EUR/GBP Price Analysis: Euro weakens near 0.8500 as short-term signals turn negative

- EUR/GBP trades near the 0.8500 zone after declining through Thursday’s session.

- Bearish bias prevails, confirmed by downside signals from momentum and short-term trend indicators.

- Immediate support rests below, while key resistance aligns around recent moving averages.

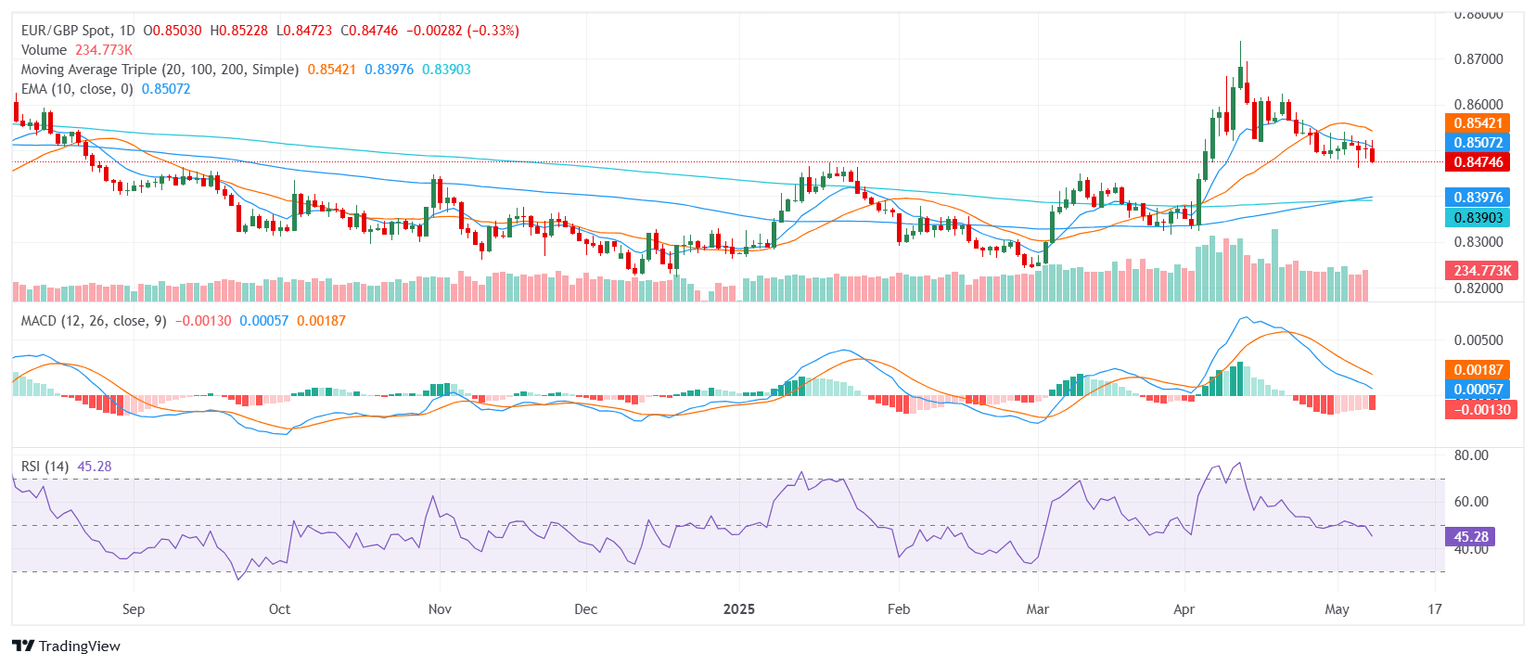

The EUR/GBP pair drifted lower on Thursday, trading near the 0.8500 zone after the European session and settling within the middle of the day’s range. The decline reflects growing bearish sentiment in the short term, with technical signals tilting to the downside. While the longer-term outlook remains supported by major moving averages, current momentum favors sellers heading into the next trading phase.

From a technical perspective, the bearish tone is underscored by several indicators. The Relative Strength Index holds a neutral stance near 46, but the Moving Average Convergence Divergence continues to show a sell signal, reinforcing the current downtrend. The 10-period Momentum is also negative, suggesting selling interest is gradually building. Meanwhile, the Average Directional Index shows weak trend strength, indicating that while pressure is present, it has yet to fully solidify.

The short-term trend structure confirms the bearish view. The 10-day Exponential and Simple Moving Averages are both trending downward above price, while the 20-day Simple Moving Average also reinforces resistance. On the other hand, the longer-term 100-day and 200-day Simple Moving Averages remain bullish, positioned well below and still sloping upward — suggesting broader structural support persists.

Support levels are found at 0.8470, 0.8457, and 0.8429. Resistance stands at 0.8498, 0.8499, and 0.8504. A breakdown below nearby support could expose the pair to a deeper correction, while a close above short-term resistance would be needed to challenge the prevailing bearish bias.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.