EUR/JPY Price Analysis: Pair remains neutral, stuck in 164.00-165.00 range

- EUR/JPY traded neutral in Wednesday's session and stands around above 164.00.

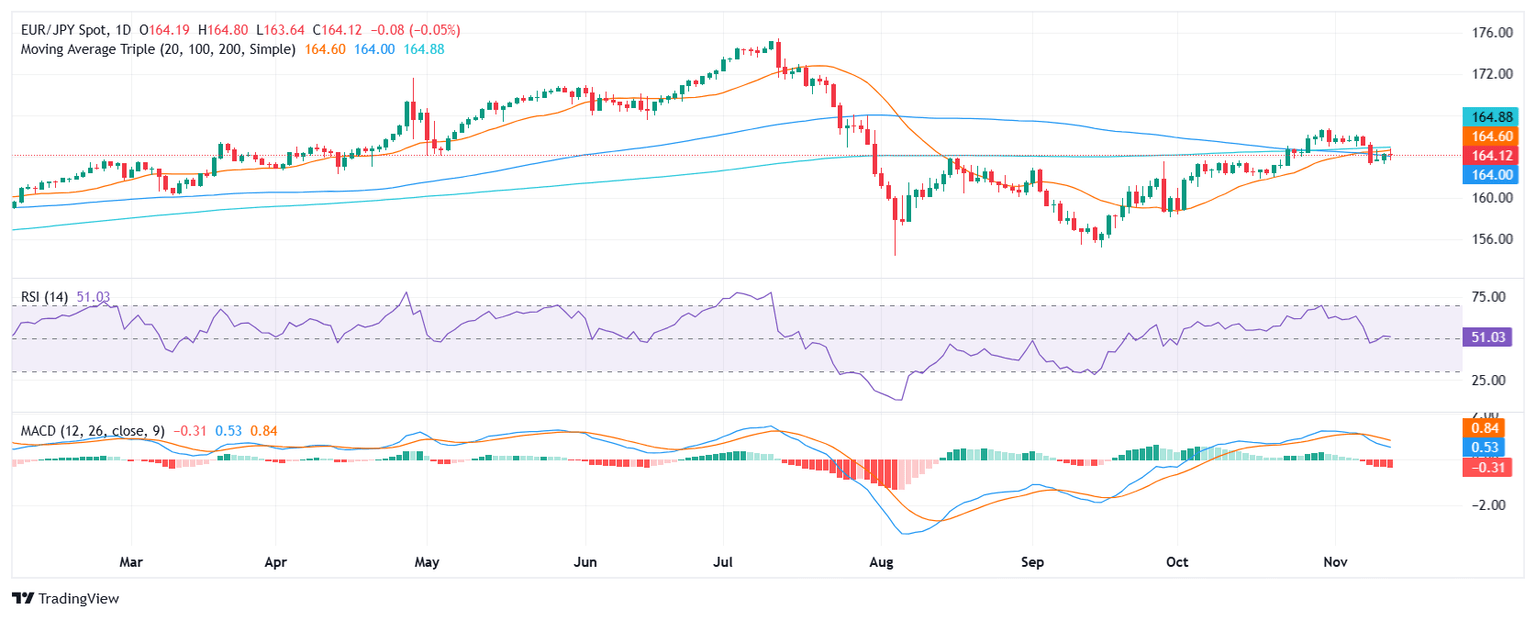

- The main SMAs converged toward the 164.00-165.00 area, forming a resistance zone that has been hard for the bulls to break.

- The MACD and RSI were giving conflicting signals hence suggesting that the outlook was mixed.

The EUR/JPY was seen around 164.00 in Wednesday's session, with indicators sending mix signals. The 164.00-165.00 area remains crucial for short-term direction.

The technical outlook for the EUR/JPY is mixed. The Relative Strength Index (RSI) is in positive territory at 51, but its flat slope suggests that buying pressure is flat. The Moving Average Convergence Divergence (MACD) is red and rising, suggesting that selling pressure is rising. The overall outlook is mixed, with the RSI and MACD giving conflicting signals.

The 164.00-165.00 range serves as a crucial resistance zone, while the RSI's flat buying pressure and the MACD's growing selling pressure create an uncertain momentum. Traders should closely monitor whether bulls can break through this resistance area to confirm a bullish trend, or if bears push the pair lower towards key support levels at 163.00 and 162.00.

EUR/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.