Dow Jones Industrial Average soars after Powell sounds dovish

- The Dow Jones shattered price records on Friday, hitting above 45,700 for the first time ever.

- Equities and general risk appetite soared after Fed Chair Powell made a dovish appearance.

- A September rate cut looks like a sure thing, bolstering general market sentiment.

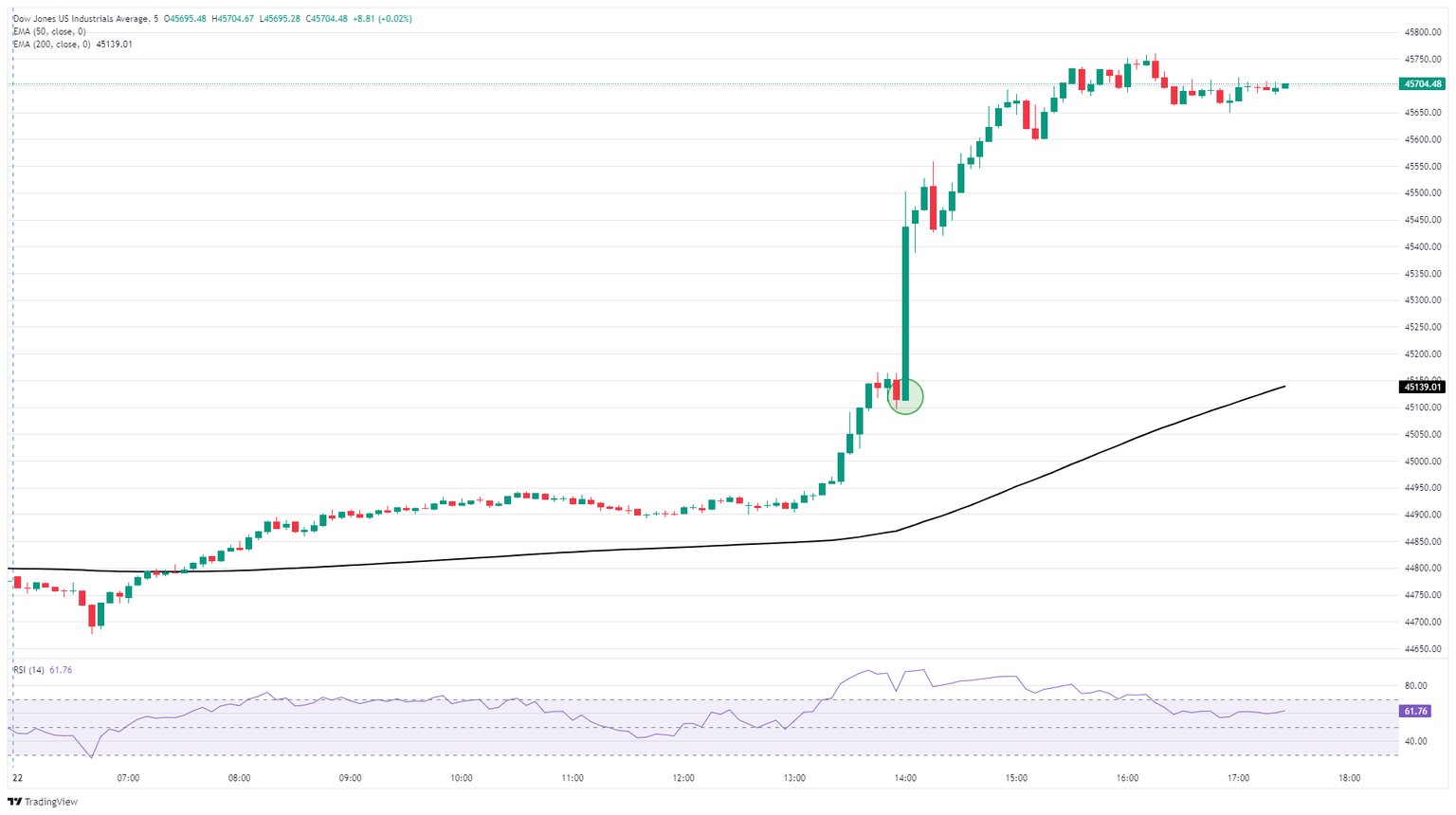

The Dow Jones Industrial Average (DJIA) soared to new all-time highs on Friday, testing above 45,700 for the first time since the index’s inception. The Dow Jones soared over 900 points in a single day as investors piled ferociously back into bullish bets, as a September interest rate cut looks to be in the bag.

