DXY meeting resistance in a bullish correction, bears lurking on risk-on themes gaining traction

- DXY holding up despite risk-on themes kicking into the financial market's playbook this week.

- Signs of a vaccine for COVID-19, surprisingly strong bank earnings reports and positive economic activity fuelling optimism.

The US dollar has made a technical upside correction, but the fundamentals are starting to stack up for the bears this juncture.

There is news that a vaccine is showing promising signs of working against the coronavirus and there is plenty of optimism being price into markets with regards to prospects of a faster economic recovery in the US and the world.

The US dollar has benefitted from deteriorating outlooks for global growth and tightening liquidity in financial markets pertaining to the downturn and virus impacts.

COVID-19 vaccine in the making

Fauci's colleagues at the National Institutes of Health and Moderna Inc developed the first COVID-19 vaccine tested in the US.

In the first round of tests on 45 volunteers, it has been reported to have heightened their mmune systems just the way scientists had hoped.

The shots are poised to begin key final testing around July 27.

The final round will be a far larger study of 30,000-people which will prove whether or not the shots really are strong enough to protect against the coronavirus.

Banks earnings in view, shaping a risk-on mood

This week is a pivotal one, with crucial data o the cards and US banks reporting their quarterly earnings and guidance on the outlook for the economic recovery.

Yesterday was a positive outcome overall from three of the top banks, for which two of their earnings beat expectations.

Today, Goldman Sachs also reported stronger-than-expected second-quarter earnings results, as surging revenues despite the pandemic buttressed the bottom line and its stock price.

Goldman’s Fixed Income, Currency and Commodities (FICC) sales and trading revenue $4.23 billion, the highest quarterly revenue in nine years

.Meanwhile, equities trading generated $2.94 billion in revenues, its best quarter in 11 years. Collectively, those businesses accounted for 54% of Goldman’s quarterly revenues.

The firm’s core investment banking business delivered $2.66 billion in earnings, up 36% from the same period a year ago.

The turbulence we have seen in recent months only reinforces our commitment to the strategy we outlined earlier this year to investors,

CEO David Solomon said in a statement.

While the economic outlook remains uncertain, I am confident that we will continue to be the firm of choice for clients around the world who are looking to reshape their businesses and rebuild a more resilient economy, he confidently added, setting the stage for higher markets for the foreseeable future.

Global recovery on the way

Indeed, the mood has been shiting gears on the back of surprisingly strong performances by the banks, a mood that could be supported if the release of tonight's Chinese 2Q20 GDP does not disappoint.

Also, today's US Beige Book, it was shown that economic activity increased in almost all districts.

Here are some of the key positive takeaways from the report:

"Consumer spending picked up as many nonessential businesses were allowed to reopen."

"Retail sales rose in all districts, led by a rebound in vehicle sales."

"Demand for professional and business services increased in most districts but was still weak."

"Employment increased in all districts as businesses reopened or increased activity, gains in retail and hospitality highlighted."

Full news: Fed's Beige Book: Economic activity increased in almost all districts

EU Recovery Fund is full focus

The news risks, besides economic data in US RetailsSales and the aforementioned Chinese GDP, comes with the European Central Central Bank, albeit likely playing second fiddle to the progress on an EU Recovery Fund.

No new measures from the ECB are expected at the July meeting, so there is going to be the potential of a more important driver at the EU summit (starting on Friday), setting the stage for a potentially softer ground for the greenback net week should the euro get a boost on any positive outcomes.

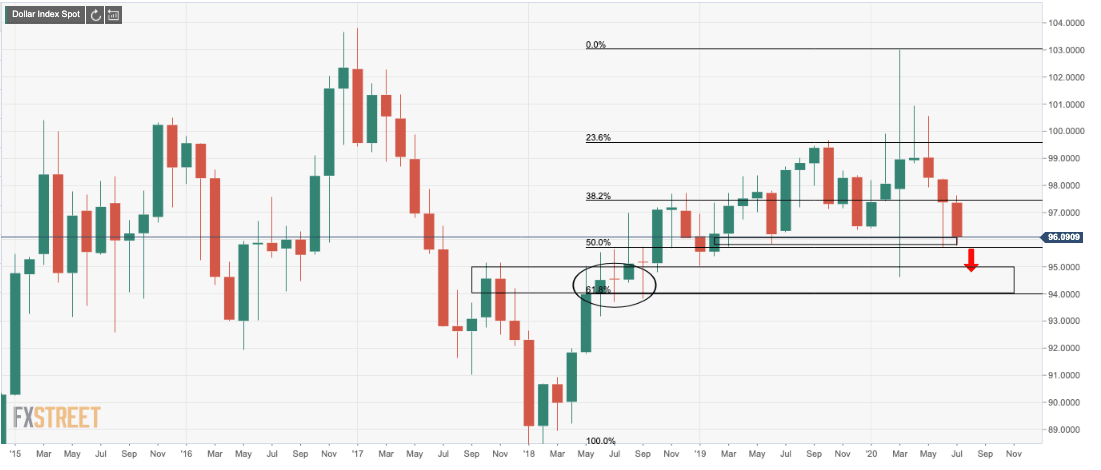

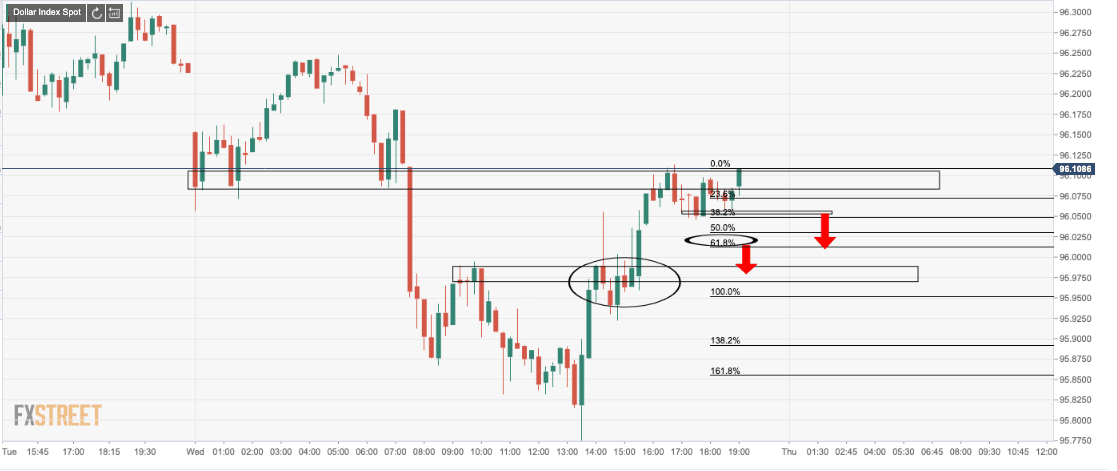

DXY structures

Bears can eye a 61.8% Fibonacci retracement target as follows:

Monthly chart

Hourly resistance playing out as well for near term structure analysis:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.