EUR/JPY Price Analysis: Dips amid risk-off mood, as tweezers top suggest downside expected

- EUR/JPY falls over 0.30%, retreating from the week's high as risk aversion grips markets, highlighted by losses in US equities.

- Technical analysis reveals a 'tweezers-top' pattern, suggesting potential for further decline if the pair breaches the 163.07 support.

- A failure to break below 163.00 could lead to a rebound, with resistances at 164.00 and the year-to-date high of 164.31 as key targets for buyers.

EUR/JPY retreats from a weekly high hit earlier during the Asian session and drops more than 0.30% on Thursday amid a risk-off impulse, as witnessed by US equities printing losses, despite falling US Treasury bond yields.

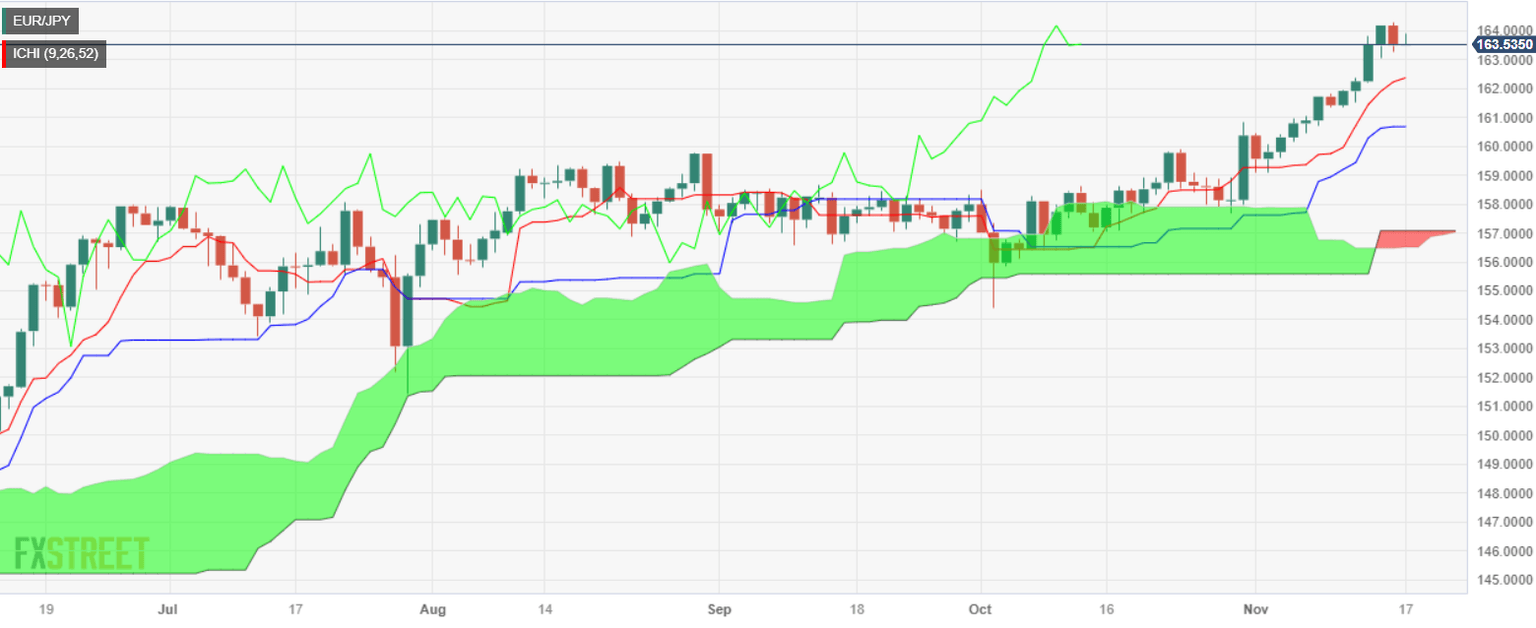

From a technical standpoint, a ‘tweezers-top’ formed in the EUR/JPY daily, though further downside is needed below the November 15 swing low of 163.07 to sponsor a leg lower. If sellers push prices below that level, the next stop would be the Tenkan-Sen at 162.31, the Senkou Span A at 161.51, and the Kijun-Sen level at 160.64.

On the other hand, EUR/JPY sellers' failure to crack below 163.00 could open the door for further upside, with the first resistance seen at the 164.00 figure. A decisive break would expose the year-to-date (YTD) high at 164.31, followed by the 165.00 figure.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.