EUR/JPY Price Analysis: Euro steadies near 162.00 as technical outlook remains mixed

- EURJPY trades near the 162.00 zone, stabilizing ahead of the Asian session.

- Mixed signals dominate, with short-term momentum soft and broader trend still supportive.

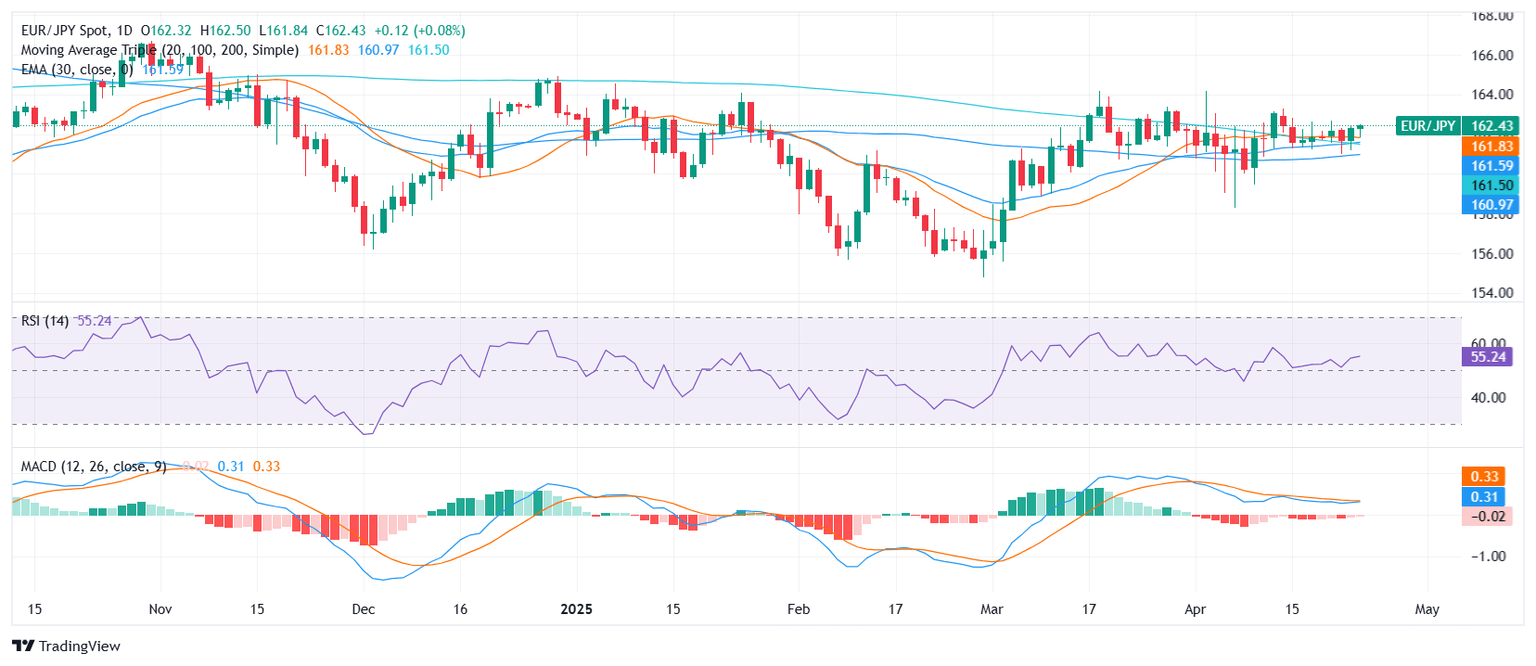

- Resistance lies near 162.30 and 162.50; support seen around 161.70 and 161.20.

The EURJPY pair was seen trading near the 162.00 area on Thursday, holding steady ahead of the Asian session after a mildly choppy European trading day. The pair remains confined within a relatively narrow daily range, suggesting investors are awaiting a fresh catalyst before pushing in either direction.

From a technical perspective, the setup remains mixed. The Relative Strength Index is sitting in neutral territory, while the MACD prints a weak sell signal. The Stochastic RSI and Average Directional Index also remain muted, reflecting limited short-term momentum and trend strength.

However, longer-term moving averages continue to support the bullish structure. The 100-day and 200-day SMAs are still pointing upward, although the 20-day SMA is beginning to flatten, hinting at potential consolidation. The Ichimoku Base Line sits just under current price levels, offering a tentative support zone.

Immediate support is seen at 161.70, followed by 161.20. On the upside, resistance levels are found at 162.30, 162.50, and then 162.85.

Overall, while EURJPY is trading close to the upper end of its recent range, the pair needs a decisive push backed by momentum to validate further upside. Until then, traders may continue to see range-bound action.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.