EUR/CAD Price Forecast: The first upside barrier emerges near 1.5100, BoC rate decision in focus

- EUR/CAD edges higher to around 1.5025 in Wednesday’s early European session.

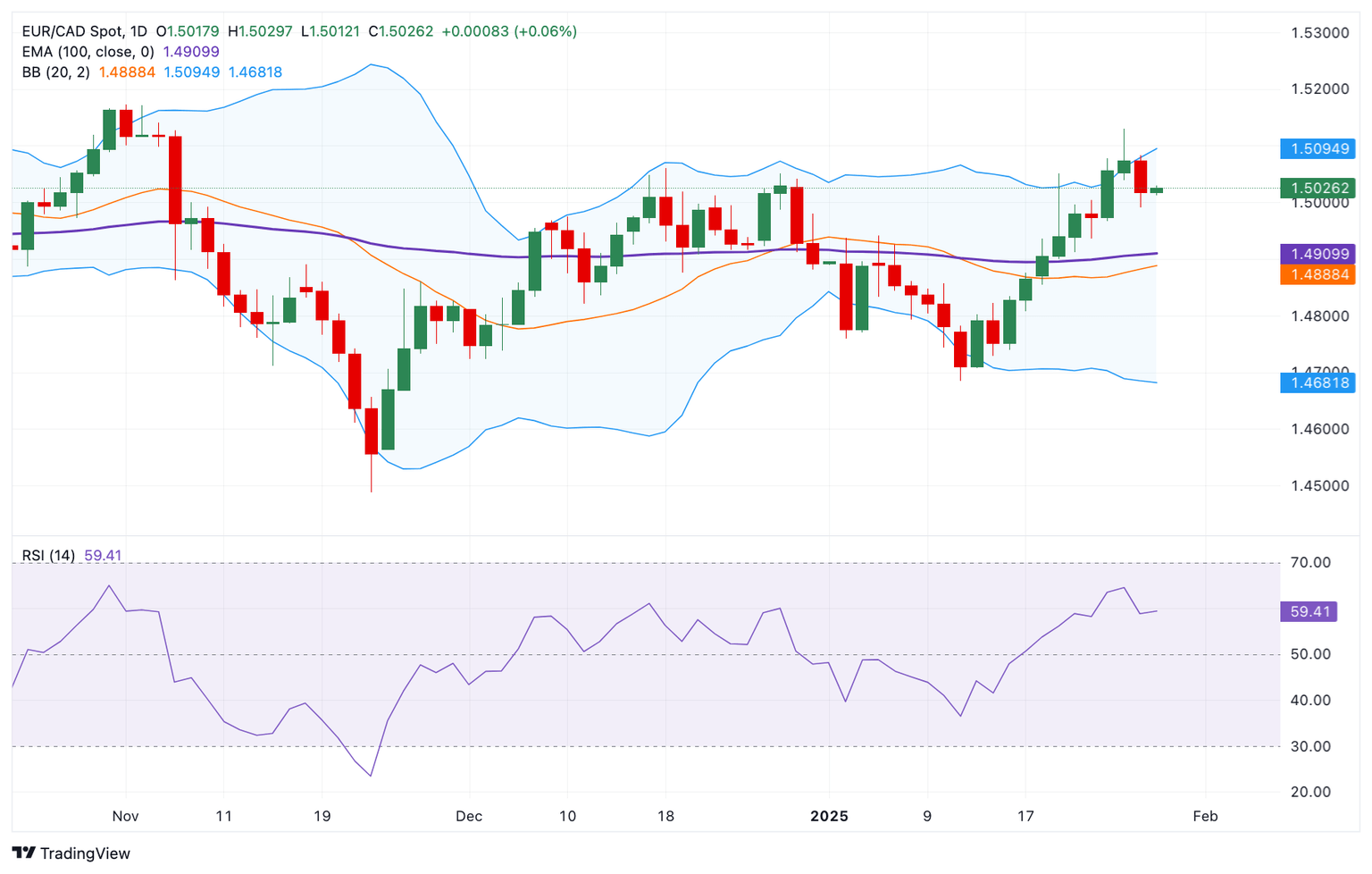

- The cross keeps the positive outlook above the 100-day EMA with a bullish RSI indicator.

- The immediate resistance level emerges at the 1.5095–1.5100 region; the first downside target is seen at 1.4936.

The EUR/CAD cross trades in positive territory around 1.5025 during the early European session on Wednesday. The Bank of Canada (BoC) will likely cut its key benchmark rate by 25 basis points (bps) at its January meeting on Wednesday.

The rising bets of BoC rate cut bets and the concerns about tariff policies from US President Donald Trump could weigh on the Canadian Dollar (CAD) against the Euro (EUR) in the near term. Trump said last week that he will impose a 25% tariff on Canada and Mexico from February 1.

Technically, the bullish outlook of EUR/CAD remains intact as the cross holds above the key 100-day Exponential Moving Averages (EMA) on the daily chart. The upward momentum is supported by the 14-day Relative Strength Index (RSI), which is located above the midline near 59.50. This indicates that further upside looks favorable.

The first upside barrier for the cross is in the 1.5095-1.5100 zone, representing the upper boundary of the Bollinger Band and psychological level. Further north, the next hurdle is seen at 1.5130, the high of January 27. A decisive break above this level will see a rally to 1.5172, the high of November 1, 2024.

On the other hand, the low of January 23 at 1.4936 acts as an initial support level for EUR/CAD. The crucial contention level to watch is 1.4905, the 100-day EMA. The additional downside filter is located at 1.4760, the low of January 2.

EUR/CAD daily chart

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.