EUR/JPY Price Analysis: Climbs above 164.00 with bulls eyeing YTD high

- EUR/JPY breaks above Tenkan-Sen, eyes 165.00 potential.

- Holding above 164.00 may lead to testing yearly highs.

- Bears aim below 164.00 for reversal; Tenkan-Sen, Kijun-Sen as supports.

The Euro posted solid gains against the Japanese Yen (JPY) on Wednesday, amid an improvement in risk appetite and the dovish stance adopted by the Bank of Japan (BoJ) despite rising interest rates. At the time of writing, the EUR/JPY trades at 164.25, up 0.67%.

EUR/JPY Price Analysis: Technical outlook

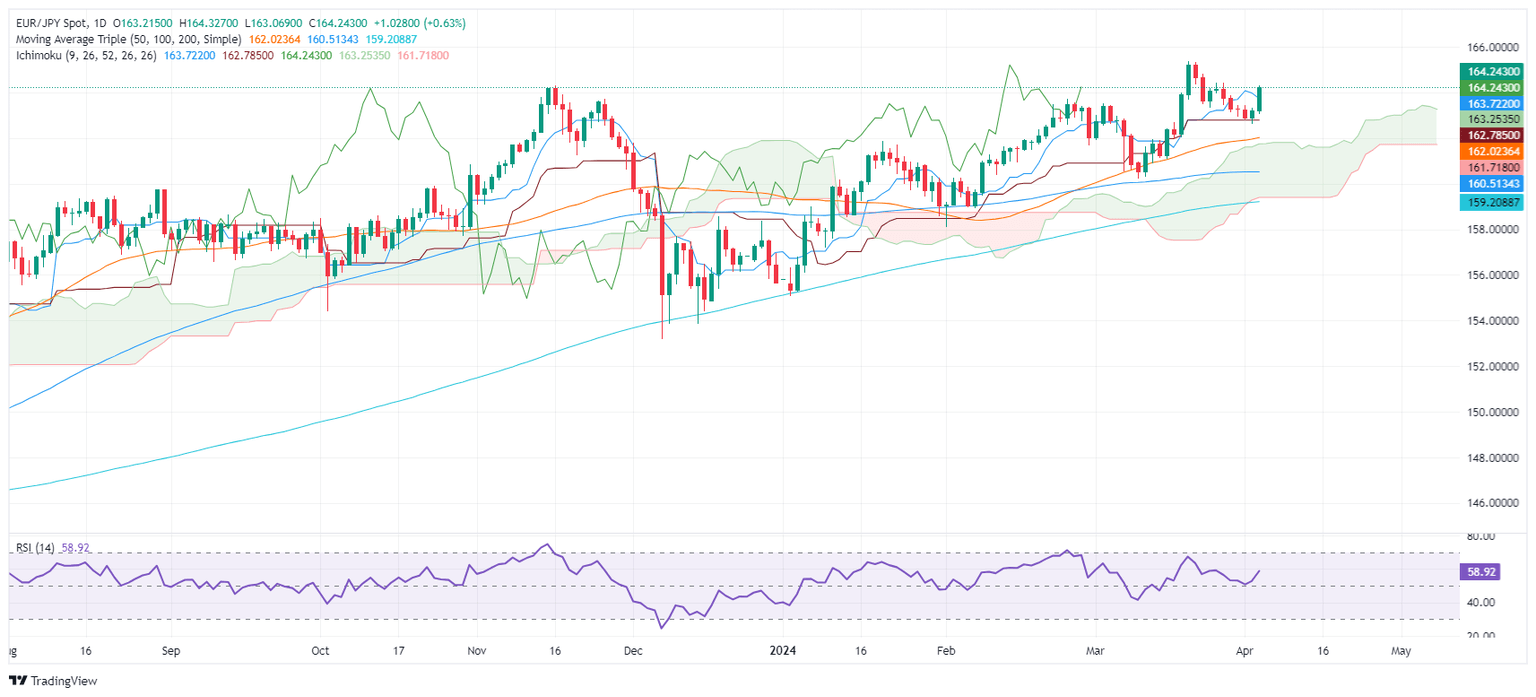

Euro bulls re-entered the market, lifting the EUR/JPY pair above the Tenkan-Sen a 163.71, which opened the door to reclaim the 164.00 mark. That suggests that buyers are gathering steam, which would open the door to challenge the 165.00 mark. A breach of the latter will expose the year-to-date (YTD) high of 165.34.

On the flip side, sellers must drag prices below 164.00 to challenge the new Tenkan-Sen level at 163.71, the next support level. Once surpassed, traders could test the Senkou Span Aat 163.25, followed by the Kijun-Sen level at 162.78.

EUR/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.