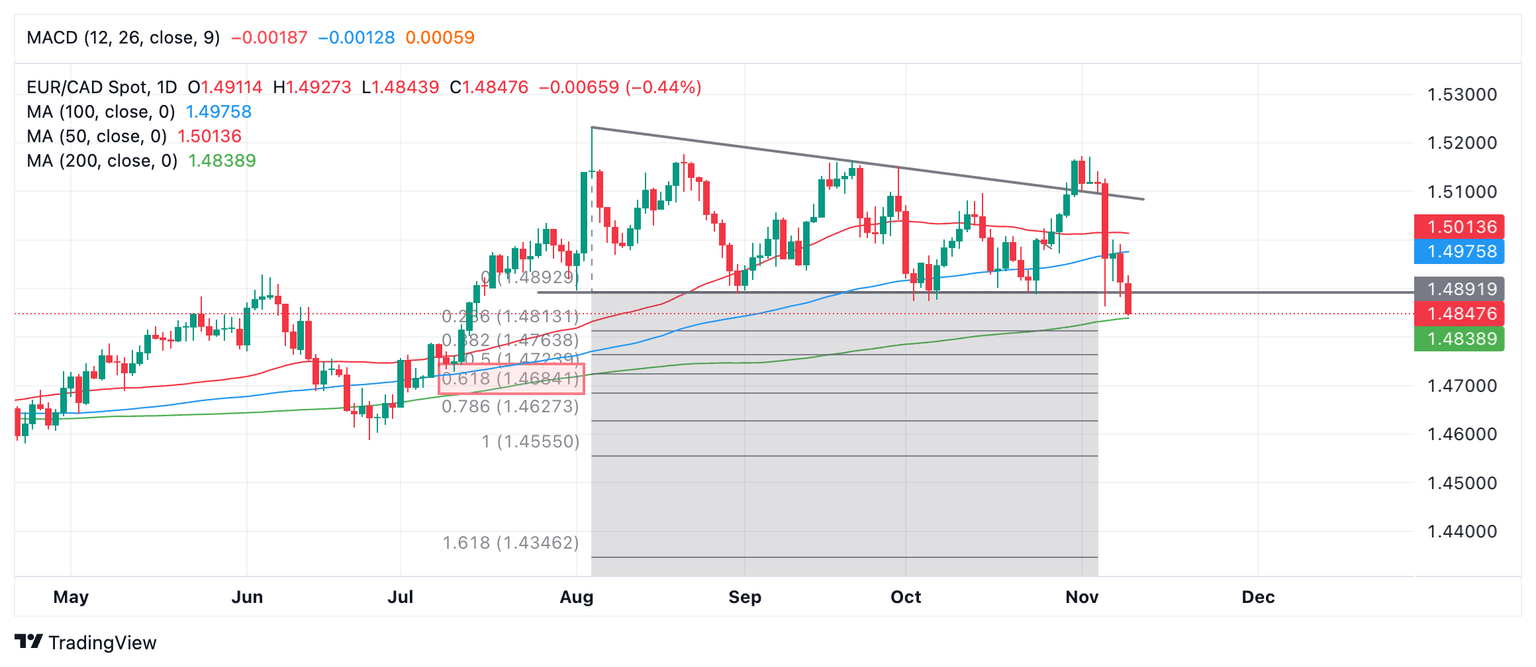

EUR/CAD Price Forecast: Breaks out of rectangular price pattern and declines

- EUR/CAD has broken below the base of a multi-month price pattern.

- It is likely to go lower if the break is decisive and it can pierce below the 200-day SMA.

EUR/CAD has broken out of the rectangular price pattern it has been forming since August.

EUR/CAD Daily Chart

A bearish close on Monday (today) would confirm a decisive breakout from the pattern. The usual method for determining the follow-through after a breakout would be to take the height of the range and extrapolate it lower by 61.8% – or in the case of an optimistic forecast 100%.

In the case of EUR/CAD this gives a minimum downside target of 1.4684. A break clearly below the green 200-day Simple Moving Average (SMA) would provide confirmation. The SMA lies at 1.4839, however, a break below 1.4820 would confirm a clear break and probably confirm a continuation lower to the aforementioned conservative target.

The 100% target for the pattern lies at 1.4555.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.