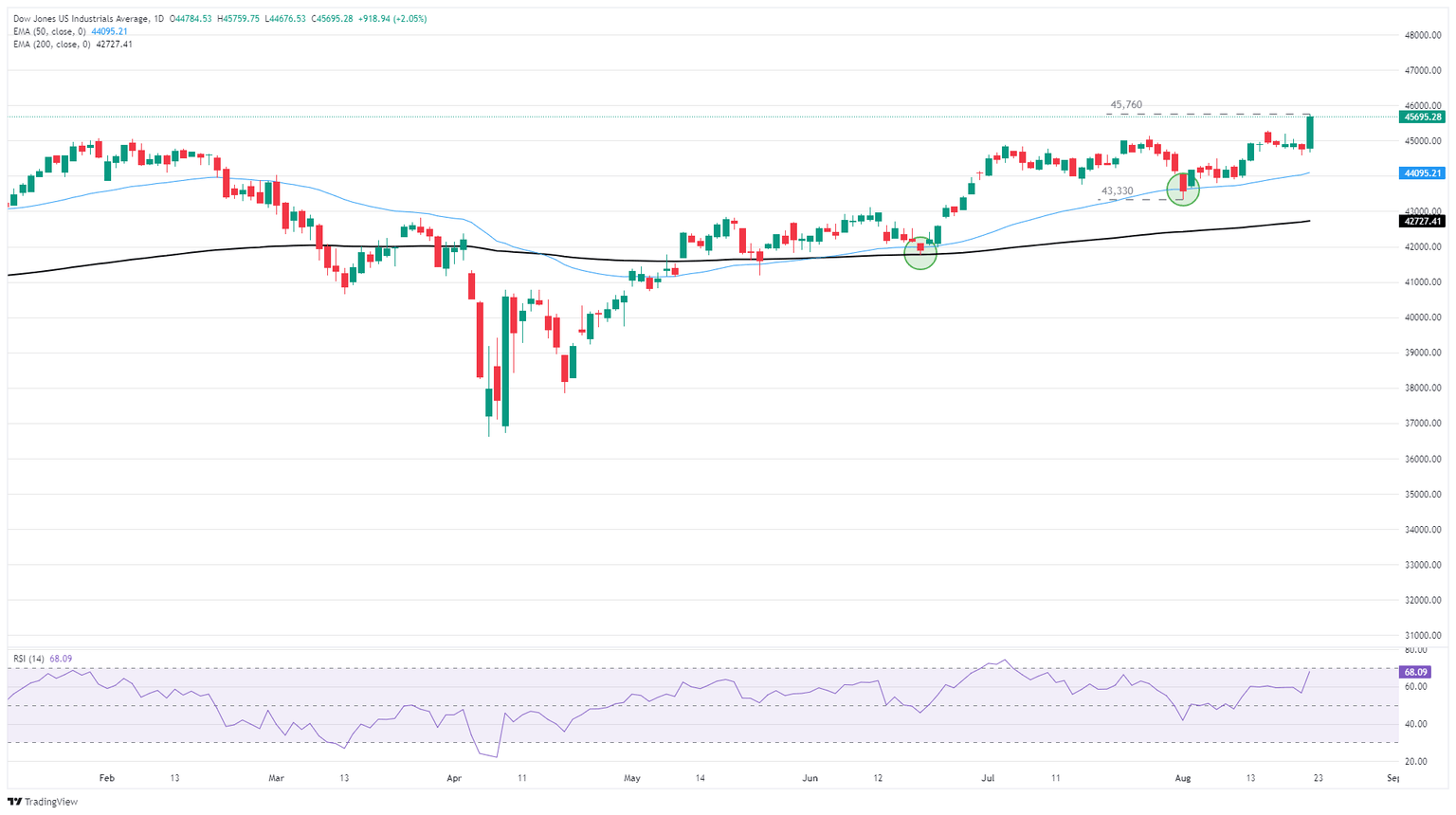

The Dow Jones is once again testing frontier territory, exploring chart regions north of 45,500. It has been nine months since the Dow posted a record monthly high, and as long as the wheels stay on the cart, August could prove to be one of the best months of 2025. The Dow Jones is up over 3.4% from August’s opening bids, and is up almost 25% from the early April tariff plunge that landed near 36,615.

Powell opens the door to rate cuts

Jerome Powell delivered surprisingly dovish remarks on Friday at the annual Jackson Hole economic symposium, hosted by the Federal Reserve (Fed) Bank of Kansas. Powell acknowledged that, despite the Fed’s overall cautious stance on interest rates, policy adjustment may be needed as downside risks grow.

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

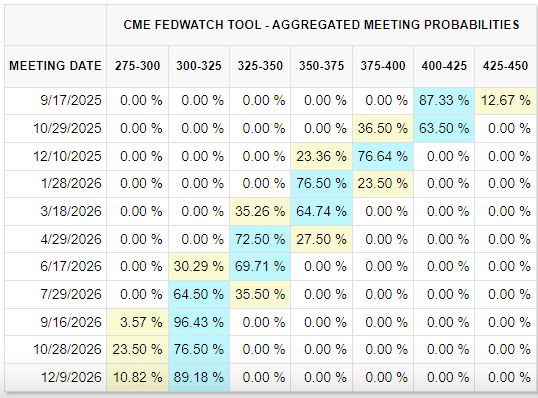

While Fed Chair Powell didn’t outright say whether or not he endorsed immediate interest rate action, his comments were enough to send markets full-tilt into bets of an interest rate cut on September 17, and equities piling into record highs. According to the CME’s FedWatch Tool, rate markets are now pricing in around 90% odds of at least a quarter-point rate trim in September, up from ~70% just the day before.

A follow-up interest rate cut in October remains unlikely, given the general unease Fed officials appear to have toward rate cuts. However, markets still have another rate trim chalked in for December.

Despite dovish Fed tones, key data risks remain

Some key roadblocks on the path to rate cuts still exist, however. Despite a steady unemployment rate and softening labor figures, both of which lend themselves to supporting interest rate cuts, US inflation remains a sticky affair, and there will be several iterations of key inflation data landing in markets’ laps before the Fed’s next interest rate decision.

The latest round of core Personal Consumption Expenditure Price Index (PCE) inflation data is expected to be released next week, one of the Fed’s key inflation metrics. Although inflation has certainly cooled from its post-pandemic highs, PCE inflation has not dipped below 2.6% since April of 2021. The upper bound of the Fed’s inflation target sits at 2.0%, well below the current figures. Any fresh sparks in inflation data could knock back the Fed’s willingness to explore interest rate cuts next month.

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Aug 29, 2025 12:30

Frequency: Monthly

Consensus: -

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.