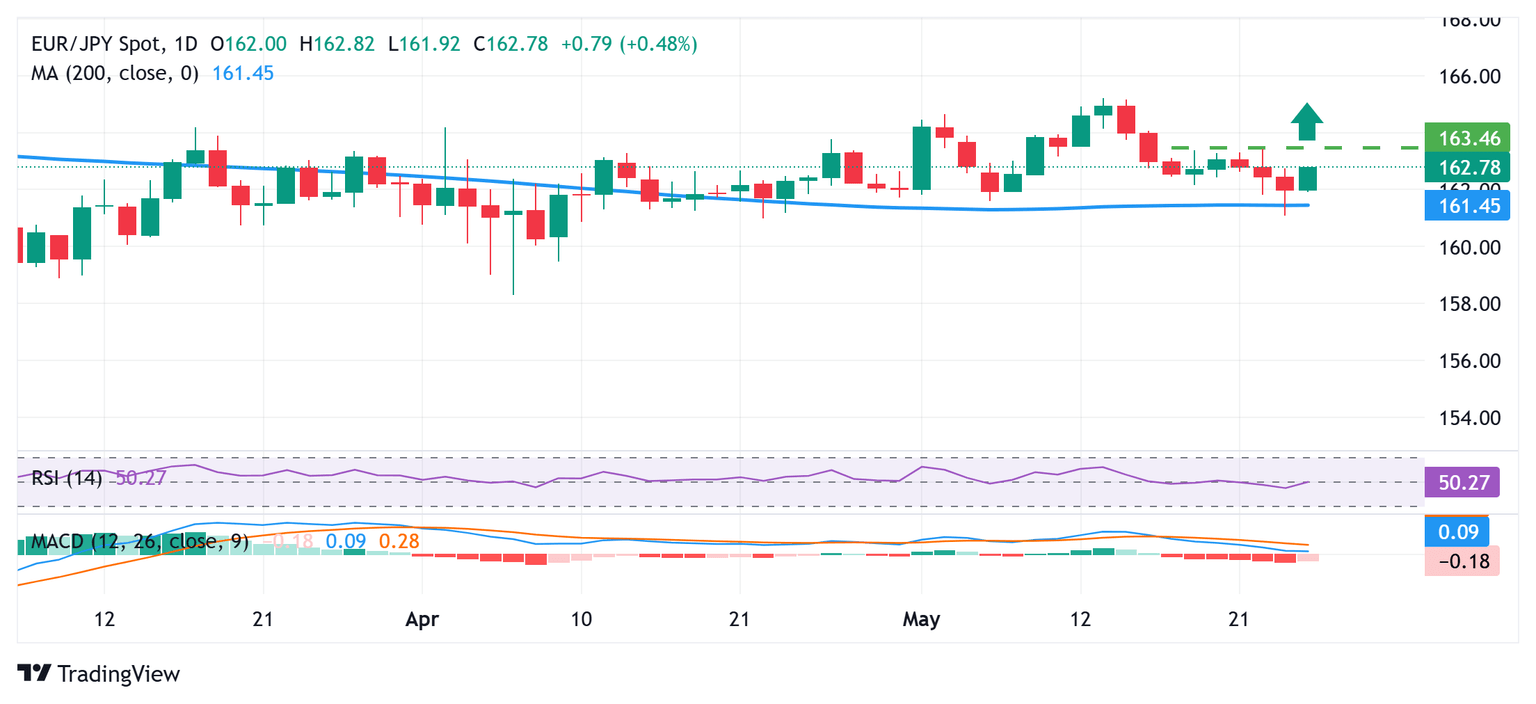

From a technical perspective, the EUR/JPY cross showed some resilience below the 200-day Simple Moving Average (SMA) on Friday. The subsequent move up favors bullish traders, though neutral oscillators on the daily chart warrant some caution amid the divergent Bank of Japan (BoJ)-European Central Bank (ECB) policy expectations and geopolitical risks, which tends to benefit the safe-haven Japanese Yen (JPY).

Hence, the strong intraday move higher might confront stiff resistance near the 163.00 round-figure mark. A sustained strength beyond, however, will suggest that the recent pullback from the 165.20 area, or the year-to-date high touched earlier this month has run its course and pave the way for further gains. The EUR/JPY cross might then aim to surpass the 163.40-163.45 supply zone and reclaim the 164.00 mark.

On the flip side, weakness below the 162.40 immediate support could attract some dip-buyers and remain limited near the 162.00 mark. This is followed by the 200-day SMA, around the 161.45 region, which, if broken decisively, might shift the near-term bias in favor of bearish traders. The EUR/JPY cross might then slide to retest Friday's swing low, around the 161.00 round figure, and eventually drop to the 160.00 psychological mark.

EUR/JPY daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.