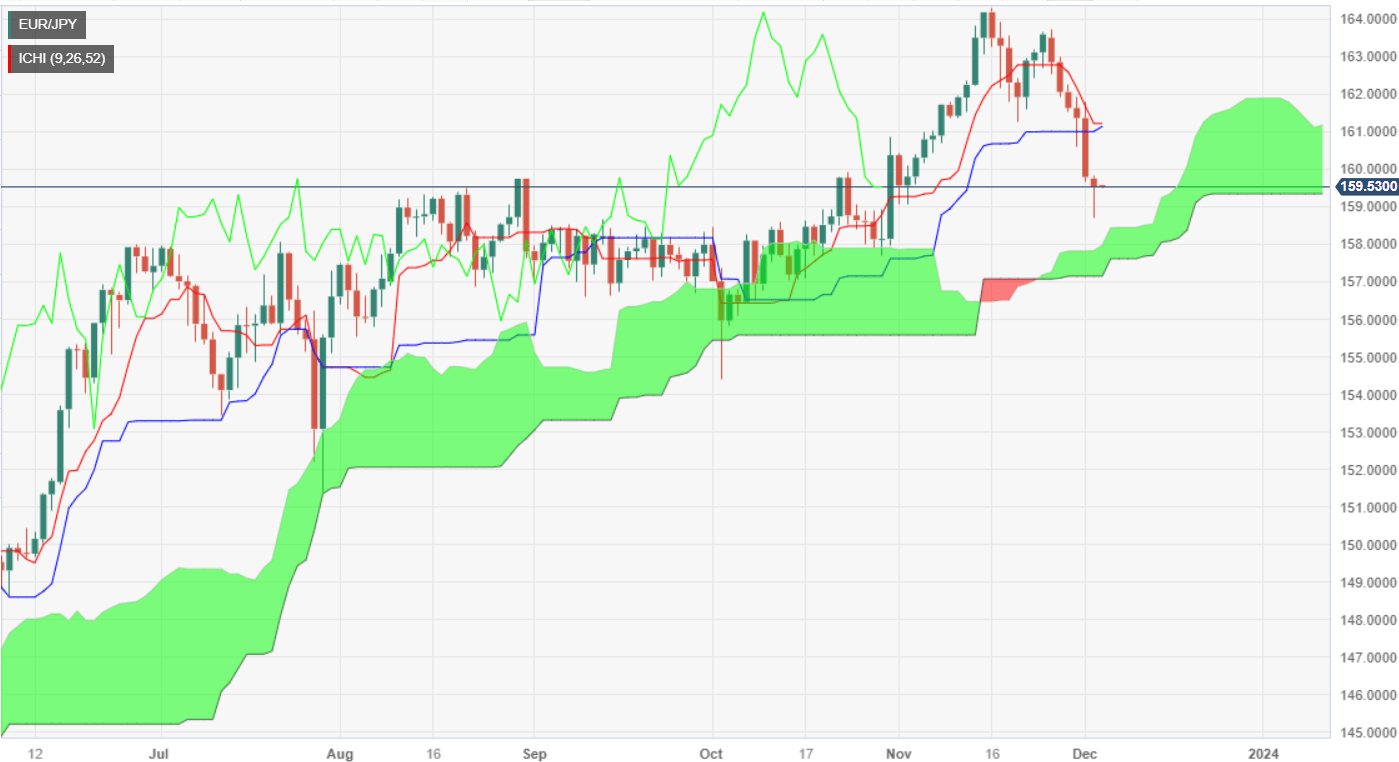

EUR/JPY Price Analysis: Rebounds at 4-week low, as dragonfly doji looms

- EUR/JPY hovers shy of the 160.00 figure after printing weekly lows at around 158.70s-

- The pair remains bullish above the Kumo, but it could cement its bias above 160.00.

- If the cross drops below 159.00, further downside is expected.

EUR/JPY exchanges hand with minuscule losses, late in the Monday North American session, down by just 0.13% after registering earlier losses of 0.50%. At the time of writing, the cross-pair is trading at 159.50.

During the session, the pair hovered around the top of the Ichimoku Cloud (Kumo) as it printed a four-week low at around 158.71 before reversing its course, with buyers reclaiming the 159.00 figure. Even though a ‘dragonfly doji’ is forming, EUR/JPY buyers must reclaim the 159.84 December 4 daily high, so they could threaten to challenge the 160.00 figure. From a price action standpoint, upside risks remain with the pair standing above the Kumo.

Next resistance is seen at the Kijun-Sen at 161.00 before buyers reclaim the Tenkan-Sen at 161.21. Nevertheless, a bearish resumption could happen if sellers push prices toward the 159.00 figure, ahead of testing the top of the Kumo at 158.00.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.