Dow Jones Industrial Average falls as Fed rate call looms ahead

- The Dow Jones fell 300 points or 0.7%, while the S&P 500 shed 60, falling nearly 1.1%.

- US equities are back to their bearish ways as trade war fears continue to weigh.

- The Fed’s latest rate call is in the barrel for Wednesday.

The Dow Jones Industrial Average (DJIA) pulled back around 300 points on Wednesday, snapping a two-day win streak and pushing back into the low side as equities remain unable to find a consistent reason to pivot confidently out of a recent downturn sparked by ongoing geopolitical turmoil pouring out of the White House since Donald Trump took office as President in January.

Both the Dow Jones and the Standard and Poor’s 500 (S&P) are back into the red on Tuesday. The Dow eased back below the 42,000 level, and the S&P 500 continues to toy with the 5,600 handle. Both major equity indexes are testing correction territory, down around 8% from record highs.

The Trump team’s plans for further tariffs slated to come into effect on April 2nd are once again shifting. President Donald Trump has asked his Treasury Secretary Scott Bessent to “rethink” the US sanctions regime. Fresh tariff talk has knocked the latest bull run flat on its back, despite Treasury Secretary Bessent hinting that tariffs may not be as across-the-board as originally envisioned. Given the Trump administration’s general anathema for consistent policy disclosure, this will hardly come as a surprise to markets that have grown accustomed to near-constant waffling, capitulation, and last-minute changes to the majority of team Trump’s trade policy proposals over the past eight weeks.

The Federal Reserve’s (Fed) latest rate call is due on Wednesday. According to the CME’s FedWatch Tool, rate markets broadly anticipate the Fed to stand pat on rates for the next two meetings, with the next quarter-point rate trim expected at the Federal Open Market Committee’s (FOMC) June meeting. However, the FOMC’s latest interest rate forecasts will be released this week. They could send rate cut expectations through the wringer if Fed policymaker’s expectations for interest rates deviate wildly from current market forecasts.

Stocks news

Stock sectors are red across the board on Tuesday as investors struggle to find a place to hide. Despite announcing a partnership to help develop processes to produce a fleet of self-driving cars, Nvidia (NVDA) and General Motors (GM) are both falling back. Nvidia is down 2.5% near $116 per share and GM is down around 1%, testing below $50 per share as it gets more difficult to spark buying interest in investors simply by announcing more AI projects.

