EUR/GBP soars to 0.8710 as US jobs disappoint, BoE rate cut in focus

- EUR/GBP rallies 100 pips from weekly lows to 0.8711 after dismal US jobs report.

- US adds just 73K jobs in July; prior months revised down by 258K.

- Eurozone HICP holds at 2.4% YoY; Core inflation beats estimates at 2.0%.

- UK Manufacturing PMI slides to 48.0, reinforcing BoE cut expectations for next week.

The EUR/GBP rallied sharply on Friday as the Bank of England's (BoE's) next week’s monetary policy decision looms, and a worse-than-expected Nonfarm Payrolls report in the United States (US), sparked talks about a possible “stagflation” scenario in the US. At the time of writing, the pair traded at 0.8711, after bouncing off weekly lows of 0.8611.

Sterling slips as weak UK PMI data and looming BoE decision weigh, while US NFP shock stokes stagflation fears

The US Bureau of Labor Statistics (BLS) revealed that Nonfarm Payroll figures for July showed the economy created a mediocre 73K jobs for the month, down from 147K, below forecasts of 110K. The data revealed that revisions from May and June were larger than normal. This means that May and June combined are 258K lower than previously reported.

Despite printing a bad report, the Unemployment Rate ticked up from 4.1% to 4.2%, within the range tolerated by the Federal Reserve. Today’s NFP is a vindication for Fed Governors Waller and Bowman, who stressed that the labor markets were beginning to show some cracks.

Across the pond, the European Union (EU) economic docket featured Harmonized Index of Consumer Prices (HICP) reading in July, which showed that inflation was unchanged at 2.4% YoY, above estimates for a 2.3% dip. Core HICP, which excludes volatile items, rose to 2% YoY for the same period, unchanged but exceeding forecasts of 1.9%.

Other data revealed that the HCOB Manufacturing Flash PMI in the EU improved for the whole bloc, Spain, and Italy, with the latter remaining in contractionary territory. Contrarily, Germany and France sank further into negative territory.

In the UK, the S&P Global Manufacturing PMI shows that business activity is deteriorating further, from 48.2 to 48. Next week, the BoE meets and is widely expected to reduce interest rates by 25 basis points to 4%, its lowest level in two and a half years.

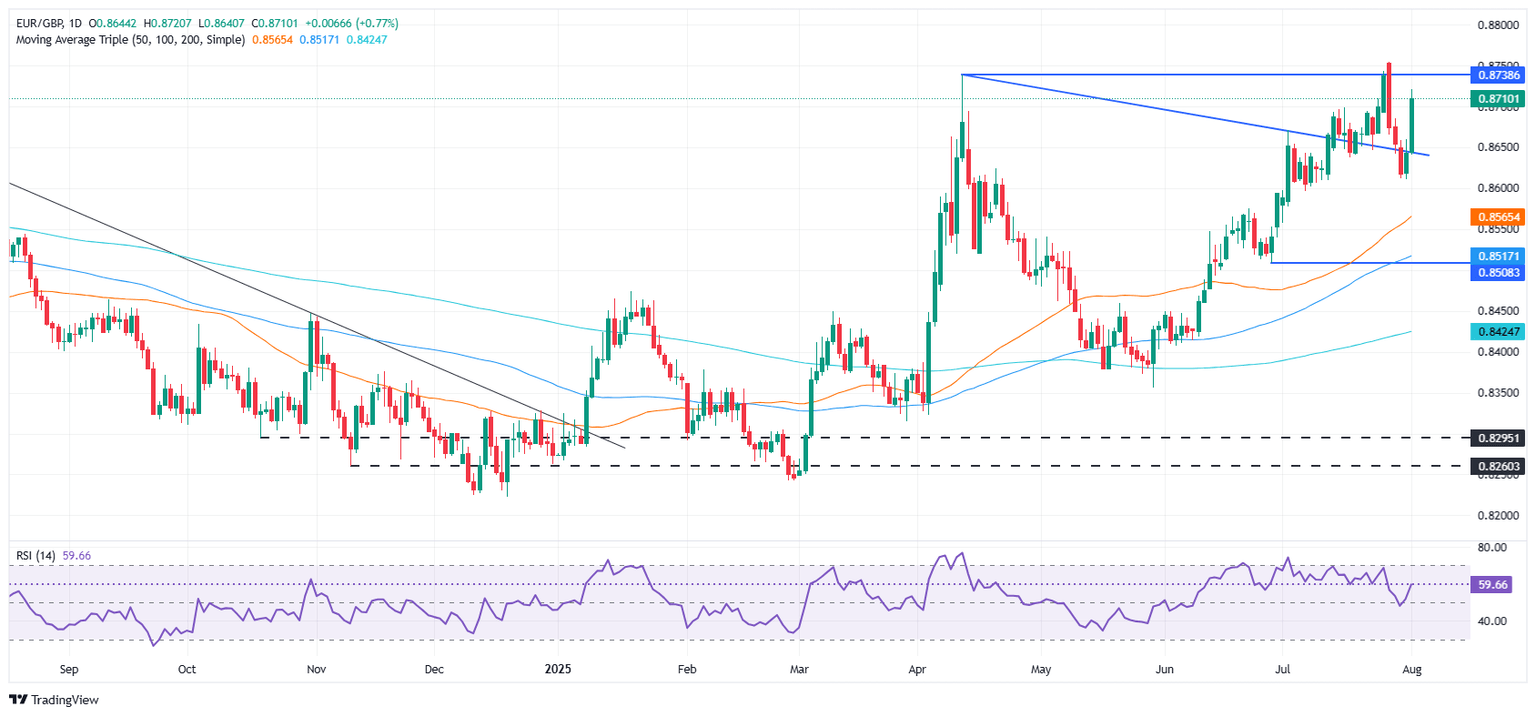

EUR/GBP Price Forecast: Technical outlook

With the EUR/GBP crossing above the 20-day SMA of 0.8661, expect this level to act as first support as the cross-pair cleared 0.8700. Further gains are seen if buyers drive prices above the YTD high of 0.8757, putting 0.8800 up for grabs.

On the flip side, a drop below the 20-day SMA and 0.8650 exposes the current week’s low of 0.8611, ahead of the 50-day SMA at 0.8565.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.