EUR/GBP Price Forecast: Breaches channel top at 0.8640 after downbeat UK data

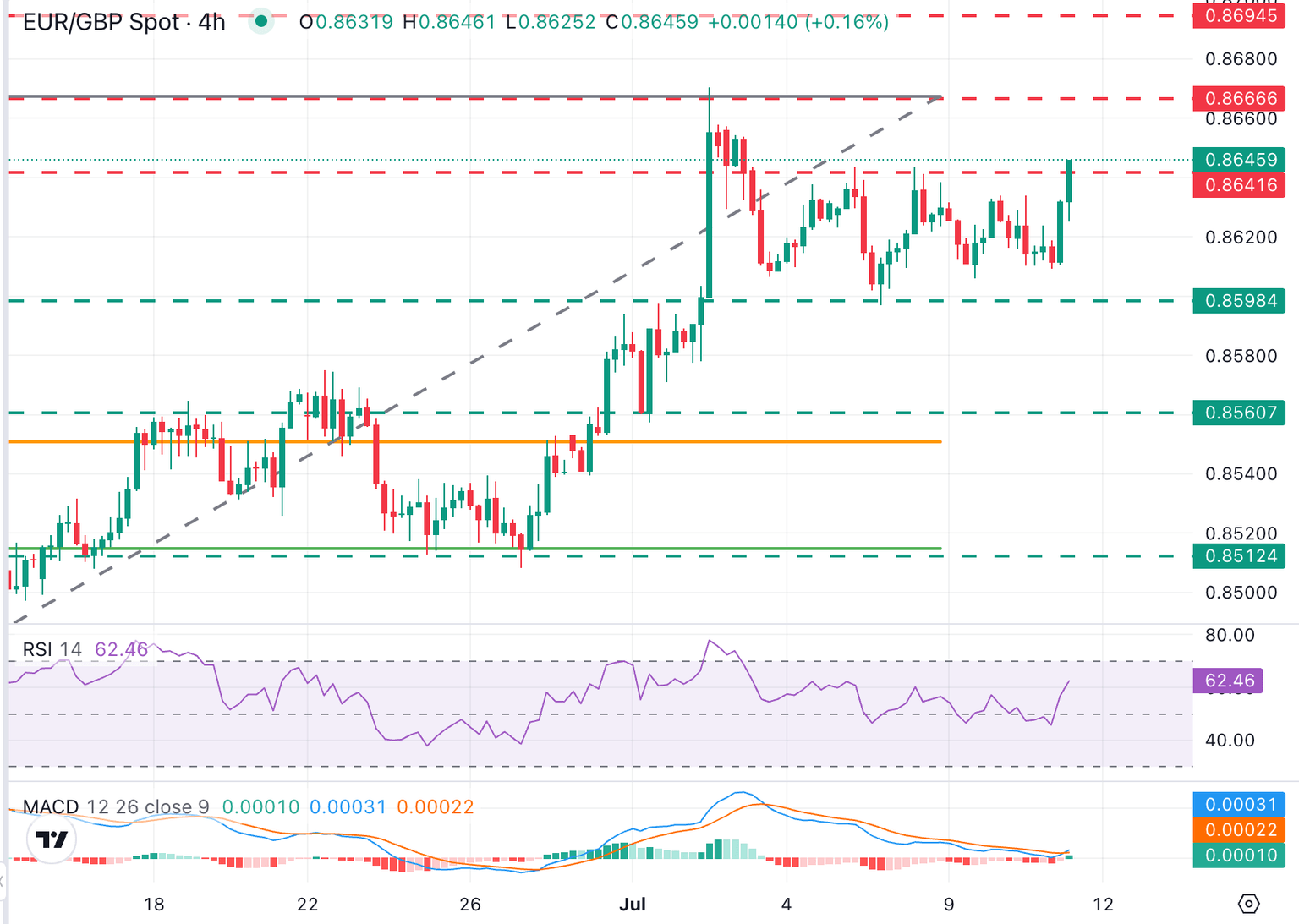

- The Euro is attempting to break above the last two weeks' channel top, at 0.8640.

- Downbeat UK GDP and manufacturing data are weighing heavily on the Pound.

- EUR/GBP: Above 0.8640, the next target is the July 2 high, at 0.8665.

The Euro is trading higher on Friday, supported by a weaker Pound, following a raft of downbeat macroeconomic figures in the UK. The pair has breached the top of the last two weeks' trading channel between 0.8600 and 0.8640 and is trading at 0.8645 at the time of writing.

The Pound dropped across the board earlier on Friday after National Statistics figures revealed that the Gross Domestic Product contracted at a 0.1% pace in May against expectations of a 0.1% increase.

At the same time, Manufacturing Production contracted 1% in the same month, well beyond the 0.1% decline foreseen by market analysts. Likewise, Industrial Production fell 0.9% against market forecasts of a flat reading.

Technical Analysis: Above 0.8640, the next target is 0.8665

The pair shows an increasing bullish momentum after breaking the top of the last two weeks' trading range. The Relative Strength Index (RSI) has crossed above 50, and the MACD is also showing a bullish cross. Nevertheless, it would be wise to wait and see if the pair manages to hold at current levels, which would give bulls hope for a retest of the July 2 high, at 0.8665

On the downside, the channel bottom, at the 0.8600 level (July 7 low), is holding bears for now. Below here, the 0.8550 - 0.8560 area, where the July 1 low meets the 38.2% Fibonacci retracement of the June-July rally, seems a plausible technical floor for a bearish reversal.

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Fri Jul 11, 2025 06:00

Frequency: Monthly

Actual: -0.1%

Consensus: 0.1%

Previous: -0.3%

Source: Office for National Statistics

Economic Indicator

Manufacturing Production (MoM)

The Manufacturing Production released by the National Statistics measures the manufacturing output. Manufacturing Production is significant as a short term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 11, 2025 06:00

Frequency: Monthly

Actual: -1%

Consensus: -0.1%

Previous: -0.9%

Source: Office for National Statistics

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.