EUR/JPY Price Analysis: Slips below 169.00 amid political turmoil

- EUR/JPY trades at 168.43, marking the second consecutive day of losses due to political uncertainty in France.

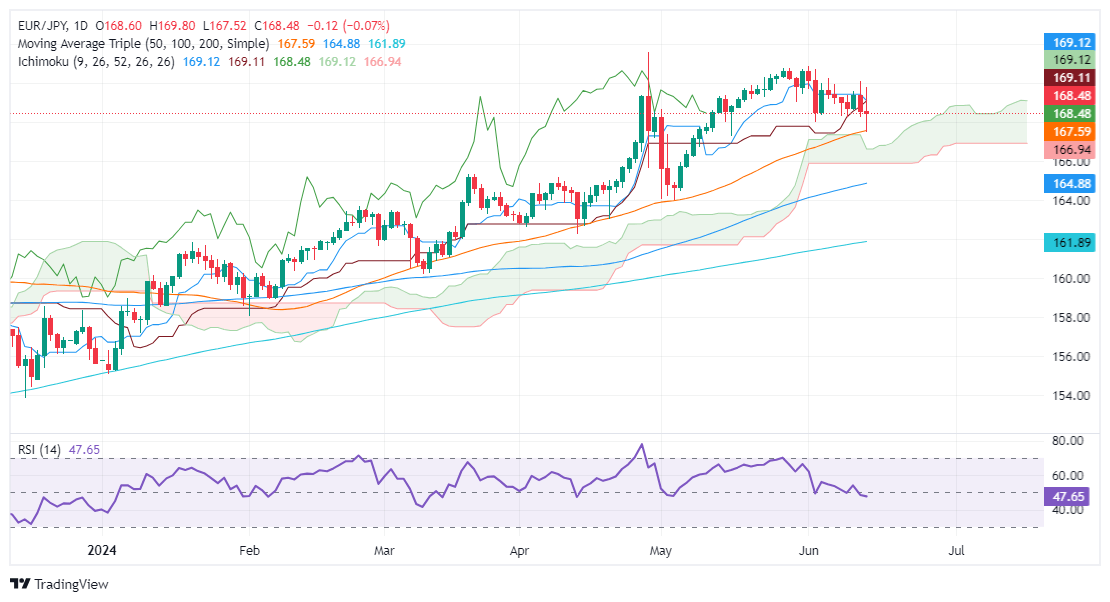

- Technical outlook: Consolidation below 170.00 with potential further losses if price drops below the 50-DMA at 167.47.

- Key support levels: Kumo bottom at 165.92 and 100-DMA at 164.78, indicating acceleration of the downtrend if breached.

The Euro tumbled for the second straight day against the Japanese Yen due to political uncertainty. France's presidential approvals plunged to their lowest level in five years ahead of the General Elections. The EUR/JPY trades at 168.43, down 0.08%.

EUR/JPY Price Analysis: Technical outlook

After peaking around 170.00, EUR/JPY has consolidated below this level but remains above the Ichimoku Cloud (Kumo), which would accelerate the downtrend if breached.

The Relative Strength Index (RSI) indicates that sellers are gaining momentum as it falls below the 50-line, suggesting that EUR/JPY could face further losses.

If EUR/JPY drops below the 50-day moving average (DMA) of 167.47, it could trigger a decline into the Kumo, signaling an acceleration of the downtrend. The next support would be the bottom of the Kumo at 165.92, followed by the 100-DMA at 164.78.

EUR/JPY Price Action - Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.