EUR/JPY cracks 15-year high, sees 161.00

- The EUR/JPY ticked into a new decade-and-a-half high bid, touching the high side of 161.00.

- EU Retail Sales coming around the corner for Wednesday.

- Japan data continues to sour, steepening Yen declines.

The EUR/JPY clipped the 161.00 handle on Tuesday, etching in a 15-year high as the pair clatters along the ceiling heading into a round of EU Retail Sales figures.

Japan Overall Household Spending for the year into September missed expectations early Tuesday, printing at -2.8% and accelerating the decline from August's -2.5% and missing the median market expectation of -2.7%.

EU Retail Sales are slated for Wednesday's European market session, and markets are expecting further downside in the long tail of the data with an improvement on the cards for the month-on-month figure.

Annualized Retail Sales into September are expected to print at -3.2% versus August's YoY of -2.1%, while September's MoM figure is forecast to rebound from -1.2% to just -0.2%.

EUR/JPY Technical Outlook

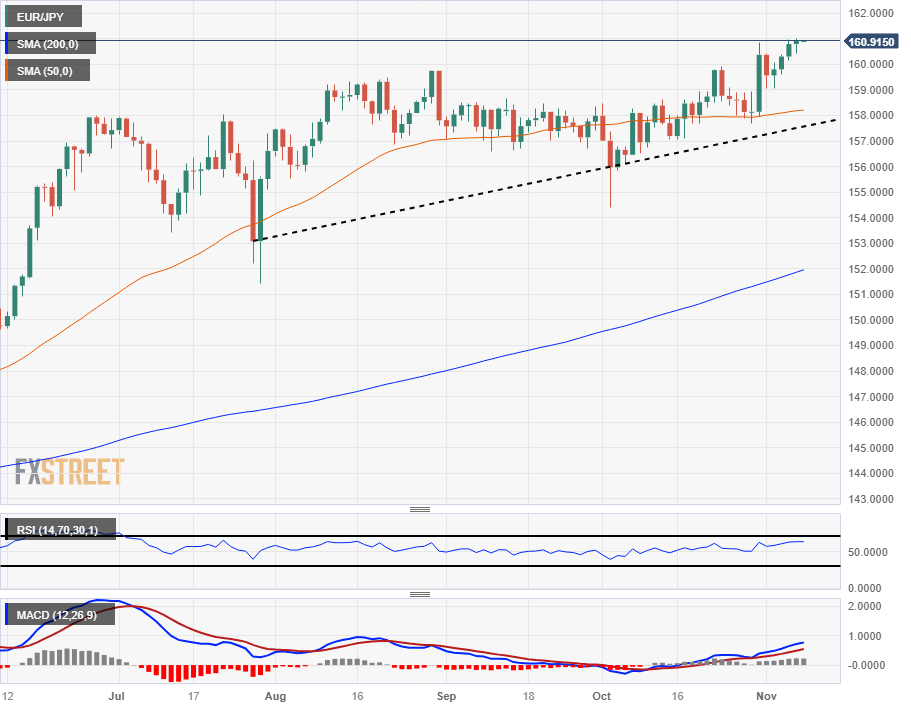

The EUR/JPY's bump into the 161.00 handle sets a fifteen year high for the pair, and is continuing to push further away from the 50-day Simple Moving Average (SMA) after rebounding from last week's swing low into the 158.00 price level. The Euro has closed four straight green days against the Yen.

Momentum has been thinning out, and a recent bout of chart congestion between 160.00 and 158.00 has left technical indicators to spool down into their midranges. On the low side, long-term technical support is at the 200-day SMA, far below current price action at 152.00.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.