EUR/CAD Price Analysis: Euro softens toward 1.5600 but broader trend stays constructive

- EUR/CAD trades near the 1.5600 zone after slipping slightly in Tuesday’s post-European session.

- Bullish bias persists on longer timeframes, despite short-term indicators showing weakness.

- Support holds just below while dynamic resistance from short-term averages remains in place.

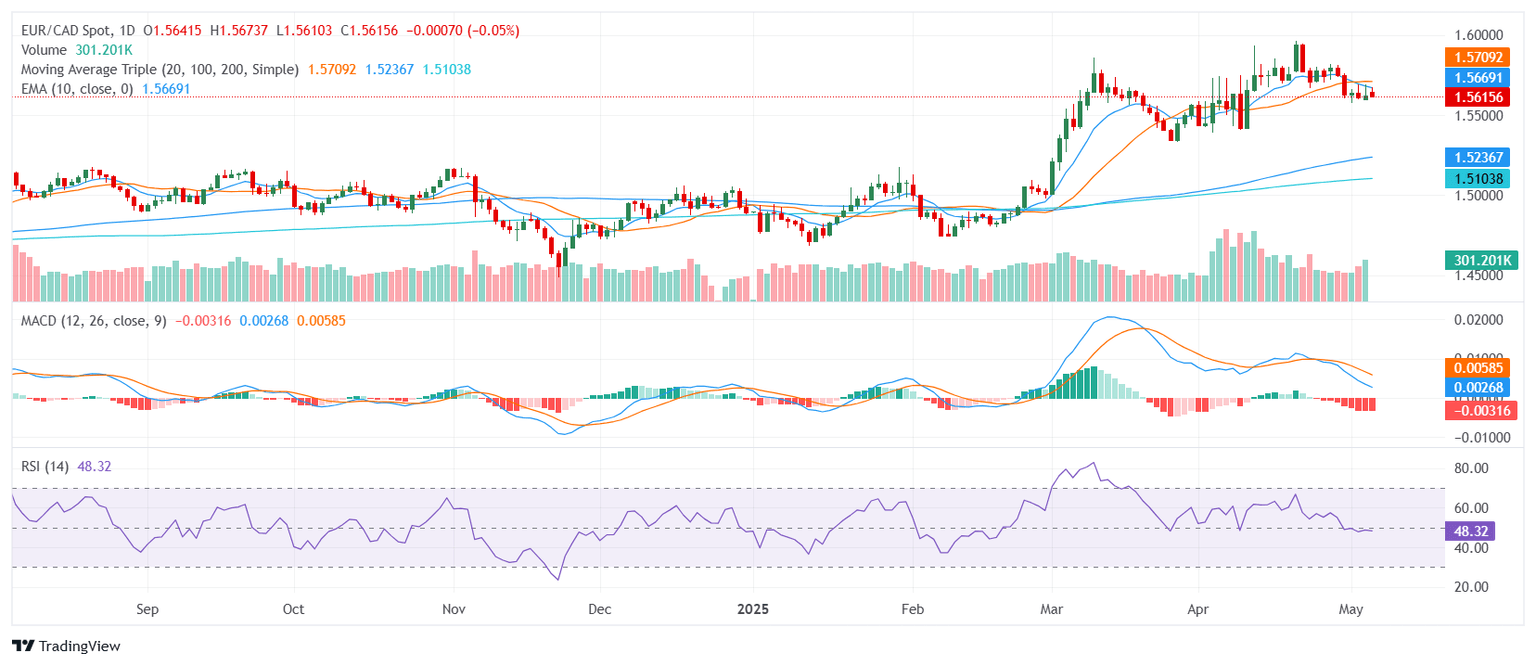

The EUR/CAD pair edged lower on Tuesday, hovering near the 1.5600 area after the European session as the pair retreated within the day’s range. Although the move reflects mild selling pressure, the broader trend structure remains favorable for buyers, particularly when viewed through the lens of longer-term averages. Short-term signals remain mixed, keeping directional conviction limited for now.

Momentum indicators offer little clarity. The Relative Strength Index stands neutral near the 48 level, reflecting equilibrium in buying and selling pressure. The Moving Average Convergence Divergence prints a sell signal, hinting at near-term softness, while both the Awesome Oscillator and Average Directional Index stay neutral, suggesting consolidation rather than trend exhaustion.

The bullish tilt is primarily supported by higher timeframes. The 50-day Exponential and Simple Moving Averages both sit below the market and continue to slope upward, joined by strong positioning of the 100-day and 200-day SMAs. These longer-term indicators provide a sturdy technical foundation despite the short-term hesitation, where the 20-day SMA points lower and may act as dynamic resistance in the near term.

Key support is found at 1.5593, 1.5570, and 1.5534. Resistance stands at 1.5633, 1.5645, and 1.5671. A move above this resistance band could reassert bullish momentum, while a break below support would shift attention back toward the rising medium-term trendlines.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.