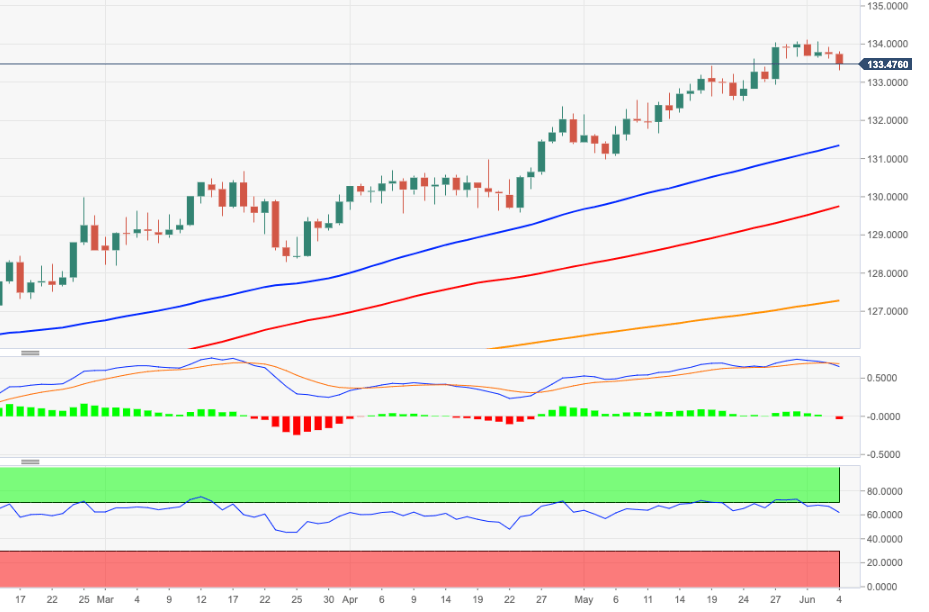

EUR/JPY Price Analysis: Corrective downside could re-test 132.50

- EUR/JPY eases further ground to the 133.30 region.

- Next on the downside appears the 132.50 zone.

EUR/JPY drops to new multi-day lows in the 133.30 region at the end of the week.

If the selling pressure gathers extra steam, then the cross could attempt a deeper pullback to, initially, the weekly lows near 132.50 (May 24). Further south comes in the 131.50 region, where coincides the 50-day SMA and the short-term support line. A move to the latter, however, remains out of favour for the time being.

In the broader picture, while above the 200-day SMA at 127.23 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.