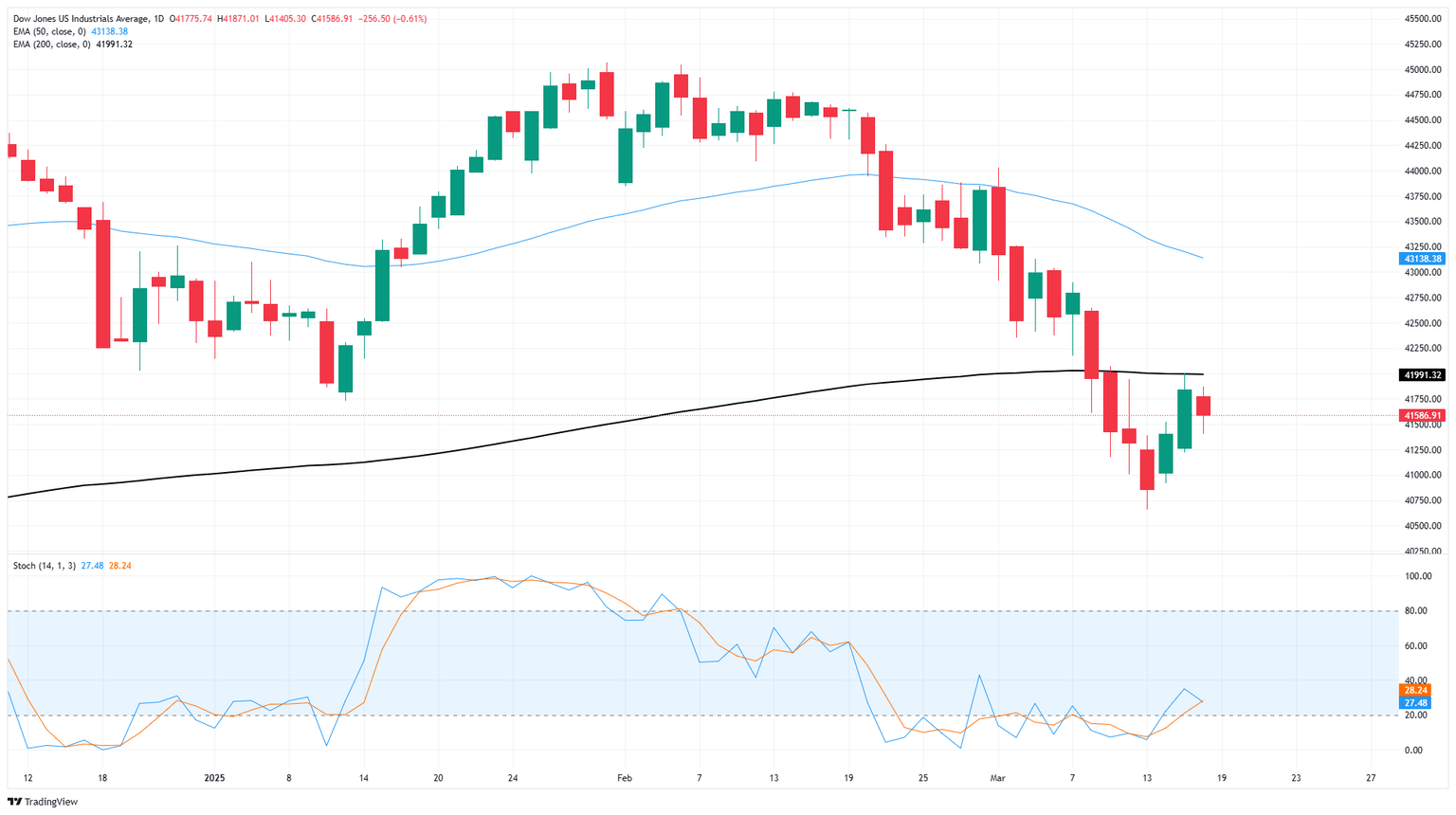

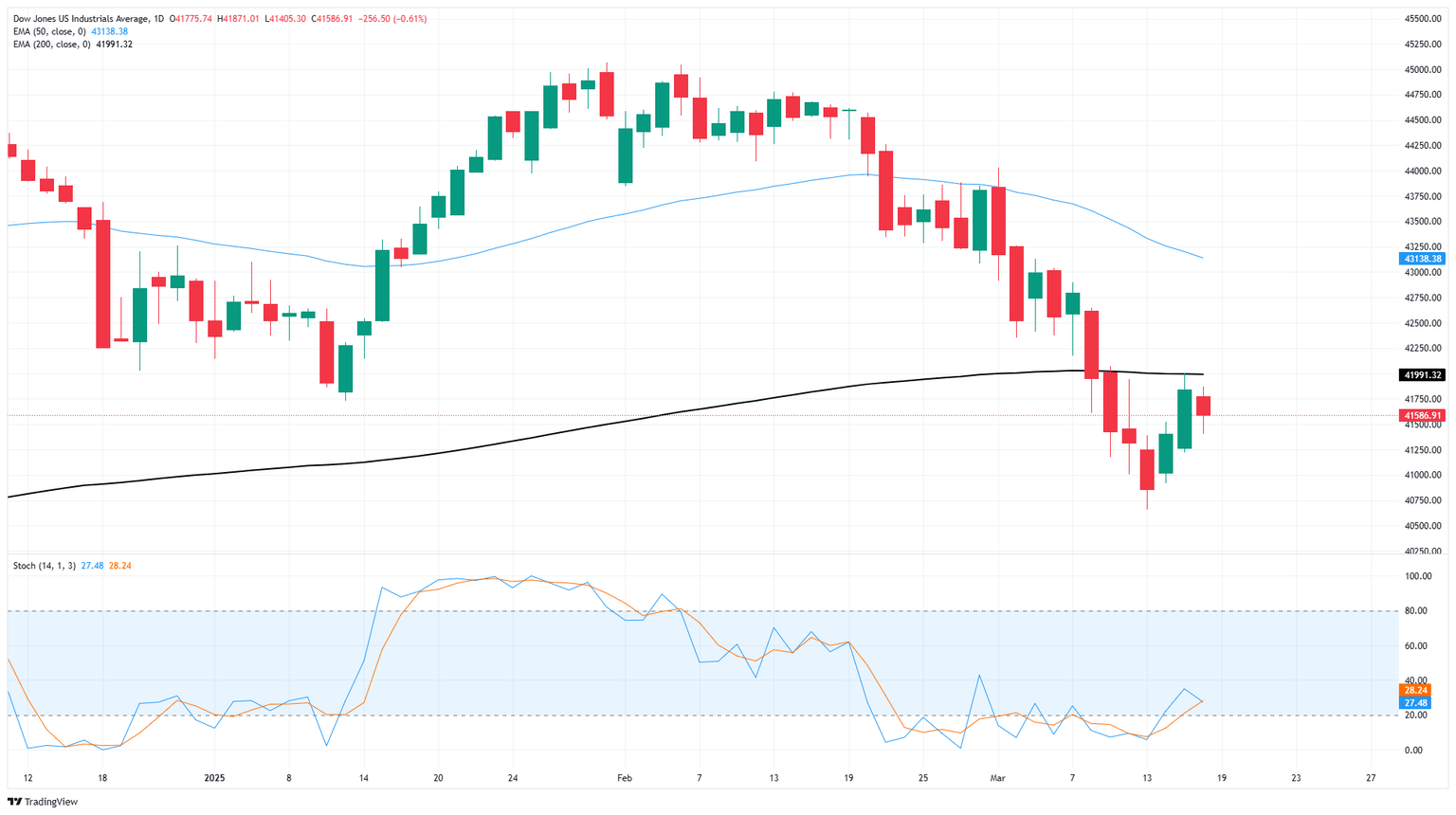

Dow Jones price forecast

With a fresh bearish daily candlestick, the Dow Jones is at risk of chalking in a technical rejection from the 200-day Exponential Moving Average (EMA) near the 42,000 major price handle. Buyers are suddenly running out of time to push bids back into the high end.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.