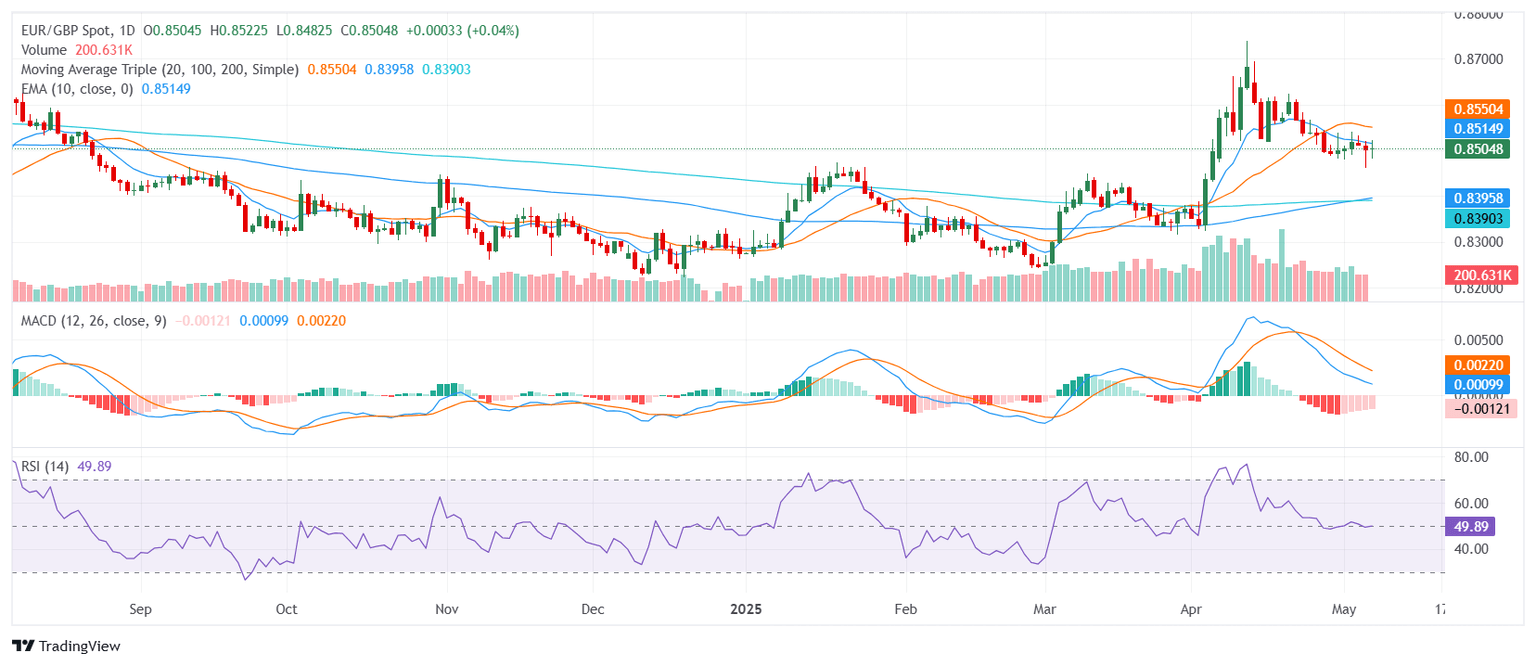

EUR/GBP Price Analysis: Euro holds steady near 0.8500 as mixed signals persist

- EUR/GBP trades near the 0.8500 zone after a quiet Wednesday session.

- Overall tone remains bullish, supported by longer-term averages despite mixed short-term signals.

- Support levels hold just below, while resistance aligns closely overhead.

The EUR/GBP pair remained relatively flat on Wednesday, hovering near the 0.8500 zone after the European session. Price action was contained within a narrow range, reflecting a market lacking clear directional momentum. While shorter-term indicators suggest some selling pressure, the broader structure remains bullish, supported by long-term moving averages that continue to trend upward.

From a technical standpoint, the pair presents a mixed picture. The Relative Strength Index (RSI) sits near 50, confirming a neutral stance, while the Moving Average Convergence Divergence (MACD) prints a sell signal, indicating potential near-term weakness. The Williams Percent Range and Average Directional Index are also neutral, pointing to a lack of strong directional bias in the immediate term.

However, the broader trend remains constructive. The 30-day Exponential Moving Average and 50-day Exponential Moving Average, both positioned just below current levels, reinforce the underlying bullish tone. Additionally, the 100-day and 200-day Simple Moving Averages, significantly lower, continue to slope upward, providing a sturdy base for the pair over the medium term.

Support is found at 0.8500, 0.8470, and 0.8452. Resistance is seen at 0.8508, 0.8510, and 0.8513. A sustained move above resistance could confirm the broader bullish outlook, while a break below support would likely lead to a retest of recent lows.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.