EUR/GBP twists on the day, looking for a foothold after ECB Accounts fallout

- The EUR/GBP is struggling to stick to the middle near 0.8700.

- The Euro got knocked back following an ECB Accounts that focused on risks and stubborn inflation.

- EU & UK PMIs beat market forecasts across the board, but most still remain in sub-50.0 contraction territory.

The EUR/GBP is grasping at the 0.8700 handle after the Euro (EUR) got knocked lower against the Pound Sterling (GBP) following a dovish showing from the European Central Bank (ECB) which moderated bullish market sentiment following a resounding thumping of Purchasing Managers' Index (PMI) figures for both the Eurozone and the UK.

Eurozone and UK PMIs broadly beat the street, printing above median market forecasts across the entire slew of component data.

Despite the market beat, topside momentum remains limited; the majority of PMI prints still remain steeply in bearish/contraction territory, and recoveries in figures are mostly forecasters struggling to nail down accurate figures: the Eurozone Flash Manufacturing PMI has under or overshot forecasts for the last ten straight months.

Eurozone Preliminary Manufacturing PMI improves to 43.8 in November vs. 43.4 expected

The Eurozone's HCOB Composite PMI for November printed at 47.1, improving over the previous month's 46.5 and beating the forecast 46.9.

UK Preliminary Services PMI returns to expansion with 50.5 in November

The shining bright spot from the European session's data docket was the UK's PMI print, with both the Services and Composite components returning to expansionary territory, at 50.5 and 50.1 respectively.

The Services PMI was expected to hold steady at 49.5, and the Composite was likewise seen flat at 48.7.

ECB Accounts: Uncertainty surrounding the economic outlook had increased

The Euro got dragged down against the Sterling after the ECB's latest Monetary Policy Meeting Accounts, which showed the Eurozone's central bank is growing increasingly unsure about the economic outlook, but is standing pat for the time being.

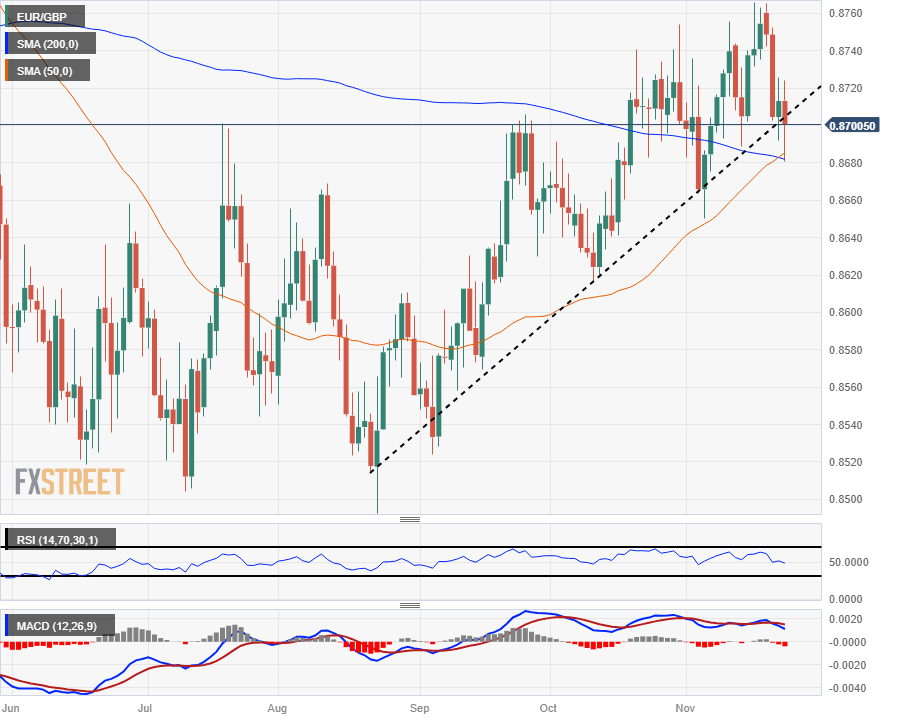

EUR/GBP Technical Outlook

The EUR/GBP's Thursday bounce sees the pair catching support from the 50-day Simple Moving Average (SMA), which is currently set to confirm a bullish crossover of the long-term 200-day SMA near 0.8680.

The EUR/GBP is also seeing some chart grind as bids come into contact with a rising trendline from late August's swing low into the 0.8500 handle.

The Euro has been struggling to develop topside momentum against the Pound Sterling ever since first piercing the 200-day SMA in mid-October, and the EUR/GBP pair has been grinding just north of the moving average ever since.

The nearest target for bidders will be the last swing high at 0.8760.

EUR/GBP Daily Chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.